Riot Platforms Stock Gains Ground in Volatile Trading Session

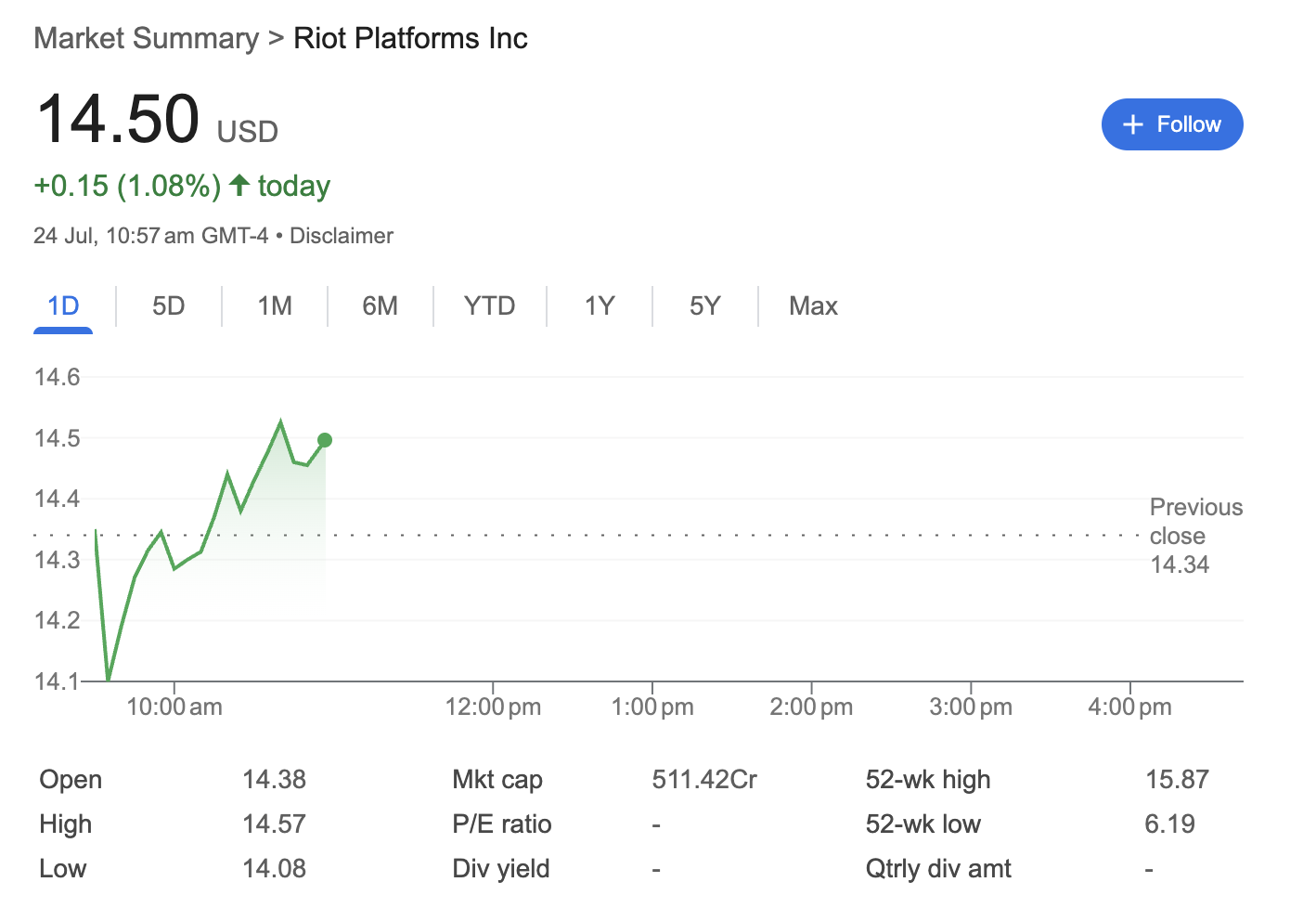

Shares of the Bitcoin mining giant Riot Platforms Inc. (RIOT) showed positive momentum in a volatile trading session on Tuesday. As of 10:57 am GMT-4 on July 24th, the stock was trading at 0.15 or 1.08% for the day, signaling renewed buying interest in the cryptocurrency-related equity.

Technical Analysis: A Story of Intraday Recovery

The technical chart for Riot Platforms reveals a battle between buyers and sellers, with the bulls ultimately gaining control in the morning session.

-

Positive Open: The stock opened at $14.38, slightly above the previous day’s close of $14.34, indicating a modestly positive start.

-

Intraday Volatility: Following the open, the stock saw a dip to a session low of 14.57. This “buy the dip” action is a sign of underlying strength and bullish conviction among traders.

-

Upward Trend: The 1-day chart shows a clear upward trend from the morning low, forming a pattern of higher highs and higher lows, which is a classic bullish intraday signal.

-

Key Resistance Ahead: The stock is now trading closer to its 52-week high of $15.87. This level will act as a significant technical and psychological resistance point. A decisive break above it could signal a continuation of the longer-term uptrend.

Fundamental Analysis: A Focus on Growth Over Profit

The fundamental data for Riot Platforms reflects its position as a major player in the capital-intensive and cyclical Bitcoin mining industry.

-

Market Capitalization: With a market cap of 511.42Cr (representing a multi-billion dollar valuation), Riot is one of the largest publicly traded Bitcoin miners, giving it significant scale and influence in the sector.

-

P/E Ratio: The Price-to-Earnings (P/E) ratio is listed as unavailable (‘-‘). This indicates that Riot Platforms has not been profitable over the last twelve months. The profitability of Bitcoin miners is heavily dependent on the price of Bitcoin, electricity costs, and their operational efficiency.

-

Dividend: The company does not pay a dividend. This is standard for companies in the crypto mining industry, as they typically reinvest capital into acquiring more mining hardware and expanding their operations to increase their share of the Bitcoin network.

Sentiment Analysis: Cautiously Optimistic

The day’s price action points to a cautiously optimistic sentiment surrounding the stock.

-

Positive Correlation to Crypto: As a Bitcoin miner, Riot’s stock sentiment is intrinsically linked to the performance and outlook of Bitcoin and the broader cryptocurrency market. The stock’s positive performance today may reflect stability or upward movement in crypto prices.

-

Investor Confidence: The strong recovery from the intraday low of $14.08 demonstrates investor confidence. It suggests that market participants view pullbacks as buying opportunities, anticipating future price appreciation.

-

Focus on Future Potential: Investors in stocks like Riot are often focused more on the future potential of Bitcoin and the company’s ability to mine it profitably than on current earnings. The positive price movement reflects a bet on that future potential.

Conclusion

Riot Platforms is demonstrating positive intraday strength, with buyers showing resilience and pushing the stock higher after an initial dip. While the technical picture appears bullish in the short term, its fundamental profile highlights its nature as a growth-oriented, non-profitable company tied to the volatile cryptocurrency market. Investors will be watching closely to see if the stock can challenge its 52-week high and how its performance continues to correlate with the movements in the digital asset space.

Disclaimer: This article is for informational purposes only and is based on the data provided in the image. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional.