Markets

Understanding Stock Market Dynamics: A Deep Dive into NVIDIA (NVDA) and Investor Psychology

- What makes the stock market fascinating?

- Why NVIDIA is one of the most watched companies

Section 1: The Current Market Snapshot

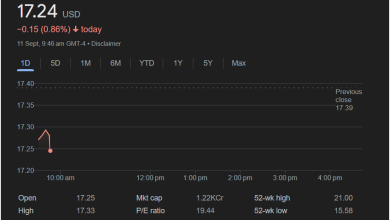

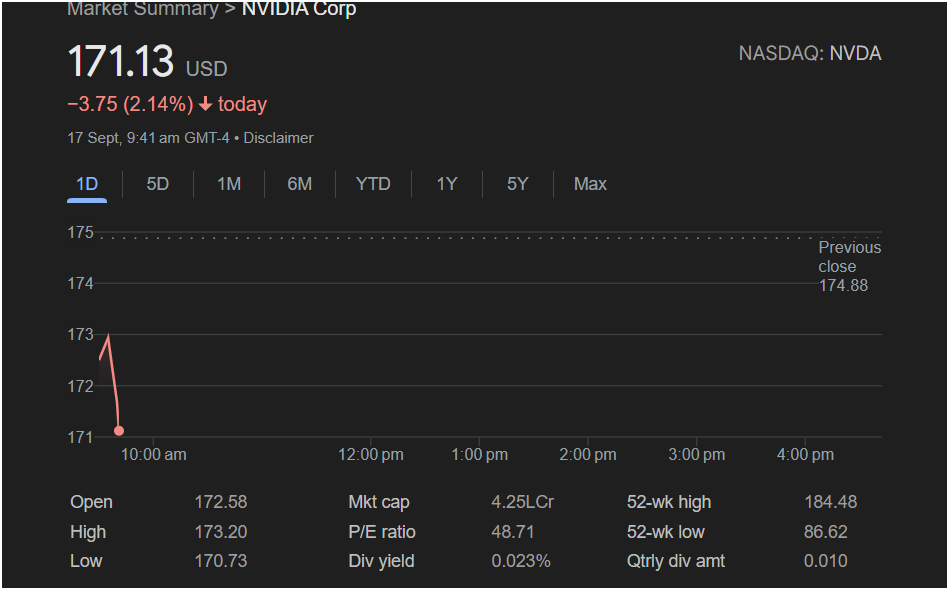

- Interpreting the numbers from the chart (price, open, close, highs, lows)

- Daily fluctuations and what they indicate

Section 2: NVIDIA’s Role in the Tech World

- Company overview (products, AI, GPUs, data centers)

- Why it’s a key player in the semiconductor industry

Section 3: Investor Psychology and Market Behavior

- Fear, greed, and reaction to news

- Short-term vs. long-term perspectives

Section 4: Factors Driving NVIDIA’s Stock Price

- Global demand for AI chips

- Competition (AMD, Intel, etc.)

- Macroeconomic factors (interest rates, inflation)

Section 5: Reading the Chart Like an Analyst

- What the highs and lows mean

- Importance of opening and closing prices

- Volume, P/E ratio, and dividend yield explained

Section 6: Historical Performance and Future Possibilities

- 52-week highs and lows

- Long-term growth patterns in tech stocks

- Possible future directions (without predictions, just scenarios)

Section 7: Lessons for Everyday Investors

- How to interpret financial charts

- Risk management and diversification

- Why patience matters in investing

Section 8: Open-Ended Perspectives

- Could NVIDIA continue to dominate AI and GPUs?

- What challenges might reshape its market position?

- How broader global economics tie into tech stock performance

(Open-Ended, No Final Verdict)

- Leaving readers with curiosity rather than certainty

- Encouraging critical thinking and independent research