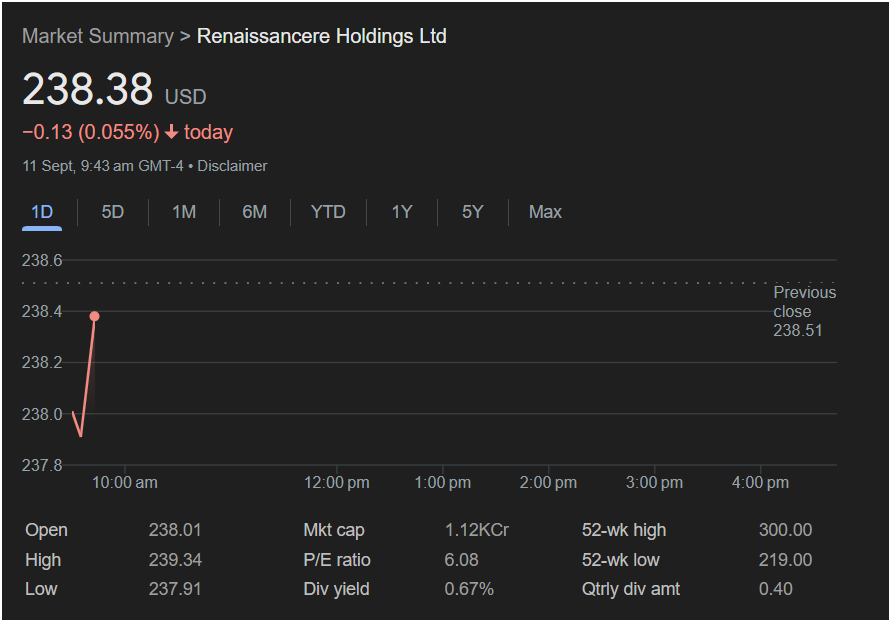

RenaissanceRe Holdings Ltd Shares Edge Lower to $238.38 in Early Trading

Reinsurance giant slips 0.05% as investors weigh market conditions and long-term dividend stability.

RenaissanceRe Holdings Ltd (NYSE: RNR) began Wednesday’s session with a modest decline, as shares traded at $238.38 at 9:43 a.m. GMT-4, down 0.13 points (0.055%) from the previous close of $238.51.

The stock opened the day at $238.01, reached an early high of $239.34, and recorded a low of $237.91 during initial trading hours. Despite the minor dip, RenaissanceRe maintains a solid market capitalization of approximately $11.2 billion, supported by a relatively low P/E ratio of 6.08, which may signal value for long-term investors.

The company’s 52-week range reflects a wide span of trading activity, from a low of $219.00 to a high of $300.00. This movement highlights the stock’s sensitivity to shifts in global insurance and reinsurance markets. While price fluctuations continue, RenaissanceRe has remained committed to delivering shareholder returns, offering a quarterly dividend of $0.40 per share with an annualized yield of 0.67%.

Market analysts note that RenaissanceRe’s performance often mirrors broader industry trends, including catastrophe exposure, reinsurance pricing, and global capital availability. Investors are closely monitoring how the company positions itself against evolving risk models and demand for reinsurance coverage amid increasingly volatile weather patterns.

Outlook:

Although today’s dip was minimal, the stock’s broader trend suggests investors remain cautious. Strong fundamentals, including a disciplined capital strategy and consistent dividend policy, may continue to support shareholder confidence. However, near-term performance will likely depend on macroeconomic conditions and the frequency of insured loss events during the remainder of the year.