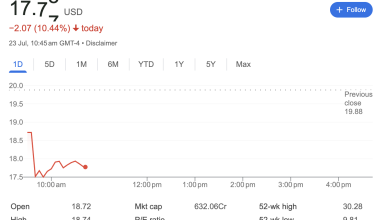

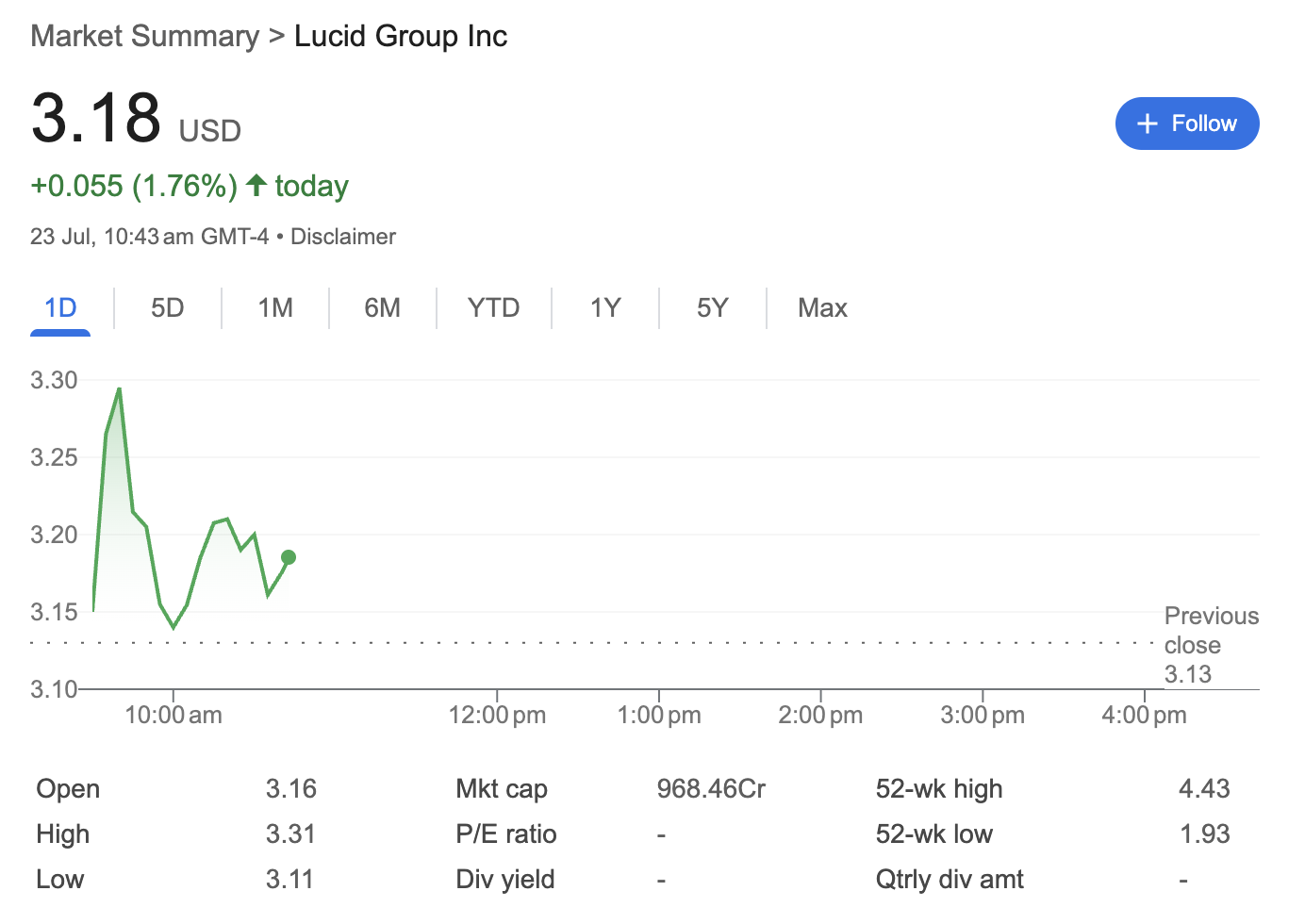

Lucid Group Stock Analysis: Price Climbs to $3.18 Amid Intraday Volatility

Date of data: 23 July, 10:43 am GMT-4

Shares of Lucid Group Inc. were seen trading higher in the morning session on July 23rd. The electric vehicle manufacturer’s stock price stood at $3.18 USD, marking an increase of $0.055, or 1.76%, for the day. This article provides a snapshot analysis based on the market data available at that time.

Technical Analysis

The intraday chart for Lucid Group reveals a session marked by significant volatility.

-

Price Action: The stock opened at $3.16, slightly above the previous day’s close of 3.31**. However, this peak was met with selling pressure, leading to a decline to the day’s low of $3.11. At the time of the report, the stock had recovered from its low and was trading at $3.18.

-

Key Price Levels:

-

Intraday Support: The session low of $3.11 serves as the immediate support level.

-

Intraday Resistance: The session high of $3.31 acts as the current resistance level that bulls were unable to break.

-

52-Week Range: The stock is trading within a 52-week range of $1.93 to $4.43. The current price is situated in the lower half of this range, indicating a significant downtrend from its yearly high.

-

Fundamental Analysis

A look at the fundamental metrics provided offers insight into the company’s current financial standing.

-

Market Capitalization: The market cap is listed as 968.46Cr USD. This figure represents the total market value of the company’s outstanding shares.

-

P/E Ratio: The Price-to-Earnings (P/E) ratio is listed as “-“. A non-existent or negative P/E ratio typically signifies that the company is not currently profitable and has negative earnings per share. This is common for companies in a high-growth phase, like many in the EV sector, that are heavily investing in research, development, and expansion.

-

Dividend Yield: The dividend yield is also listed as “-“, indicating that Lucid Group Inc. does not pay a dividend to its shareholders. The company likely reinvests any available capital back into its operations to fuel future growth.

Sentiment Analysis

The market sentiment for Lucid Group on this day appears to be mixed, with elements of both bullish and bearish activity.

-

Positive Sentiment: The stock’s 1.76% gain from the previous close points to positive buying interest in the morning session. The ability to open higher and hold gains suggests short-term optimism among some investors.

-

Cautious Sentiment: The sharp rejection from the day’s high of $3.31 indicates that there is considerable selling pressure or profit-taking at higher price levels. This suggests that while some are buying, others are using price rallies as an opportunity to sell, reflecting underlying caution or a lack of strong conviction for a sustained upward move.

In summary, while Lucid’s stock showed a positive gain for the day, its journey was characterized by notable volatility. The fundamental data points to a growth-stage company focused on expansion rather than immediate profitability, a profile that often attracts investors with a higher tolerance for risk.

Disclaimer: This article is for informational purposes only and is based on data from a specific point in time as shown in the provided image. It should not be considered financial advice. Investors should conduct their own research and consult with a qualified financial professional before making any investment decisions.