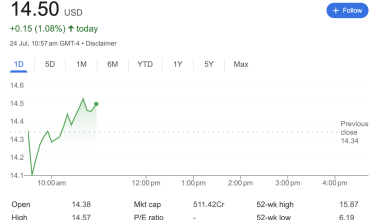

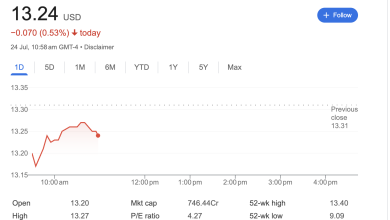

Oscar Health (OSCR) Stock Surges Over 4% on Heavy Trading Volume

New York – Oscar Health, Inc. (NYSE: OSCR) is experiencing a dynamic trading session, with its stock price rallying significantly after an initial dip. As of 10:21 AM EDT, the stock was trading at 0.56 or +4.11% for the day.

The health insurance technology company is seeing a surge in investor interest, evidenced by unusually high trading volume, signaling a potentially pivotal day for the stock.

Technical Analysis

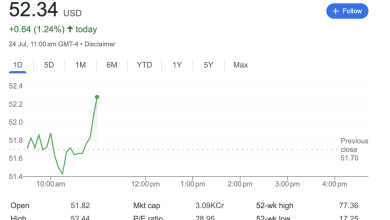

The intraday candlestick chart for Oscar Health reveals a dramatic reversal. The stock opened the session at $13.00, well below the previous day’s close of $13.62. It briefly touched a low of $12.86 before buyers stepped in with force.

This initial selling pressure was quickly overwhelmed, leading to a powerful rally that pushed the stock price above its previous close and toward the day’s high of $14.23. This pattern, known as an opening gap reversal, is often interpreted by technical analysts as a strong bullish signal, indicating that initial bearish sentiment has been decisively rejected.

Fundamental Analysis

The provided data offers a snapshot of Oscar Health’s current financial standing:

-

Market Capitalization: The company commands an intraday market cap of approximately $3.61 billion.

-

Valuation: Oscar Health is trading with a Price-to-Earnings (P/E) ratio of 35.41, based on a positive Earnings Per Share (EPS) of $0.40 over the trailing twelve months (TTM). A positive EPS is a significant metric, indicating the company has achieved profitability.

-

Volatility: The stock has a Beta of 1.90, suggesting it is historically almost twice as volatile as the broader market.

-

Analyst Outlook: The one-year analyst target estimate for OSCR is $17.49, which implies potential upside from its current trading price.

-

Upcoming Events: The next earnings date is listed as August 6, 2025. The company does not currently pay a dividend.

Sentiment Analysis

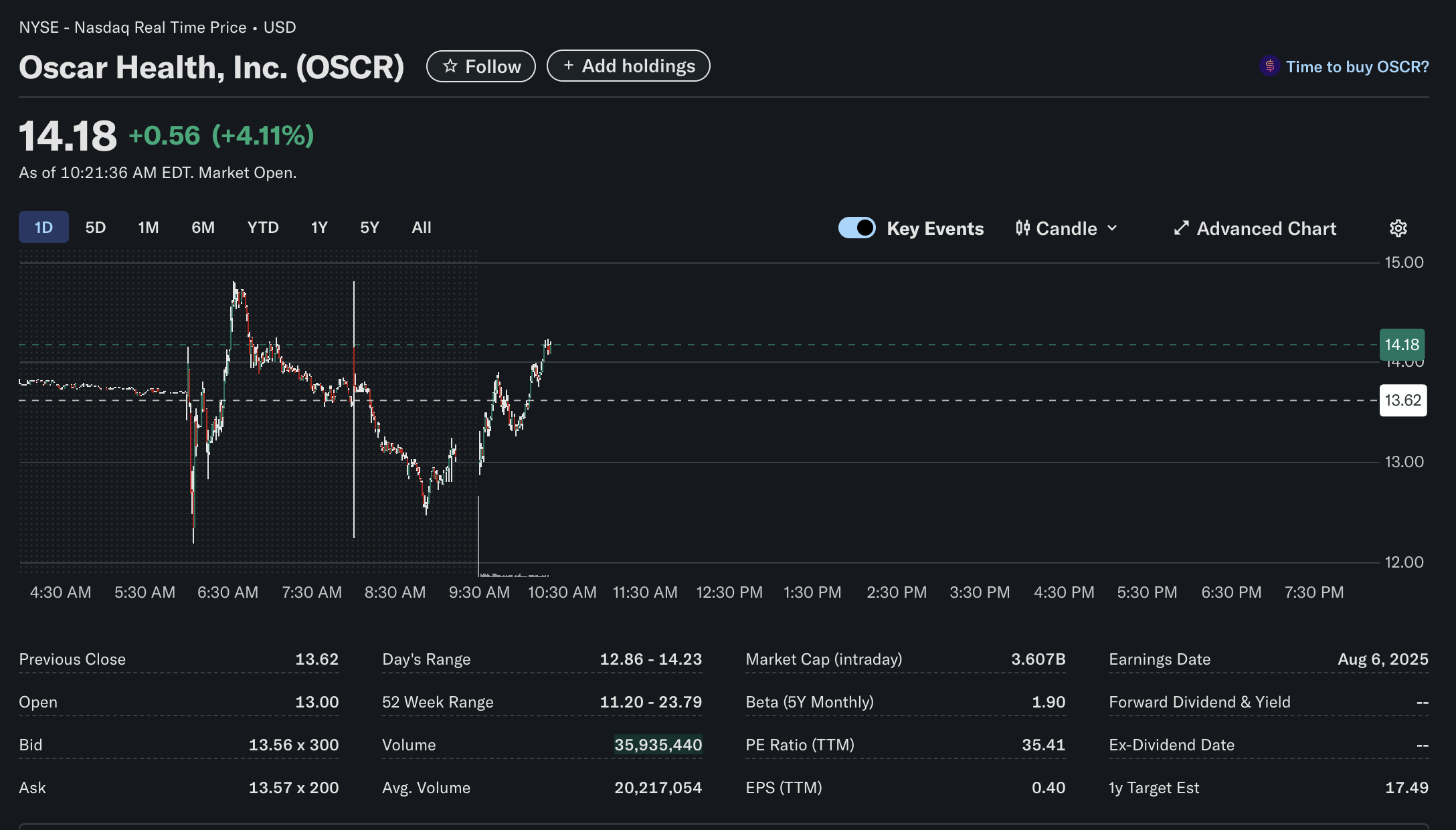

Market sentiment for Oscar Health appears strongly bullish in today’s session. The most telling indicator is the trading volume. At over 35.9 million shares traded before mid-day, it has already far surpassed the average daily volume of approximately 20.2 million shares.

A significant price increase accompanied by high volume suggests strong conviction among buyers and heightened market interest. The powerful recovery from the morning’s low further reinforces this positive sentiment, showing that investors are actively buying into the stock despite the initial weakness at the open.

Disclaimer: This article is for informational purposes only and is based on a snapshot of stock data from the trading platform shown. It should not be considered financial or investment advice. All investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.