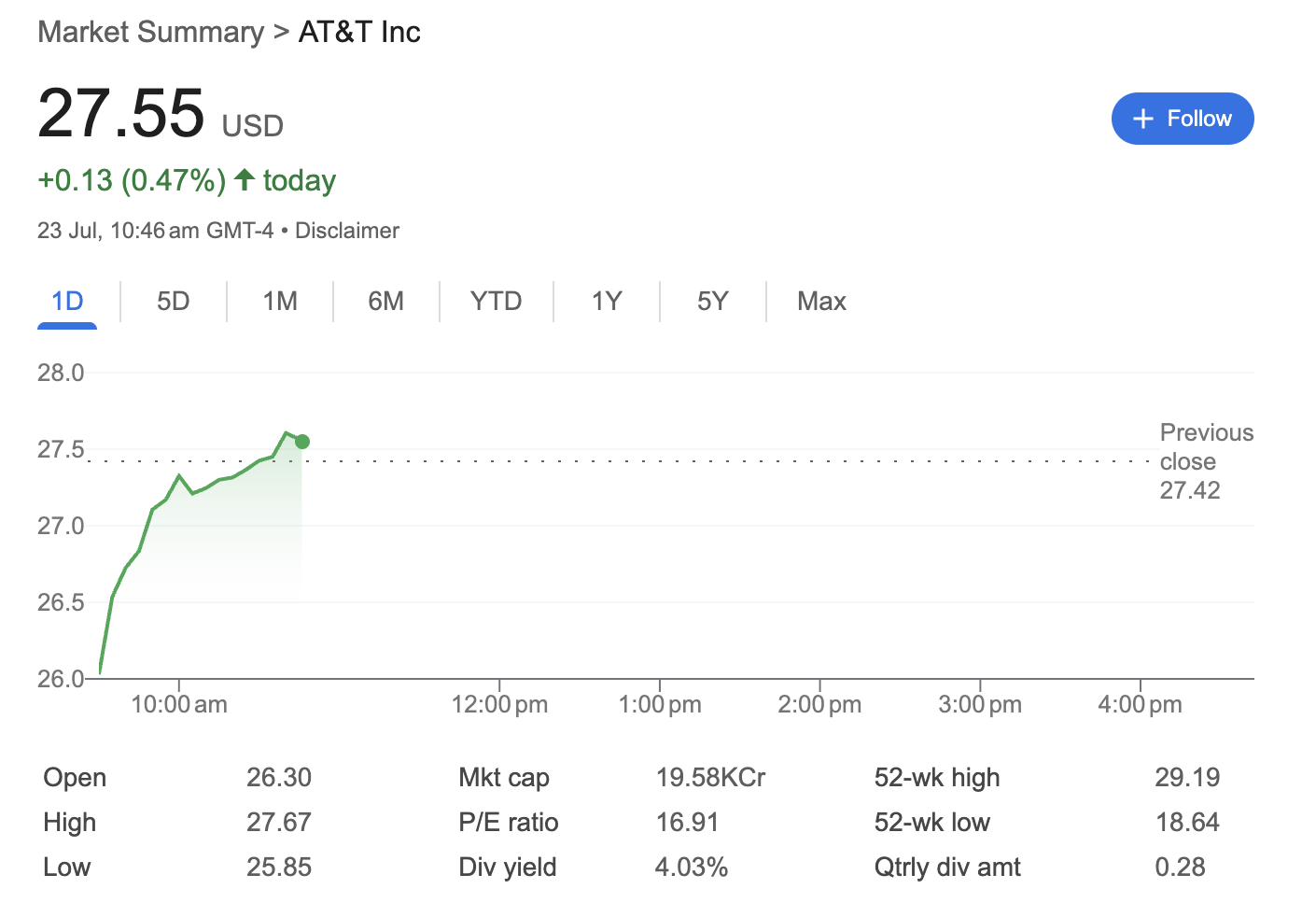

AT&T Stock Shows Bullish Intraday Momentum with Strong Fundamentals

A snapshot analysis reveals AT&T (T) trading higher on the day, backed by a solid dividend yield and a reasonable valuation, signaling positive investor sentiment.

Based on market data from July 23rd at 10:46 am GMT-4, AT&T Inc. stock was trading at 27.55 USD, marking a gain of $0.13 (0.47%) for the day. This analysis breaks down the technical, fundamental, and sentiment indicators from the provided information.

Technical Analysis

The technical picture for AT&T on an intraday basis appears positive.

-

Intraday Trend: The 1D chart shows a strong upward trend since the market opened. The stock began the day at $26.30 and has since climbed steadily, indicating significant buying pressure.

-

Price Action: At 27.55 USD, the stock is trading near its high for the day of $27.67 and is well above its opening price and the previous day’s close of $27.42. This sustained move above the prior close is a bullish signal for the session.

-

52-Week Range: The current price is positioned in the upper half of its 52-week range ($18.64 – $29.19). While not at its peak, this suggests the stock has recovered significantly from its lows and is maintaining longer-term strength.

Fundamental Analysis

The fundamental data points provided in the summary offer insight into the company’s valuation and appeal to different types of investors.

-

Valuation (P/E Ratio): With a Price-to-Earnings (P/E) ratio of 16.91, AT&T appears to be reasonably valued. This P/E level is often considered fair for a large, established blue-chip company, suggesting the stock price is not overly inflated relative to its earnings.

-

Dividend Yield: A key highlight is the dividend yield of 4.03%. This is a substantial yield, making AT&T an attractive option for income-focused investors seeking regular cash flow from their investments. The quarterly dividend amount is listed as $0.28 per share.

-

Market Capitalization: The market cap is noted as 19.58KCr. This figure, likely representing a value in the hundreds of billions of US dollars, confirms AT&T’s status as a large-cap company, which is typically associated with stability and market leadership.

Sentiment Analysis

The overall market sentiment for AT&T during this trading session appears to be bullish.

-

Positive Price Movement: The green, upward-pointing arrow and the positive percentage change (+0.47%) are direct indicators of positive market sentiment.

-

Buying Pressure: The sharp rise from the opening bell, pushing the price well above both the open and the previous close, demonstrates strong investor demand and confidence in the stock for the day. The ability to sustain these gains in the first hour of trading reinforces this positive outlook.

Disclaimer: This article is based on a market data snapshot from a specific point in time and is for informational purposes only. It should not be considered financial advice. Stock market conditions are dynamic and can change rapidly. Readers should conduct their own research or consult with a qualified financial advisor before making any investment decisions.