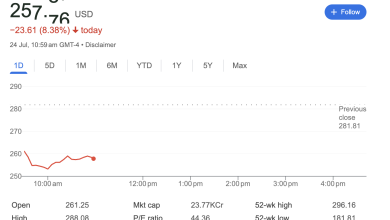

SentinelOne (S) Stock Sees Sharp Reversal as Sellers Take Control in Volatile Session

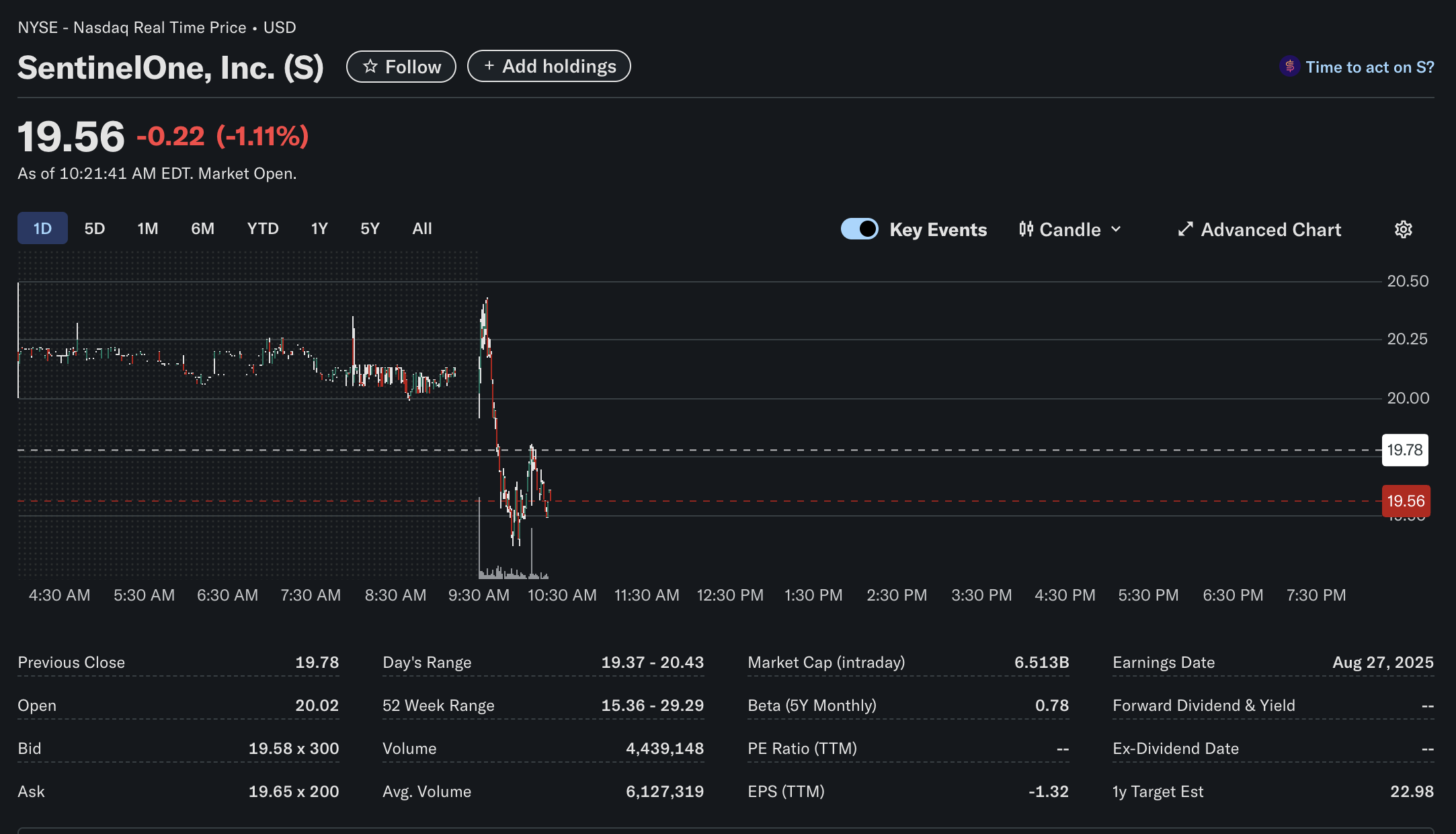

Shares of cybersecurity firm SentinelOne, Inc. (NYSE: S) are experiencing a highly volatile trading day, marked by a dramatic price reversal shortly after the market opened. As of 10:21 AM EDT, the stock was trading at 0.22 (-1.11%).

