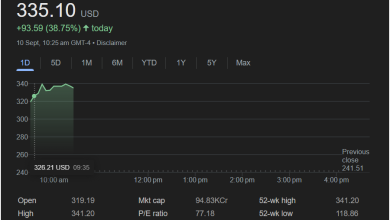

IBM Stock Plummets Over 8% in Major Sell-Off, Wiping Out Recent Gains

Shares of the technology giant IBM are experiencing a significant downturn, gapping down at the market open and falling sharply in a move indicative of strong investor concern.

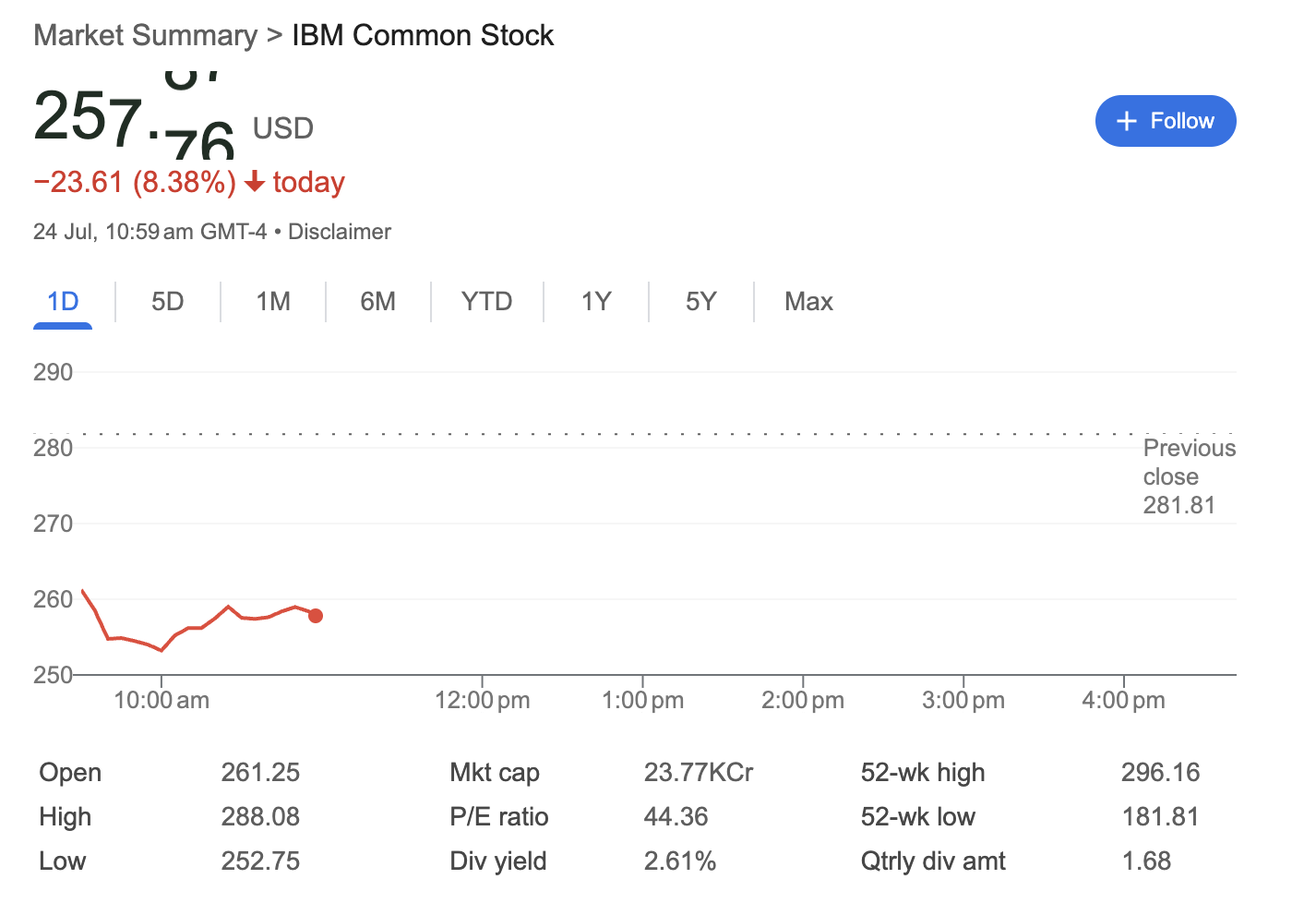

International Business Machines Corp. (IBM) saw its stock price plunge during morning trading on July 24th. As of 10:59 am GMT-4, the blue-chip stock was trading at 257.76 USD, a steep decline of -23.61 USD, representing an 8.38% loss for the day. This significant drop has caught the attention of the market, signaling a sharp reversal in sentiment for the legacy tech company.

Here is a comprehensive analysis of the stock’s performance based on the available data.

Technical Analysis: A Bearish Gap and a Break in Trend

The technical picture for IBM is decidedly bearish today. The most significant event is the massive “gap down” at the market open. After closing the previous session at 281.81 USD, the stock opened at 261.25 USD, immediately erasing nearly 20 dollars of its value.

Key technical data points include:

-

Day’s Low: 252.75 USD

-

Previous Close: 281.81 USD

-

52-Week Range: 181.81 USD – 296.16 USD

Following the lower open, sellers continued to drive the price down to a low of 252.75 USD before a slight bounce. The current price action indicates a major break in the stock’s recent upward momentum, which had carried it close to its 52-week high of 296.16 USD. The data also lists a daily high of 288.08 USD, which likely occurred in pre-market trading before a significant negative catalyst prompted the sharp sell-off at the market’s open.

Fundamental Analysis: A Profitable Titan Under Pressure

Despite the sharp price drop, IBM’s fundamental profile remains that of a mature, profitable technology powerhouse.

-

Market Cap: 23.77KCr

-

P/E Ratio: 44.36

-

Dividend Yield: 2.61%

-

Quarterly Dividend Amount: 1.68 USD

IBM is a mega-cap company, a staple in many investment portfolios. Its Price-to-Earnings (P/E) ratio of 44.36 is relatively high for a mature company, suggesting that investors had priced in significant growth expectations. A sharp sell-off like this can occur when new information (such as an earnings report or guidance) causes the market to aggressively re-evaluate those future growth prospects.

A key attraction for many IBM investors is its reliable dividend. The company offers a healthy 2.61% dividend yield. Following today’s price drop, that yield becomes mathematically more attractive to new investors, which may provide some price support from income-focused buyers.

Sentiment Analysis: Decidedly Negative and Catalyst-Driven

Market sentiment for IBM is overwhelmingly negative. A single-day drop of over 8% for a stock of IBM’s size is a major event and is not the result of random market noise. This move is almost certainly driven by a significant fundamental catalyst, such as a disappointing earnings release, weak forward-looking guidance, an analyst downgrade, or negative news impacting its core business segments.

The gap down at the open confirms that negative sentiment formed overnight or in pre-market hours, leading to an immediate wave of selling. While the stock has seen a minor bounce from its intraday low, sellers remain firmly in control, indicating that investor confidence has been severely shaken.

Disclaimer: This article is for informational purposes only and is based on publicly available market data at a specific point in time. It should not be considered financial or investment advice. Investing in securities involves risk. Readers should conduct their own thorough research and consult with a qualified financial professional before making any investment decisions.