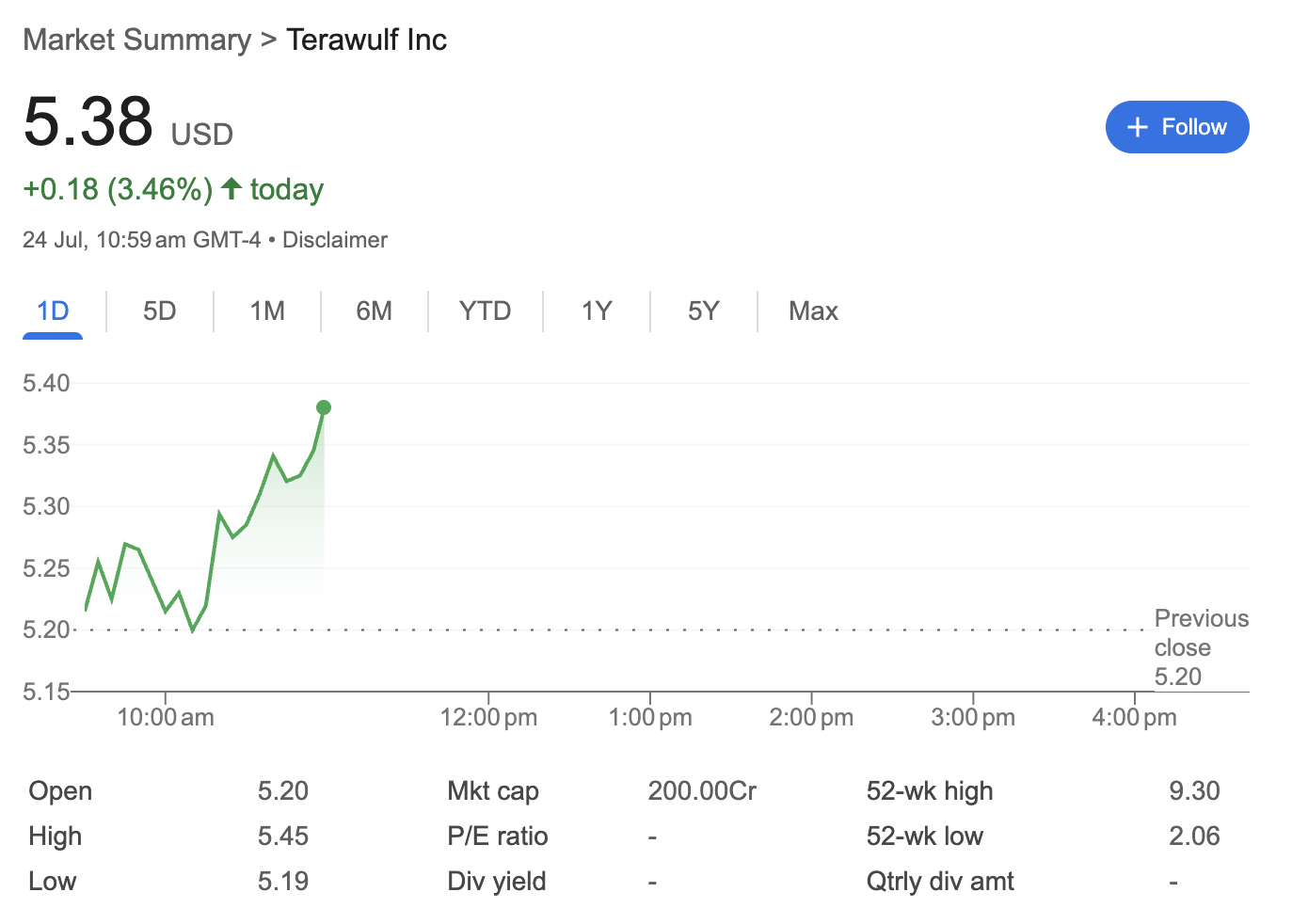

Terawulf Stock Jumps Over 3% in Strong Morning Session

Shares of Terawulf Inc. (WULF) experienced a notable surge in morning trading on July 24th, climbing over 3% as buying pressure built throughout the session. This report provides an analysis of the stock’s performance based on the technical, fundamental, and sentiment data available.

At 10:59 am GMT-4, the stock of Terawulf Inc., a company involved in digital asset infrastructure and bitcoin mining, was trading at 5.38 USD. This reflected a solid intraday gain of $0.18, or 3.46%, indicating strong positive momentum for the day.

Technical Analysis: A Resilient Upward Trend

The intraday technical chart for Terawulf showcases a pattern of resilience and building momentum.

-

Intraday Trend: The stock opened flat at 5.19. From there, it established a clear upward trend, marked by a series of higher highs and higher lows, eventually reaching a session high of $5.45. This pattern suggests that early selling pressure was quickly absorbed by buyers.

-

Price in Context: At 2.06**, highlighting a significant recovery over the past year. However, it remains considerably below its 52-week high of $9.30, indicating there is still significant ground to cover to reclaim its peak.

-

Volatility: The chart’s choppy, stair-step ascent is characteristic of many stocks in the volatile cryptocurrency sector, reflecting active trading and shifting sentiment throughout the session.

Fundamental Analysis: A Focus on Future Potential

The fundamental metrics provide insight into the company’s current financial status and investor expectations.

-

Market Capitalization: The market cap is listed as 200.00Cr. The “Cr” (Crore) notation is commonly used in the Indian numbering system. Investors should cross-reference this figure with primary US market sources, as Terawulf’s market capitalization is typically reported in millions of US dollars.

-

P/E Ratio: The Price-to-Earnings (P/E) ratio is marked as “-“. A non-existent P/E ratio typically signifies that the company has reported a net loss (negative earnings) over the trailing twelve-month period. This is not uncommon for companies in the capital-intensive bitcoin mining industry, where profitability can be heavily influenced by cryptocurrency prices and operational costs.

-

Dividends: The dividend yield and quarterly dividend amount are both listed as “-“, confirming that Terawulf does not pay a dividend. This is standard practice for growth-focused or not-yet-profitable companies that reinvest cash flow back into operations and expansion.

Sentiment Analysis: Clearly Bullish and Speculative

The market sentiment for Terawulf on this day appears strongly bullish and is likely driven by speculation.

-

Positive Price Action: The 3.46% gain and the sustained upward trend are clear indicators of positive investor sentiment. The market is buying into the stock’s story for the day.

-

Speculative Driver: Given the lack of a positive P/E ratio, the bullish sentiment is unlikely to be based on current profitability. Instead, it is more likely tied to external factors, such as a rise in the price of Bitcoin, positive sector news, or specific company developments that boost confidence in its future potential.

-

Strong Buying Interest: The stock’s recovery from its intraday low and its push toward the session high demonstrate that buyers are in control and are actively accumulating shares.

Conclusion

Terawulf Inc. is demonstrating strong intraday performance, driven by positive market sentiment and a clear upward technical trend. The move appears speculative in nature, as the company’s fundamental data suggests it is not yet profitable. Investors are likely betting on the company’s future prospects and the broader health of the digital asset market rather than its current earnings.

Disclaimer: This article is for informational purposes only and is based on data from the provided image. It should not be considered financial or investment advice. All investors should conduct their own thorough research and consult with a qualified financial professional before making any investment decisions.