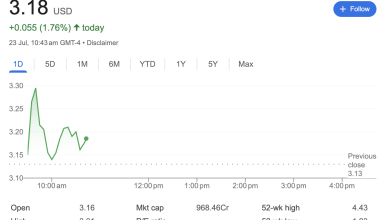

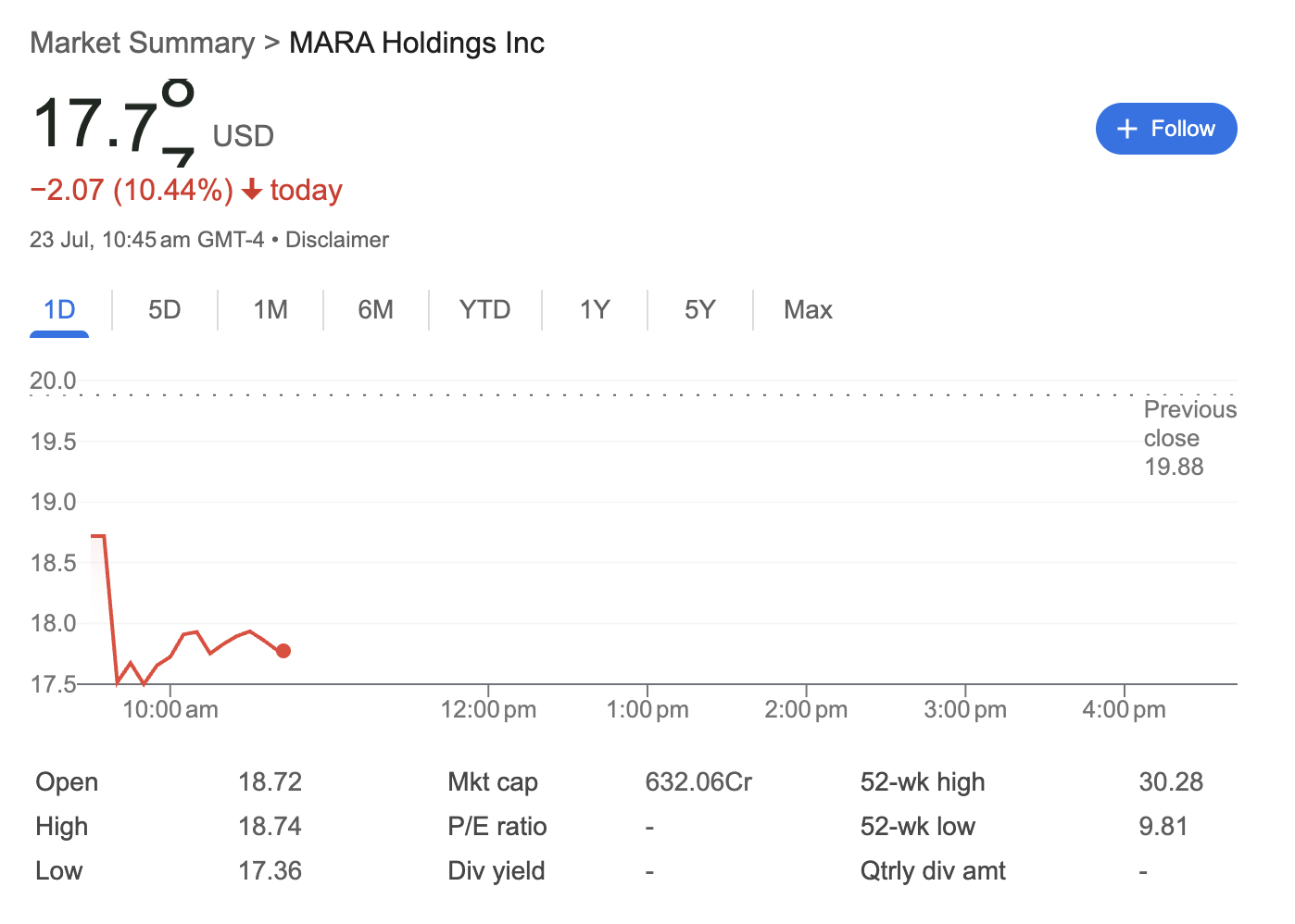

Marathon Digital (MARA) Stock Sees Sharp Decline, Plunging Over 10% in Morning Trade

Marathon Digital Holdings (MARA), a prominent player in the cryptocurrency mining sector, experienced a significant downturn in early trading on July 23rd, with its stock price falling by over 10%. This analysis provides a snapshot of the stock’s performance using technical, fundamental, and sentiment indicators based on the available data.

As of 10:45 am GMT-4, the stock, listed as “MARA Holdings Inc” in the data summary, was trading at 17.77 USD. This represents a substantial drop of 2.07 USD, or 10.44%, for the day. The sharp decline points to strong selling pressure and negative sentiment surrounding the stock in the short term.

Technical Analysis: Bearish Signals Dominate

The intraday chart and technical data reveal a clear bearish trend for Marathon Digital on the day.

-

Significant Gap Down: The stock opened at 18.72 USD, well below the previous day’s close of 19.88 USD. This “gap down” is a strong technical indicator that suggests negative sentiment or news may have influenced traders before the market opened.

-

Price Action: Following the open, the stock’s price quickly fell, reaching an intraday low of 17.36 USD. The intraday high was 18.74 USD, barely above the opening price, indicating that sellers took control almost immediately.

-

Key Levels to Watch:

-

Immediate Support: The day’s low of 17.36 USD serves as the primary support level. A break below this price could signal further downward momentum.

-

Immediate Resistance: The opening price of 18.72 USD and the day’s high of 18.74 USD form the initial resistance zone. For any bullish reversal to begin, the price would need to reclaim these levels.

-

-

Broader Context: The current price is trading within its 52-week range, which spans from a low of 9.81 USD to a high of 30.28 USD. While the day’s performance is negative, the stock remains significantly above its yearly low.

Fundamental Analysis: A Look at the Core Data

The provided financial metrics offer a glimpse into the company’s fundamental standing.

-

Market Capitalization: MARA has a market capitalization of 632.06Cr, which typically translates to approximately $6.32 billion, placing it in the mid-to-large-cap category.

-

Profitability: The P/E ratio is listed as “-“, indicating that the company may not have positive net earnings on a trailing basis. This is not uncommon for companies in the volatile crypto mining industry, where focus is often on growth and asset accumulation (i.e., Bitcoin) rather than immediate net profit.

-

Dividends: The company does not pay a dividend, as confirmed by the “-” for both Div yield and Qtrly div amt. This aligns with a growth-oriented strategy where cash is reinvested into operations and expansion rather than distributed to shareholders.

Sentiment Analysis: Overwhelmingly Negative

The market sentiment for MARA on this day is decidedly bearish. A double-digit percentage drop, combined with a significant gap down from the previous close, reflects strong selling pressure and a lack of buyer confidence during the morning session. Such sharp movements in stocks like Marathon Digital are often correlated with the price fluctuations of Bitcoin or broader market trends, although the specific catalyst for this drop is not provided in the image.

Disclaimer: This article is based on a snapshot of market data for MARA Holdings Inc. as of 10:45 am GMT-4 on July 23rd. Market conditions are highly volatile and can change rapidly. The information provided is for informational purposes only and should not be considered financial or investment advice. Readers should conduct their own research before making any investment decisions.