Amazon Stock Closes Flat at $232.33, Pre-Market Trading Shows Modest 0.68% Gain

Global E-commerce Leader Continues to Hold Investor Confidence as Market Eyes AI and Logistics Growth

Amazon’s Steady Market Presence

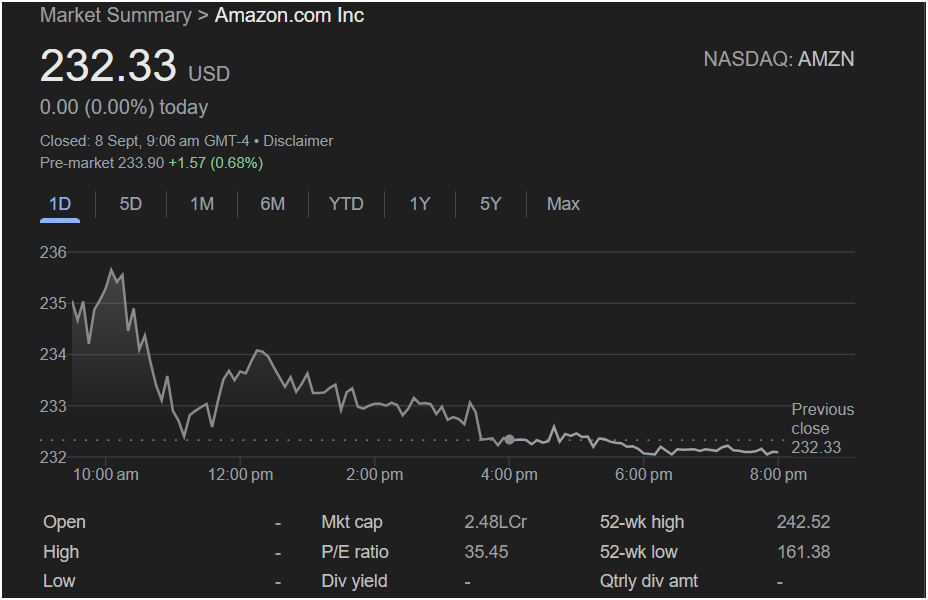

Amazon.com Inc. (NASDAQ: AMZN), one of the world’s largest and most influential technology companies, closed Monday’s trading session at $232.33, showing no change from the previous day’s close. While regular market hours ended flat, pre-market trading data indicated a 0.68% uptick, pushing the share price to $233.90 as of 9:06 a.m. GMT-4.

This performance reflects investor optimism as Amazon continues to expand across multiple high-growth sectors, including cloud computing (AWS), artificial intelligence, advertising, logistics, and e-commerce. Although the day’s trading range remained narrow, investors appear to be holding their positions, waiting for upcoming economic data, earnings reports, and potential industry catalysts.

Detailed Stock Performance

Throughout the trading day, Amazon’s share price fluctuated between $232 and $236, with an early spike toward $235 before gradually settling back toward the $232 range. The market action was relatively calm, suggesting consolidation after recent volatility.

Amazon’s market capitalization stands at $2.48 trillion, reaffirming its position among the top global technology giants alongside Apple, Microsoft, Alphabet, and Meta. Its price-to-earnings (P/E) ratio of 35.45 reflects continued investor expectations for strong growth and profitability, particularly in its high-margin businesses such as AWS and digital advertising.

Amazon’s 52-week range spans $161.38 to $242.52, meaning the stock is currently trading near the upper end of its yearly performance, a positive sign for long-term shareholders.

Amazon Web Services (AWS): The Growth Engine

A significant driver of Amazon’s valuation is Amazon Web Services (AWS), its cloud computing division. AWS remains a market leader, holding roughly 32–34% of global cloud market share according to recent industry reports.

AWS provides services ranging from basic storage and computing power to advanced machine learning, data analytics, and enterprise-level solutions. As artificial intelligence adoption accelerates across industries, AWS is well-positioned to capture additional market share, which could directly impact Amazon’s top-line growth and profitability.

In its most recent earnings report, AWS revenue grew at a double-digit rate year-over-year, showing resilience despite macroeconomic pressures. Investors expect continued momentum in this division, particularly as businesses shift to cloud-first strategies.

E-Commerce Operations: Returning to Growth

Amazon’s core e-commerce business has experienced mixed performance in the post-pandemic era. After surging during the global lockdowns of 2020–2021, demand moderated in 2022 and early 2023 as inflation and interest rates weighed on consumer spending.

However, Amazon’s recent initiatives — including Prime Day sales, grocery delivery expansion, and international market penetration — have helped reignite growth. Its focus on same-day and next-day delivery logistics has also given it a competitive edge over traditional retailers.

In 2025, Amazon is reportedly expanding its presence in emerging markets, which could open new revenue streams and provide a long-term growth runway.

Artificial Intelligence and Advertising

Another major factor driving investor enthusiasm is Amazon’s investment in artificial intelligence. AI is being deployed across multiple verticals within Amazon’s ecosystem — from product recommendation algorithms to warehouse robotics and voice assistant improvements via Alexa.

Amazon’s advertising segment, already a multi-billion-dollar business, benefits from AI-driven personalization that increases the effectiveness of ad placements on its platform. This has made Amazon the third-largest digital advertising company in the world, behind Google and Meta.

Macroeconomic Factors and Market Sentiment

Amazon’s stock price is also influenced by broader market conditions. In 2025, the global economy continues to grapple with a mixed macroeconomic environment — moderating inflation, fluctuating interest rates, and geopolitical uncertainties.

Tech stocks like Amazon often act as a barometer for investor sentiment. The fact that AMZN remains near its 52-week highs indicates that market participants see the company as a relatively safe bet with strong growth potential despite global headwinds.

Competition and Industry Landscape

Amazon faces competition on several fronts:

- Retail: Walmart, Target, and Alibaba continue to compete aggressively in online and offline retail.

- Cloud Computing: Microsoft Azure and Google Cloud are the biggest challengers to AWS, each investing heavily in AI infrastructure.

- Streaming and Entertainment: Amazon Prime Video competes with Netflix, Disney+, and Apple TV+.

Despite this, Amazon’s integrated ecosystem of services — Prime membership, AWS, advertising, and logistics — gives it a competitive moat that few rivals can match.

Analyst Expectations and Future Outlook

Wall Street analysts remain broadly bullish on Amazon. Many have price targets above $250, citing continued expansion of AWS, strong advertising revenue, and improving e-commerce profitability as key catalysts.

Upcoming quarterly earnings reports will be closely watched for insights into consumer spending trends and AWS performance. Positive results could push the stock toward new highs, while weaker-than-expected numbers could trigger short-term volatility.

Long-Term Investment Thesis

For long-term investors, Amazon represents a diversified technology play with exposure to multiple high-growth sectors. Its leadership in e-commerce, cloud computing, AI, and logistics makes it one of the most strategically positioned companies in the world.

The company’s commitment to innovation, infrastructure investment, and shareholder value creation has allowed it to weather past downturns and emerge stronger.