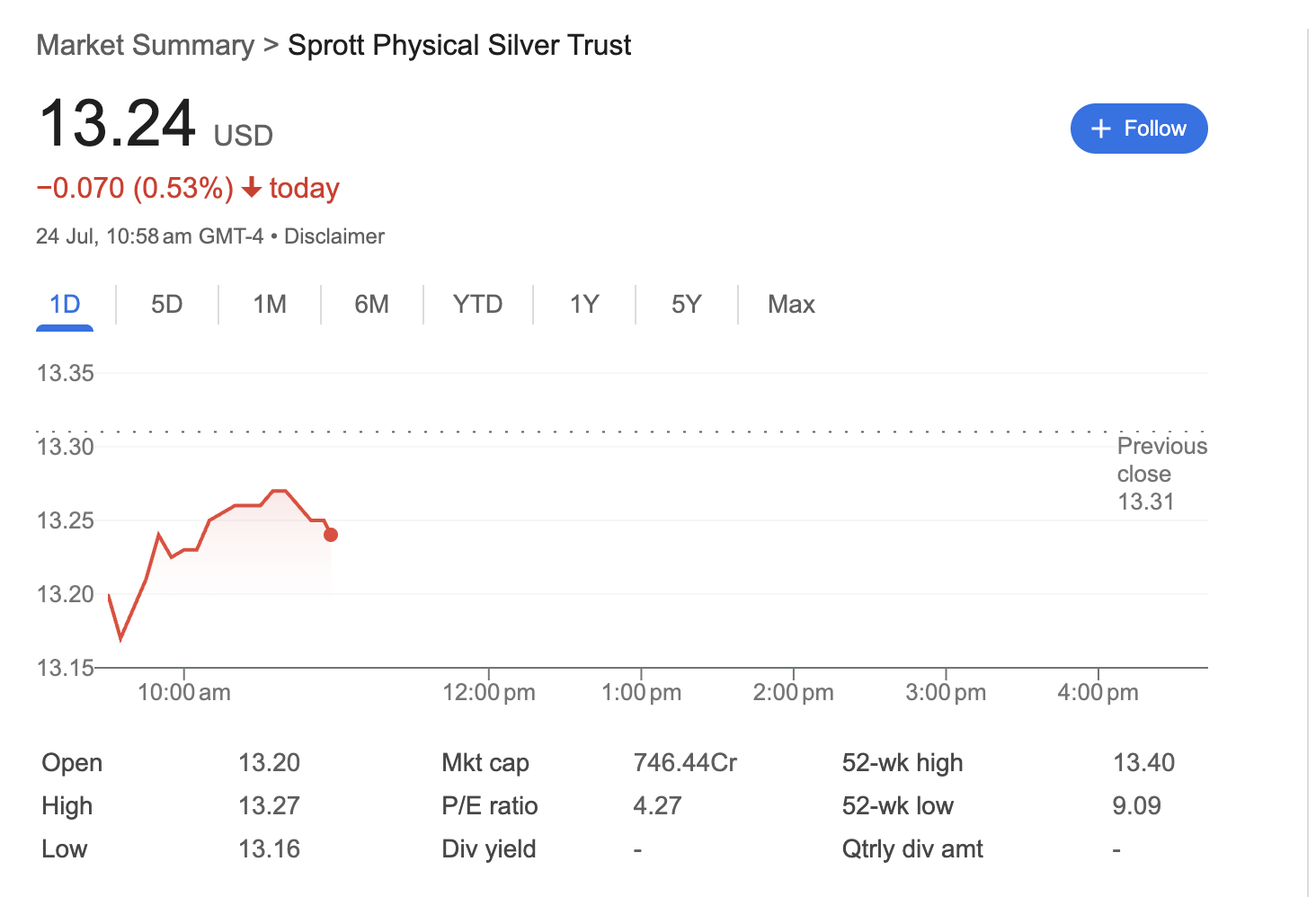

Sprott Physical Silver Trust (PSLV) Dips Slightly, Consolidating Near 52-Week High

The Sprott Physical Silver Trust (PSLV), a popular investment vehicle for holding physical silver, experienced a modest pullback on July 24, trading in a tight range after a strong recent run-up. This analysis examines the technical, fundamental, and sentiment indicators for the trust.

On the morning of July 24, at approximately 10:58 AM GMT-4, shares of the Sprott Physical Silver Trust were trading at 0.070 (0.53%) for the day.

Technical Analysis: Healthy Consolidation After a Strong Rally

The technical picture for PSLV suggests a period of consolidation after a significant upward trend.

-

Proximity to Yearly High: The most significant technical feature is the trust’s price relative to its 52-week range. Trading at 13.40**. This indicates that the asset has been in a powerful uptrend over the past year, moving far from its 52-week low of $9.09.

-

Intraday Action: The trust opened at $13.20 and traded within a narrow band between a low of $13.16 and a high of 13.31**, suggests a pause or minor profit-taking rather than a significant reversal.

-

Key Level: The previous day’s close of $13.31 now acts as a minor resistance level for the trust to reclaim.

Fundamental Analysis: A Direct Play on Physical Silver

Understanding the fundamentals of PSLV requires looking beyond traditional stock metrics.

-

Asset Structure: The Sprott Physical Silver Trust is a closed-end fund that holds physical silver bullion. Its primary objective is to provide a secure and convenient way for investors to own silver. Therefore, its price performance is directly correlated with the spot price of silver.

-

Market Capitalization: The trust has a market cap of 746.44Cr, indicating it is a large and liquid vehicle for silver investment.

-

P/E Ratio and Dividends: The trust has a listed P/E ratio of 4.27. It is important to note that a P/E ratio is not a standard metric for evaluating a commodity trust, as it does not generate earnings like an operating company. The trust also does not pay a dividend, as its purpose is to store value through the holding of a physical asset, not to generate income.

Sentiment Analysis: Long-Term Bullishness Meets Short-Term Pause

The sentiment surrounding PSLV appears to be a mix of long-term optimism and short-term caution.

-

Strong Underlying Bullish Sentiment: The fact that the trust is trading near its 52-week high demonstrates strong positive sentiment for silver as an asset over the medium to long term. Investors have clearly been accumulating positions.

-

Neutral Intraday Sentiment: The slight dip and tight trading range suggest a neutral to slightly bearish sentiment for the session. This could be interpreted as the market taking a “breather” to digest recent gains before a potential next move. There is no sign of panic selling; rather, the price action is calm and orderly.

In conclusion, the Sprott Physical Silver Trust is showing signs of healthy consolidation near multi-month highs. While experiencing a minor dip in the current session, its strong performance over the past year points to robust investor demand for physical silver. The trust’s future direction will be almost entirely dependent on the price movements in the global silver market.

Disclaimer: This article is based on a static image of market data from a specific point in time and is for informational purposes only. It should not be considered financial advice. All investment decisions should be made with the help of a qualified financial professional.