GoPro Stock Skyrockets Over 50% in Trading Frenzy: A Deep Dive into the Surge

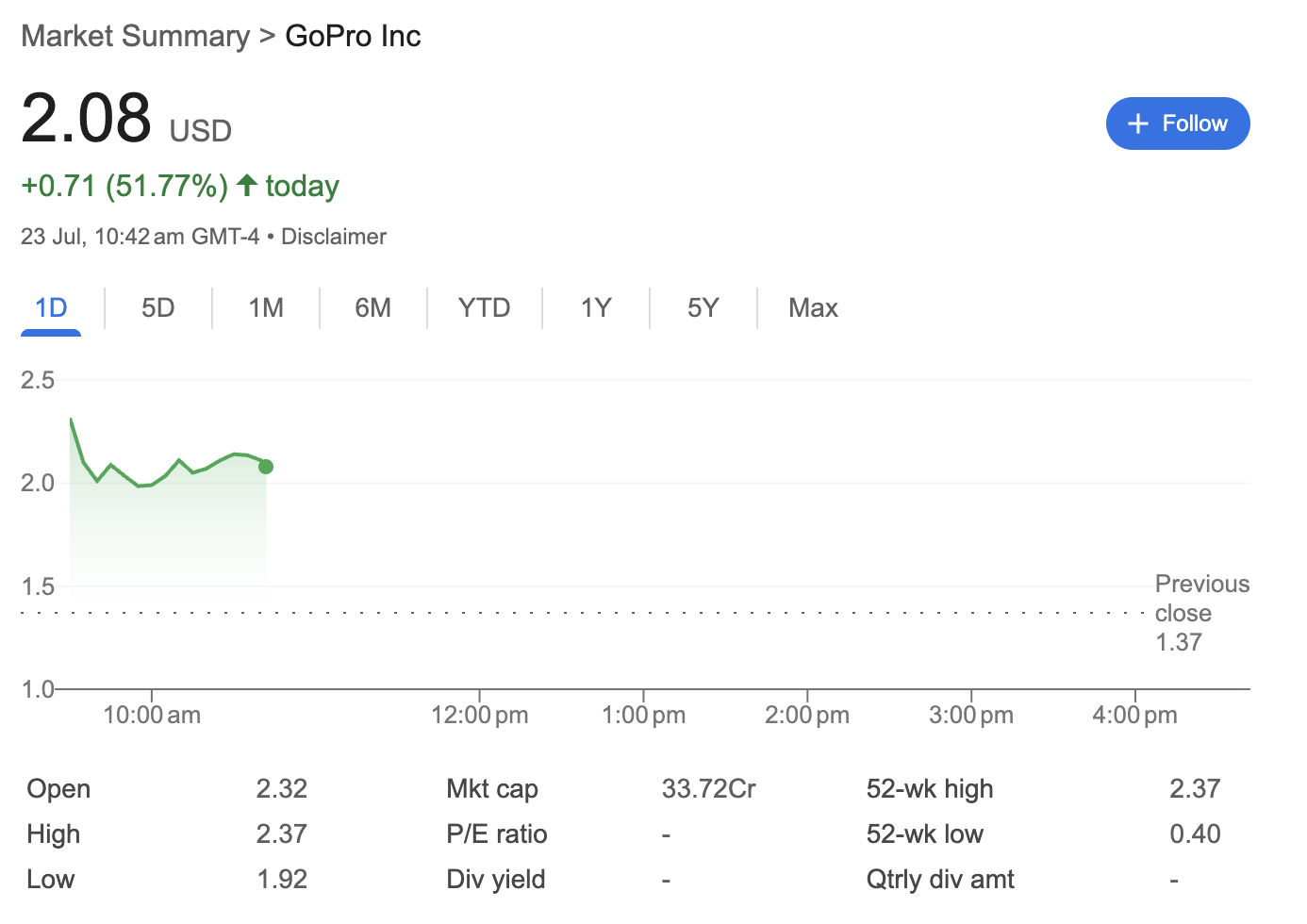

GoPro Inc. (GPRO) experienced a monumental day in the market, with its stock price surging by more than 50% in a dramatic trading session. As of 10:42 am GMT-4 on July 23rd, the stock was trading at 0.71 or 51.77% for the day. This explosive move has captured the attention of investors and market analysts alike. Here’s a breakdown of what the data tells us.

Technical Analysis: A Story of Extreme Volatility and Bullish Momentum

The technical indicators from the day’s trading paint a picture of intense buying pressure and significant volatility.

-

Massive Price Gap: The stock opened for trading at $2.32, a massive gap up from the previous close of $1.37. This indicates an overwhelming amount of buy orders before the market even opened, often triggered by significant overnight news.

-

New 52-Week High: The rally propelled the stock to a high of $2.37, which also marked a new 52-week high. Reaching this milestone is a strong bullish signal, suggesting the stock has broken through previous resistance levels.

-

Intraday Volatility: Despite the powerful upward trend, the session was not a straight line up. The stock traded in a wide range, hitting a low of $1.92 before settling at $2.08 at the time of reporting. This wide range highlights the high level of volatility and indecision among traders after the initial surge.

-

Chart Pattern: The 1-day chart shows a sharp spike at the open, followed by a partial retracement, indicating some investors were taking profits after the initial jump.

Fundamental Analysis: A Look Beneath the Surface

While the price action is dramatic, the fundamental data available offers a more sober perspective on the company’s financial health.

-

Market Capitalization: With a market cap of 33.72Cr (which can be interpreted as approximately $337.2 million), GoPro is classified as a small-cap stock. Stocks in this category are known for their potential for high growth but also come with higher risk and volatility.

-

P/E Ratio: The Price-to-Earnings (P/E) ratio is listed as unavailable (‘-‘). This typically suggests that the company has had negative earnings per share over the last twelve months, meaning it has not been profitable.

-

Dividends: GoPro does not pay a dividend, as indicated by the blank “Div yield” and “Qtrly div amt” fields. This is common for companies that are either in a growth phase, reinvesting all earnings back into the business, or are working to manage their finances and are not in a position to distribute profits to shareholders.

Sentiment Analysis: Overwhelmingly Positive

A price move of over 50% in a single morning is a clear and powerful indicator of extremely positive market sentiment.

-

Catalyst-Driven Move: Such a significant rally is almost always driven by a major news event. While the specific catalyst is not mentioned in the data, this type of move is often associated with factors like:

-

A surprisingly strong earnings report and/or positive future guidance.

-

The announcement of a revolutionary new product or technology.

-

News of a potential merger, acquisition, or a major strategic partnership.

-

-

Investor Euphoria: The gap up at the open and the push to a new 52-week high reflect a wave of investor euphoria and a “fear of missing out” (FOMO) that can fuel rapid price increases. The market is aggressively repricing the stock based on new information or speculation.

Conclusion

The data from July 23rd shows GoPro stock in the midst of an extraordinary rally, driven by powerful technical momentum and overwhelmingly bullish sentiment. However, the fundamental picture, particularly the lack of a P/E ratio, suggests underlying financial challenges. Investors will be keenly watching to see if the catalyst behind this surge has fundamentally altered the company’s long-term outlook or if this is a short-term, sentiment-driven spike. The high volatility presents both significant opportunities and substantial risks for traders.

Disclaimer: This article is for informational purposes only and is based on the data provided in the image. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional.