Robinhood (HOOD) Stock Sees Sharp Intraday Drop Amid High Volume and Conflicting Signals

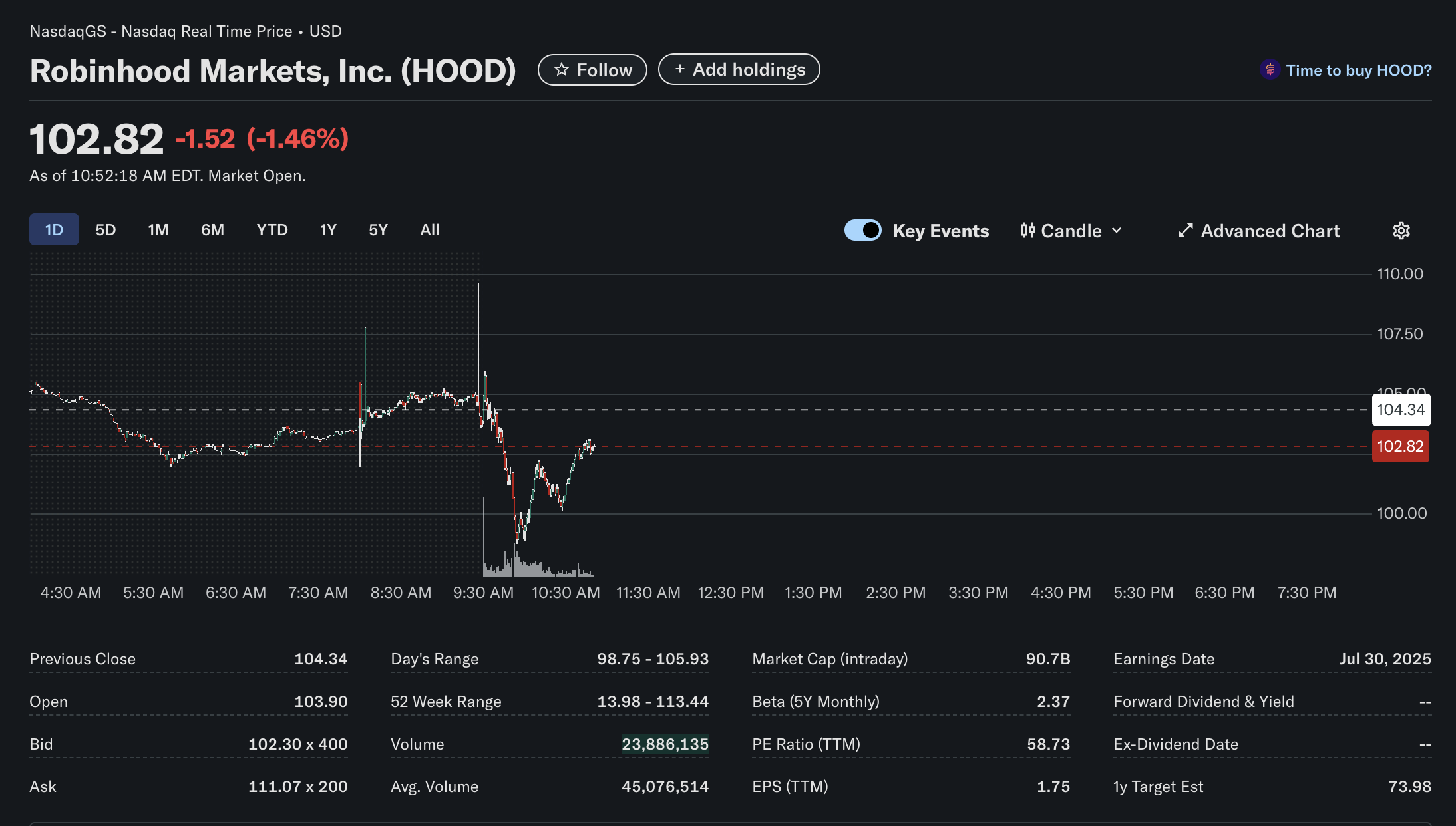

Robinhood Markets, Inc. (NASDAQ: HOOD) experienced a notably volatile trading session, with its stock price facing significant downward pressure shortly after the market opened. As of 10:52 AM EDT, the stock was trading at $102.82, a decrease of $1.52 or 1.46% for the day. This price movement was accompanied by heavy trading volume and a mix of financial metrics that present a complex picture for the popular trading platform’s stock.

Technical Analysis: A Sharp Sell-Off at the Opening Bell

A close look at the intraday chart reveals a dramatic technical event. After trading relatively stable in the pre-market session around the previous day’s close of $104.34, HOOD’s stock price plummeted at the 9:30 AM market open.

-

Price Action: The stock saw a precipitous drop from an opening price of $103.90 to an intraday low of $98.75 within minutes. This move represents a significant break from its pre-market stability.

-

Volume Spike: The sell-off was accompanied by a massive spike in trading volume, which stood at over 23.8 million shares by mid-morning. This high volume indicates strong conviction behind the selling pressure, suggesting a significant news event or a large institutional sell order may have triggered the drop.

-

Key Levels: The stock is currently attempting to find support after the drop, but it remains below its previous close of $104.34, a key level for technical traders. The day’s range of $98.75 – $105.93 highlights the extreme volatility experienced.

Fundamental Analysis: A Tale of High Valuation and Cautious Outlook

The fundamental data for Robinhood presents a conflicting narrative, blending strong recent performance with potentially cautionary signals for the future.

-

Valuation: With a market capitalization of $90.7 billion, Robinhood is a major player in the financial services industry. Its Price-to-Earnings (P/E) ratio is 58.73, a figure that is relatively high and typically suggests investors have strong expectations for future earnings growth.

-

Performance vs. Analyst Targets: The stock is trading near the upper end of its 52-week range of $13.98 – 73.98**. This figure is substantially below the current trading price, suggesting that, on average, Wall Street analysts believe the stock may be overvalued at its current level.

-

Volatility: The stock’s Beta of 2.37 confirms what the day’s chart shows: HOOD is significantly more volatile than the overall market. A beta greater than 1.0 implies that the stock’s price movements are amplified compared to the market index.

Sentiment Analysis: Uncertainty and Divergence in the Market

The sentiment surrounding HOOD stock appears to be one of uncertainty and divergence.

-

Negative Short-Term Sentiment: The sharp sell-off on high volume is a clear indicator of negative sentiment in the immediate term. Such a move can shake investor confidence and lead to further volatility.

-

Bull vs. Bear Conflict: There is a clear disconnect between the market’s current valuation of the stock (reflected in its high P/E and price near its 52-week high) and the cautious outlook from analysts. This suggests a battle between bullish investors who are optimistic about the company’s growth and bearish analysts who see risks of a potential price correction. The high volume and wide price swings confirm that the stock is currently a major point of debate among investors.

In summary, while Robinhood’s stock has delivered strong returns over the past year, the current technical and fundamental picture calls for careful observation. The sharp intraday drop, high volatility, and significant gap between the market price and analyst estimates suggest a period of price discovery and potential turbulence ahead.

Disclaimer: This article is for informational purposes only and is based on publicly available data as of a specific point in time. It does not constitute financial, investment, or trading advice. All investment activities carry risks, and individuals should consult with a qualified financial professional before making any investment decisions.