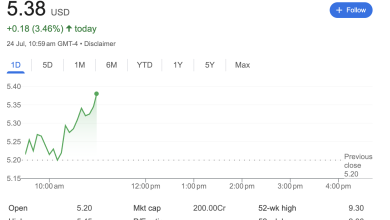

Opendoor (OPEN) Stock Sees Extreme Volatility, Surges 6% After Dramatic Intraday Plunge

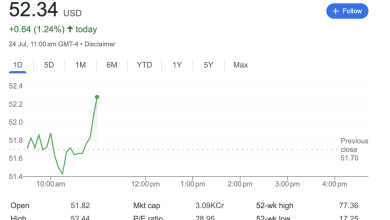

NEW YORK – Shares of real estate technology company Opendoor Technologies Inc. (NASDAQ: OPEN) are experiencing a chaotic and highly volatile trading session today. As of 10:20 AM EDT, the stock was trading at $3.40, a gain of over 5.9%, but this simple figure masks a dramatic intraday story of a massive price swing that has captured the market’s attention.

The stock’s wild ride poses a key question for investors, aptly summarized by a tag on the trading platform itself: “OPEN: Risk or rebound?” A deeper look into the day’s action provides critical insights.

Technical Analysis: A Chart of Extremes

Today’s trading session for Opendoor is a textbook example of extreme volatility and a technical battle between buyers and sellers.

-

The Gap Up and Plunge: The stock gapped up significantly at the market open to $3.8850, well above its previous close of $3.2100. However, this initial optimism was immediately met with intense selling pressure, causing the price to plummet to a day’s low of $2.8300 within the first 30 minutes of trading.

-

A Violent Rebound: From the low, buyers stepped in forcefully, driving the price back up towards the mid-$3 range. This “V-shaped” recovery on the intraday chart indicates that despite the initial sell-off, there is significant interest in the stock at lower prices.

-

Monumental Volume: The immense trading volume is a key indicator of the significance of today’s move. With over 433 million shares traded early in the session, it has already dwarfed the average daily volume of 137 million. This high volume confirms that a major catalyst is driving the action, leading to a fierce tug-of-war.

Fundamental Analysis: Conflicting Signals

The fundamental data presented provides a mixed and cautionary picture, which may help explain the volatility.

-

Profitability Concerns: Opendoor is not currently profitable, with a trailing twelve-month (TTM) Earnings Per Share (EPS) of -$0.52. This is common for high-growth tech companies but remains a key risk factor for investors focused on bottom-line results.

-

High Volatility Profile: The stock’s Beta of 2.68 confirms it is historically more than twice as volatile as the overall market. Today’s price action, while extreme, is consistent with its high-risk profile.

-

Analyst Target Discrepancy: A critical point of concern is the one-year analyst target estimate of $1.15. This consensus target is significantly below the current trading price of $3.40, suggesting that Wall Street analysts, on average, hold a bearish long-term view that is currently at odds with the market’s trading activity. This major disconnect between analyst valuation and market price is likely contributing to the fierce debate between bulls and bears.

Sentiment Analysis: A Classic Battleground

Market sentiment for Opendoor is clearly fractured and highly dynamic, making it a classic “battleground” stock.

-

Euphoria to Panic: The session began with euphoric sentiment, reflected in the large gap up at the open. This quickly flipped to panic selling, as early buyers may have taken profits or new information was digested negatively.

-

Cautious Optimism Returns: The strong rebound from the lows indicates a powerful shift in sentiment, with dip-buyers seeing value and opportunity. The market is now in a state of flux, with traders and investors trying to determine the stock’s true direction.

-

Speculative Frenzy: The combination of a wide trading range and massive volume points to a high degree of speculative interest. Day traders are likely heavily involved, adding to the intraday price swings.

Outlook

Opendoor’s stock is at a critical juncture. The remainder of the trading session will be pivotal in determining whether the morning’s rebound has legs or if sellers will regain control. The day’s high (2.83) have been established as crucial short-term levels of resistance and support. Given the conflicting signals between the bullish intraday recovery and the bearish analyst consensus, investors should brace for continued volatility.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. Investors should conduct their own thorough research and consult with a professional financial advisor before making any investment decisions.