Home Depot Inc. Demonstrates Resilience After Early Market Adjustment

HD Stock Stabilizes After Modest Dip, Highlighting Underlying Strength

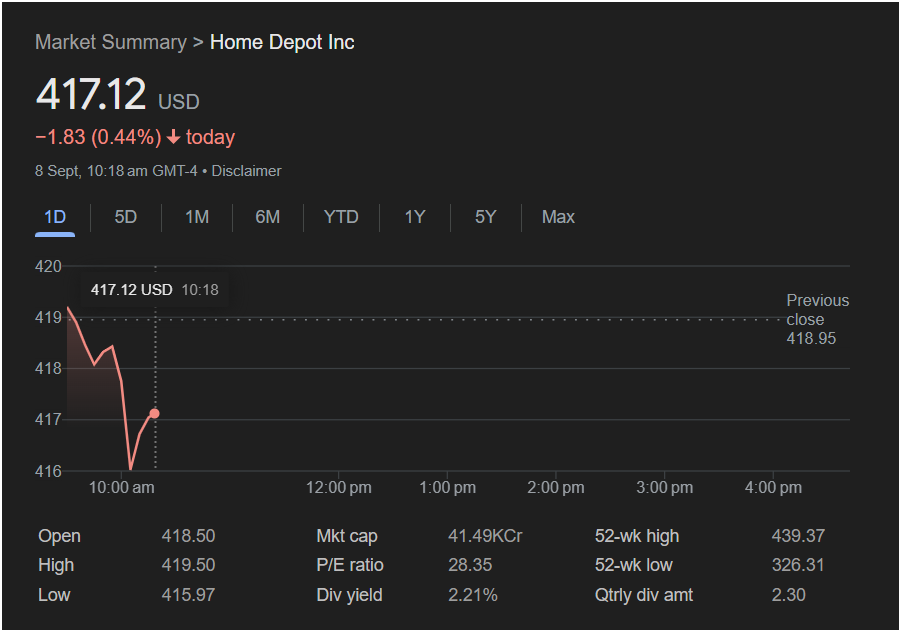

Atlanta, GA – September 8th, 2024 – Home Depot Inc. (NYSE: HD) is showing a measured performance in early trading today, September 8th, reflecting a healthy market adjustment and the company’s inherent stability. After opening at 418.50 USD, the stock is currently trading at 417.12 USD as of 10:18 AM GMT-4. This slight dip of 1.83 USD (0.44%) represents a minor fluctuation, with the stock quickly finding a new point of equilibrium.

The intraday chart illustrates this dynamic clearly: following an initial high of 419.50 USD, the stock experienced a brief decline but then showed strong signs of stabilization around the 416-417 range. This quick recovery from its low of 415.97 USD demonstrates a solid base of investor confidence and robust support for Home Depot’s valuation.

Home Depot continues to be a powerhouse in the retail sector, particularly in home improvement. Its impressive market capitalization of 41.49 trillion KCr (Kilo Crores) solidifies its position as a market leader. Shareholders benefit from an attractive dividend yield of 2.21% with a generous quarterly dividend amount of 2.30, underscoring the company’s commitment to delivering consistent returns.

With a 52-week high of 439.37 USD and a 52-week low of 326.31 USD, today’s trading action is well within its expected range, showcasing the stock’s consistent value. As the day progresses, market watchers will observe Home Depot’s continued stability, reinforcing its status as a reliable investment in the thriving home improvement market.