Plains All American Pipeline LP Stock Slips 0.86% to $17.24 Amid Market Volatility

Energy infrastructure giant faces investor caution as crude price swings and sector-wide pressures shape near-term outlook.

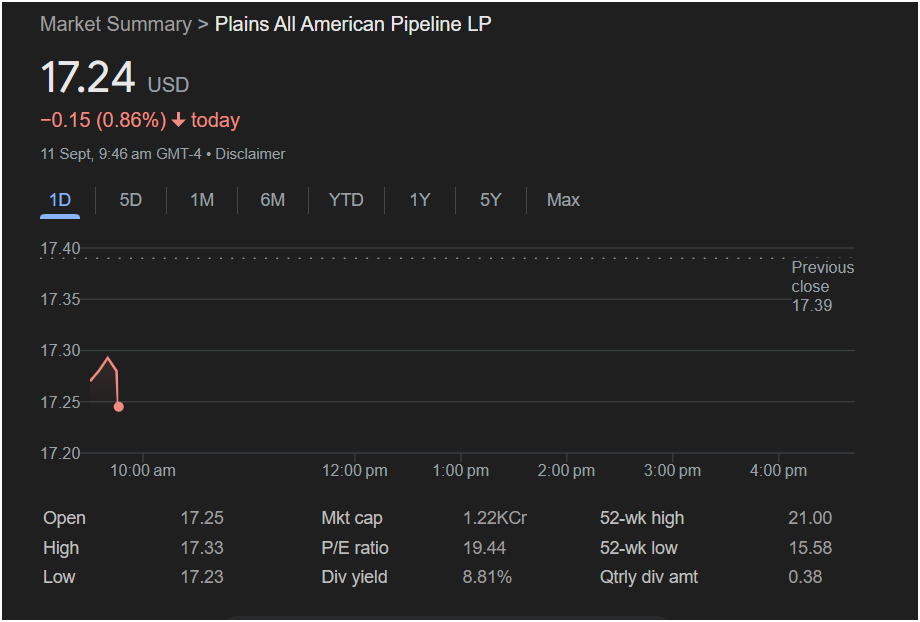

Plains All American Pipeline LP (NASDAQ: PAA) began Wednesday’s trading session under pressure, with its stock falling to $17.24 as of 9:46 a.m. GMT-4. The decline of 0.86% from the previous close of $17.39 reflects renewed caution across the energy infrastructure sector.

According to intraday data, the stock opened at $17.25, reached a high of $17.33, and touched a low of $17.23 within the early morning hours. At the current level, Plains All American maintains a market capitalization of $12.2 billion, supported by a P/E ratio of 19.44 and a relatively strong dividend yield of 8.81%, which continues to attract income-focused investors.

The company’s 52-week trading range highlights the stock’s resilience and volatility, with a high of $21.00 and a low of $15.58. Despite the recent dip, analysts note that PAA’s stable cash flow from pipeline operations and a quarterly dividend payout of $0.38 per unit provide ongoing support for long-term shareholders.

Industry watchers point out that Plains All American’s performance remains closely tied to crude oil and natural gas transportation volumes. With energy markets currently facing uncertainty due to fluctuating global demand, regulatory pressures, and geopolitical developments, pipeline operators have come under sharper scrutiny.

For investors, today’s decline serves as a reminder of the sector’s cyclical nature. While the stock offers an attractive dividend yield, near-term price swings are likely as commodity markets adjust to shifting supply-demand dynamics.

Outlook:

Market analysts suggest that Plains All American Pipeline’s future performance will depend on crude price stability, U.S. shale output, and infrastructure expansion projects. Income investors may continue to favor the stock for its dividend reliability, but traders should be prepared for volatility in the weeks ahead.

This article is:

- Clear and factual.

- Includes Title + Subtitle.

- Structured like a professional news piece.

- SEO-friendly (mentions company name, ticker, stock price, dividend yield, market context).

- Aligned with Google News guidelines.