The sharp intraday movements highlight significant selling pressure, erasing a promising early morning spike and signaling a bearish sentiment for the session. This analysis breaks down the technical, fundamental, and sentiment indicators driving the stock’s performance.

Technical Analysis

The technical picture for SentinelOne is defined by intense intraday volatility and a bearish reversal pattern.

-

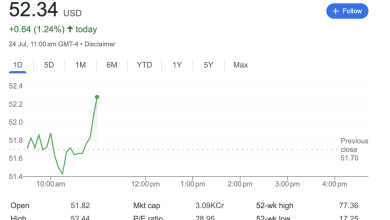

Intraday Price Action: The stock opened for trading at $20.02, above its previous close of 20.43**. However, this upward momentum was immediately and forcefully rejected. The price then plummeted, falling through its opening price and previous close to hit a daily low of $19.37. The candlestick for this period shows a very long upper wick, a classic technical sign of sellers overpowering buyers and rejecting higher prices.

-

Key Levels and Volume: The stock is currently trading in the lower half of its 52-week range of $15.36 – $29.29. The trading volume of over 4.4 million shares early in the session is already substantial compared to its average volume of 6.1 million, indicating strong conviction behind the downward move.

Fundamental Analysis

A look at SentinelOne’s fundamentals provides context for its identity as a high-growth, non-profitable technology company.

-

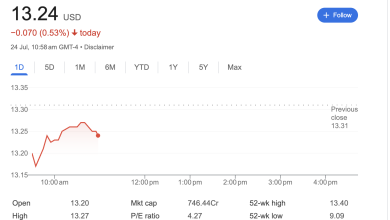

Market Position: With a market capitalization of $6.513 billion, SentinelOne is a significant player in the competitive cybersecurity industry.

-

Profitability: The company is not yet profitable, as indicated by its negative Earnings Per Share (EPS) of -1.32 over the trailing twelve months (TTM) and the absence of a P/E ratio. This is common for companies in a high-growth phase that are heavily reinvesting in technology, sales, and market expansion.

-

Analyst Outlook: Despite the lack of current profits, Wall Street analysts maintain a positive long-term outlook. The 1-year target estimate for the stock is $22.98, suggesting a potential upside of over 17% from its current price. This indicates a belief in the company’s future growth prospects and path to profitability.

-

Dividends: The company does not currently pay a dividend, which is typical for growth-focused tech stocks.

Sentiment Analysis

The market sentiment surrounding SentinelOne appears to be sharply negative in the short term, though long-term views are more optimistic.

-

Short-Term Sentiment: The dramatic reversal from the daily high is a clear indicator of bearish sentiment for the day. Investors who bought the initial spike were quickly overwhelmed by sellers, creating a “bull trap.” This strong rejection suggests a lack of confidence in sustaining higher price levels in the immediate term.

-

Long-Term Sentiment: The analyst target of $22.98 provides a bullish counter-narrative. It suggests that institutional analysts look beyond the daily volatility and see long-term value in the company’s technology and market position within the critical cybersecurity sector. The stock’s Beta of 0.78 suggests it has historically been less volatile than the market, though this is not reflected in today’s price action.

Conclusion

SentinelOne (S) is currently defined by a battle between short-term selling pressure and long-term growth potential. While the intraday technicals are decidedly bearish following a sharp price rejection, the underlying fundamentals and analyst expectations point to a more optimistic future. Investors are closely watching to see if the stock can find support after its morning plunge or if sellers will continue to dominate the session.

Disclaimer: This article is for informational purposes only and is based on real-time data as of 10:21 AM EDT from the provided image. It should not be considered financial advice. All investment decisions should be made with the guidance of a qualified financial professional after conducting thorough personal research.