Super Micro Computer ( smci ) Stock Rebounds After Early Dip, Climbs Over 1%

Shares of Super Micro Computer Inc. (SMCI) demonstrated resilience in morning trading on July 24th, recovering from an early session dip to post a solid gain, signaling positive investor sentiment as the day progressed.

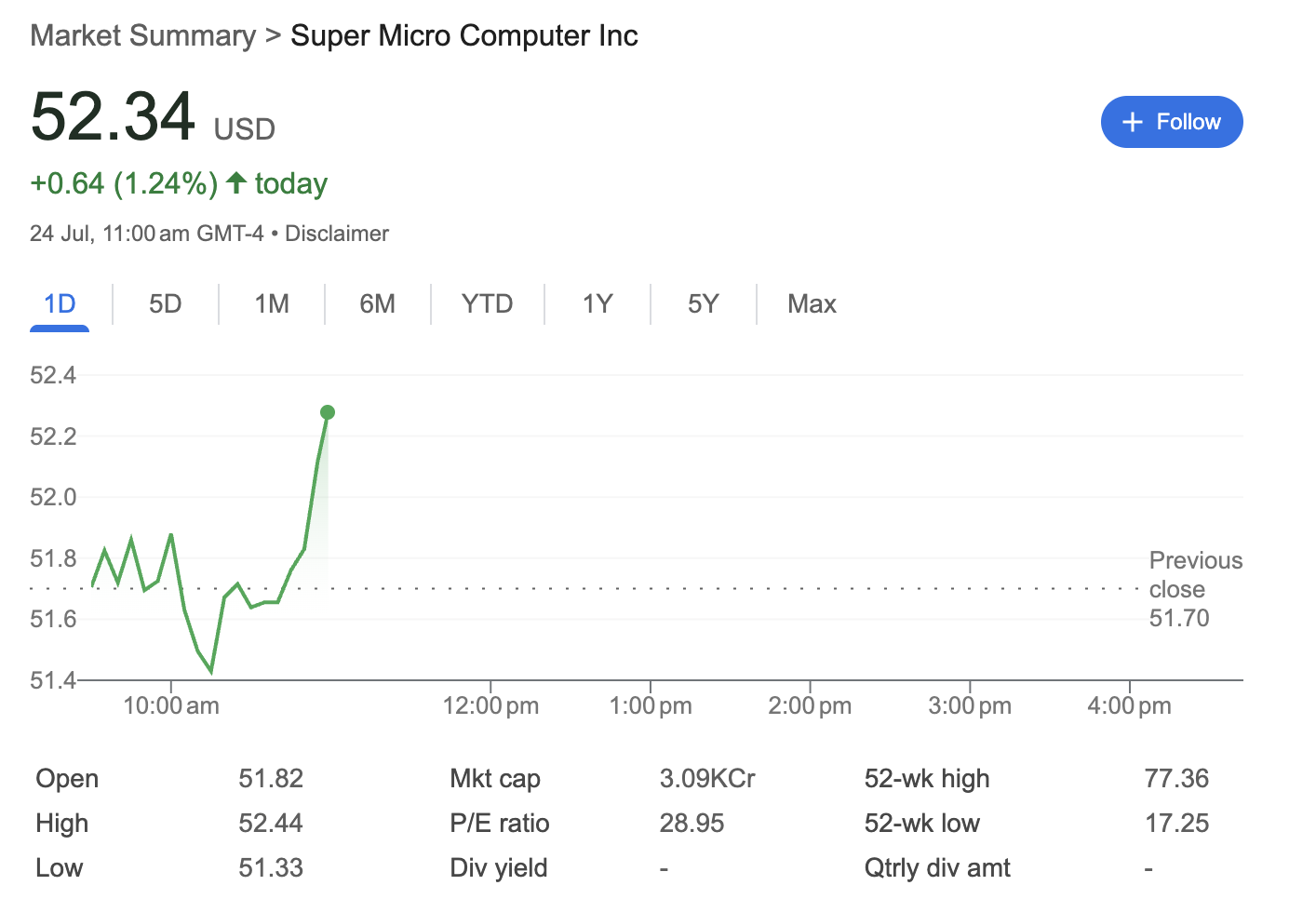

As of 11:00 am GMT-4, the server and data center solutions provider’s stock was trading at 52.34 USD. This represents a gain of 0.64 USD, or 1.24%, for the day, reflecting a bullish turn after a volatile start.

Technical Analysis: A Bullish Reversal from the Morning Low

The intraday price chart for Super Micro Computer reveals a classic case of buyers stepping in to reverse an early decline.

-

Price Action: The stock opened at 51.82 USD, slightly above the previous close of 51.70 USD. It then experienced selling pressure, dropping to an intraday low of 51.33 USD. However, this dip was short-lived, as the stock found its footing and staged a sharp rally, surging to a session high of 52.44 USD just before 11:00 am.

-

Key Levels to Watch:

-

Immediate Support: The morning’s low of 51.33 USD has established itself as a key support level for the day.

-

Immediate Resistance: The intraday high of 52.44 USD serves as the current resistance. A breakout above this level could lead to further gains.

-

-

Broader Context: The stock is trading well within its 52-week range, which spans from a low of 17.25 USD to a high of 77.36 USD. The current price action shows a significant gain over the past year, though it has pulled back from its peak.

Fundamental Analysis: A Profitable Growth Company

The financial metrics provided offer a solid fundamental profile for Super Micro Computer.

-

Market Capitalization: The company has a market cap of 3.09KCr, which translates to approximately $30.9 billion USD. This places it firmly in the large-cap segment of the market.

-

Profitability and Valuation: Super Micro Computer is a profitable company, as indicated by its P/E ratio of 28.95. This means investors are willing to pay nearly 29 times the company’s trailing twelve-month earnings per share, a valuation that is often seen in technology companies with strong growth prospects.

-

Dividend Policy: The company does not currently pay a dividend (Div yield is “-“). This is a common strategy for growth-oriented companies, which typically prefer to reinvest their earnings back into the business to fuel further expansion, research, and development.

Sentiment Analysis: Bullish Momentum Takes Over

Market sentiment for Super Micro Computer turned distinctly positive as the morning session unfolded. While the initial dip might have suggested some bearishness or profit-taking, the strong and swift reversal from the lows indicates robust buying interest. The ability to shake off early weakness and rally to a new session high demonstrates underlying confidence from investors in the stock’s near-term outlook.

Disclaimer: This article is based on a snapshot of market data for Super Micro Computer Inc. as of 11:00 am GMT-4 on July 24th. Market conditions are highly volatile and can change rapidly. The information provided is for informational purposes only and should not be considered financial or investment advice. Readers should conduct their own research before making any investment decisions.