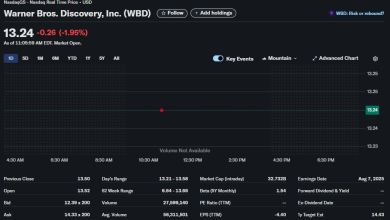

CSX Corp Stock Analysis: Shares Gain 1.44% Despite Fading from Morning High

Date of data: 24 July, 10:59 am GMT-4

Shares of railroad transportation company CSX Corp. were trading in positive territory during the morning session on July 24th. The stock price stood at 0.50, or 1.44%, for the day. However, the intraday price action reveals a more complex picture of initial bullish strength met by significant selling pressure.

Technical Analysis

The technical chart for CSX shows a day of significant price swings within the first hour of trading.

-

Price Action: The stock opened with a substantial gap up at $36.37, well above the previous day’s close of 36.38**. This bullish opening was short-lived, as the stock quickly reversed, falling sharply to an intraday low of $35.17. Following this drop, the price entered a consolidation phase, trading sideways.

-

Key Price Levels:

-

Intraday Support: The session low of $35.17 serves as the primary support level.

-

Intraday Resistance: The opening high of $36.38 has established itself as a strong resistance level that sellers defended vigorously.

-

52-Week Range: The stock is trading near the upper end of its 52-week range of $26.22 to $37.10. This proximity to its annual high suggests a strong underlying uptrend over the past year.

-

Fundamental Analysis

The fundamental data for CSX Corp. portrays a financially sound, large-cap, and profitable company.

-

Market Capitalization: With a market cap listed as 6.70KCr USD, CSX is a major player in the transportation industry.

-

P/E Ratio: The company has a Price-to-Earnings (P/E) ratio of 21.14. This moderate valuation indicates that the stock price is reasonably aligned with its earnings, suggesting it is not overly expensive. A positive P/E confirms the company’s consistent profitability.

-

Dividend Yield: CSX offers a dividend yield of 1.47%, with a quarterly dividend payment of $0.13 per share. This demonstrates a commitment to returning capital to shareholders, making the stock potentially attractive to income-focused investors.

Sentiment Analysis

The market sentiment for CSX on this day is distinctly mixed, reflecting a tug-of-war between buyers and sellers.

-

Initial Bullish Sentiment: The significant gap up at the open indicates strong positive sentiment carrying over from after-hours trading or based on pre-market news. This enthusiasm pushed the stock to a new intraday high. The fact that the stock remains firmly in the green (up 1.44%) also reflects underlying strength.

-

Short-Term Bearish/Cautious Sentiment: The immediate and sharp sell-off from the high is a classic “fade the gap” move. This suggests that traders and short-term investors used the opening strength as an opportunity to take profits or initiate short positions. The failure to sustain the opening gains points to significant caution at higher valuation levels.

In conclusion, CSX Corp. is demonstrating underlying strength by holding onto daily gains, supported by solid fundamentals and a positive long-term trend. However, the morning’s trading activity highlights notable short-term resistance and a willingness from sellers to step in, capping the immediate upside.

Disclaimer: This article is for informational purposes only and is based on data from a specific point in time as shown in the provided image. It should not be considered financial advice. Investors should conduct their own research and consult with a qualified financial professional before making any investment decisions.