Rocket Companies (RKT) Stock Shows Intraday Volatility Amid High Valuation Metrics

A snapshot of Rocket Companies Inc. stock on July 23 reveals a turbulent trading session, with the stock experiencing a sharp drop after the market open before finding some stability. This analysis delves into the technical, fundamental, and sentiment indicators from that moment in time.

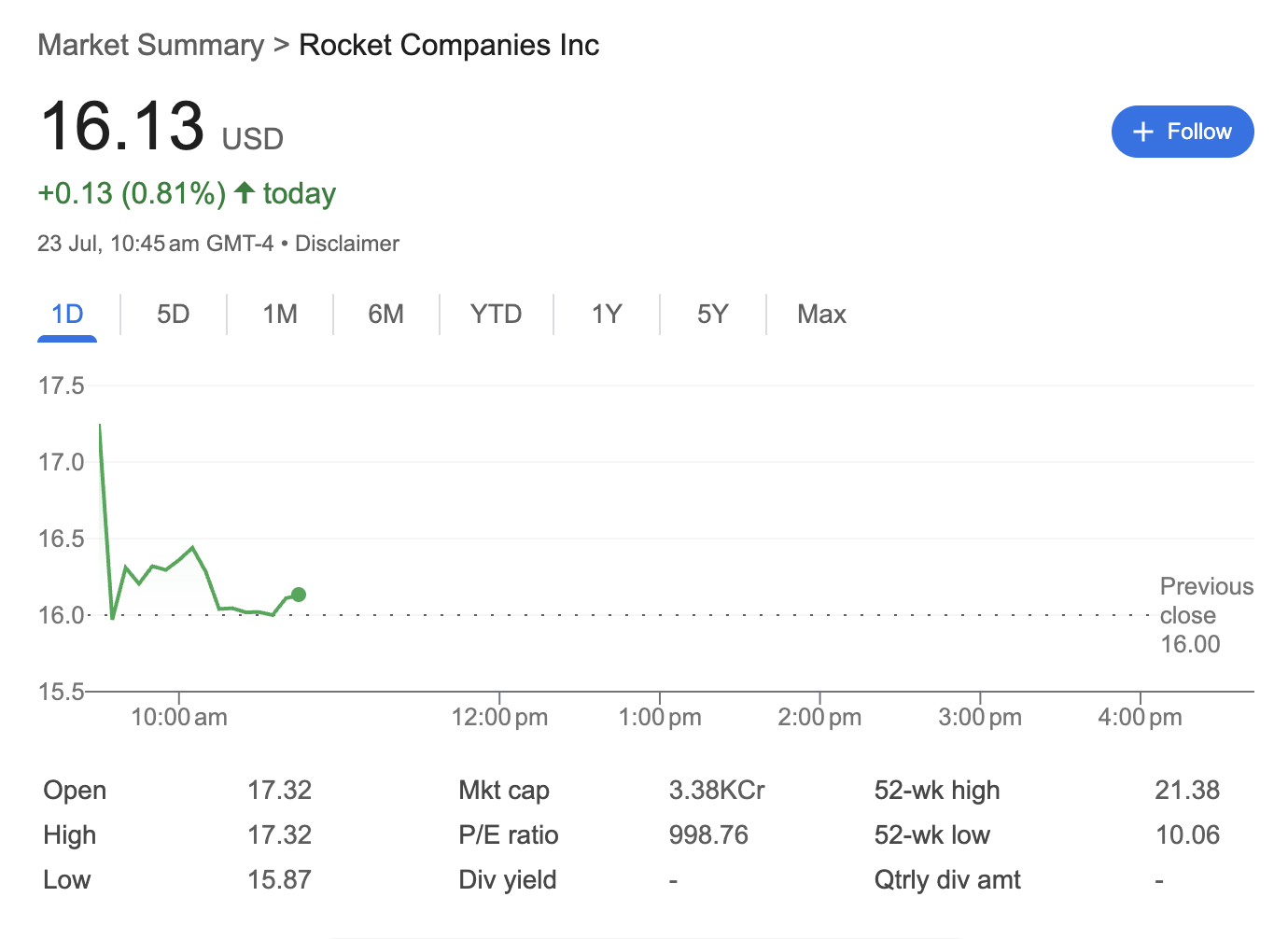

On the morning of July 23, at approximately 10:45 AM GMT-4, shares of Rocket Companies Inc. were trading at $16.13 USD. While this represented a modest gain of 0.81% for the day, the headline number belied a session marked by significant price swings.

Technical Analysis: A Story of an Early Sell-Off

The intraday chart for Rocket Companies tells a clear story of early-session bearish pressure.

-

Sharp Opening Drop: The stock opened the day at its high of 15.87 shortly after the market opened.

-

Key Price Levels: The previous day’s close was $16.00, a level the stock was attempting to hold above at the time of the snapshot. The wide intraday range between $15.87 and $17.32 highlights the high volatility.

-

52-Week Perspective: The stock was trading closer to its 52-week low of 21.38. This suggests that, from a broader perspective, the stock was in a larger downtrend or period of consolidation leading up to this day.

Fundamental Analysis: High Expectations Baked In

The fundamental data points provide crucial context to the stock’s valuation.

-

Market Capitalization: The company’s market capitalization was listed as 3.38KCr, which translates to approximately $33.8 billion USD. This figure places Rocket Companies firmly in the large-cap category.

-

Price-to-Earnings (P/E) Ratio: The most striking fundamental metric is the P/E ratio of 998.76. A P/E ratio this high is exceptional and indicates that investors were willing to pay a very high premium for the company’s earnings. This often suggests strong expectations for future growth, or it can be a sign that current earnings are very low relative to the stock price.

-

Dividend Yield: The company did not offer a dividend, as indicated by a null dividend yield and quarterly dividend amount. This is common for companies that prefer to reinvest their profits back into the business to fuel growth.

Sentiment Analysis: A Mixed Picture

While the image contains no direct sentiment polls, the price action and metrics offer clues.

-

Bearish Intraday Sentiment: The immediate and sharp sell-off from the day’s high of $17.32 suggests a strong wave of negative sentiment or profit-taking at the market’s open.

-

Underlying Bullishness?: The stock’s ability to bounce off its low of $15.87 and trade above the previous close of $16.00 indicates that some buyers saw value at these lower levels. Furthermore, the extremely high P/E ratio suggests that a significant portion of the market held a long-term bullish outlook on the company’s growth prospects, despite the short-term price weakness.

In summary, the provided snapshot of Rocket Companies Inc. captures a moment of conflict in the market. While short-term technicals pointed to bearish volatility, the underlying fundamental valuation suggested that investors held high hopes for the company’s future.

Disclaimer: This article is based on a static image of market data from a specific point in time and is for informational purposes only. It should not be considered financial advice. All investment decisions should be made with the help of a qualified financial professional.