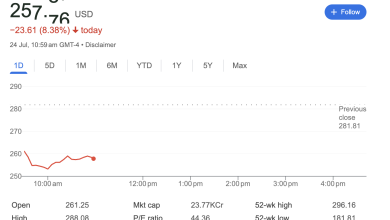

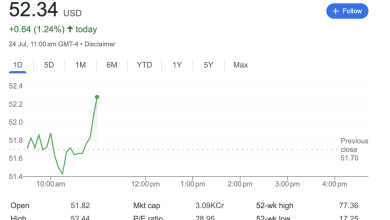

NVIDIA (NVDA) Stock Tumbles Sharply at Market Open, Erasing Billions in Value

New York, NY – Shares of semiconductor giant NVIDIA Corporation (NVDA) experienced a dramatic sell-off at the start of today’s trading session on the Nasdaq. As of 10:21 AM EDT, the stock was trading at 166.49 USD, a significant drop of -4.89 USD, representing a -2.85% decline from its previous close.

The sudden downward move was accompanied by heavy trading volume, indicating a significant shift in investor sentiment for the high-flying tech leader.

Technical Analysis: A Sharp Reversal from Recent Highs

A close look at the technical data reveals a starkly bearish picture for the morning’s trading.

-

Intraday Action: After trading relatively flat in the pre-market session, NVIDIA’s stock plunged vertically the moment the market opened at 9:30 AM EDT. The price gapped down from its open of 171.22, hitting a day’s low of 164.58 before finding some buying support. The subsequent small recovery to the 166.49 level suggests some dip-buying, but the overwhelming momentum remains negative.

-

Volume Spike: The sell-off was backed by immense volume. By 10:21 AM, over 69.5 million shares had already changed hands, a substantial portion of its average daily volume of approximately 200 million shares. This high volume confirms strong conviction behind the selling pressure.

-

Key Price Levels: The stock fell sharply from its previous close of 171.38. This level will now act as a significant resistance point. The day’s low of 164.58 is the immediate support level to watch. It’s also noteworthy that the stock was trading near its 52-week high of 174.25 before this drop, suggesting a potential exhaustion of the recent rally or a negative catalyst prompting profit-taking.

Fundamental Analysis: A Look at the Metrics

While the specific catalyst for the drop is not detailed in the image, the provided fundamental metrics give important context.

-

Valuation and Volatility: With a massive intraday market capitalization of 4.058 trillion USD, NVIDIA is one of the world’s most valuable companies. Its Price-to-Earnings (P/E) ratio of 53.68 indicates high growth expectations are priced in by the market. The stock’s Beta of 2.13 signifies that it is more than twice as volatile as the overall market, meaning its price swings (both up and down) are typically amplified.

-

Analyst Expectations: The 1-year analyst target estimate stands at 173.92 USD. Today’s sharp drop has pushed the current price significantly below this average target, which could prompt re-evaluations from market analysts.

Potential reasons for such a sharp decline could range from broader market weakness and sector-wide profit-taking to specific company news or a prominent analyst downgrade that occurred overnight or just before the market open.

Sentiment Analysis: A Swift Shift to Bearish

The market sentiment for NVIDIA has clearly turned negative in the short term.

-

Strong Selling Pressure: A nearly 3% drop on high volume immediately at the open is a classic sign of institutional selling and a rapid souring of sentiment. Investors who were bullish yesterday are rushing to sell today.

-

Fear and Profit-Taking: Given that the stock is up significantly over the past year (52-week range of 86.62 – 174.25), a sharp drop like this often triggers a wave of profit-taking from investors looking to lock in their substantial gains amid newfound uncertainty.

-

Volatility in Action: The high Beta of 2.13 is on full display. Just as the stock can experience outsized gains on good news, it is susceptible to sharp drops when negative sentiment takes hold, demonstrating the higher risk associated with high-growth technology stocks.

Disclaimer: This article is for informational purposes only and is based on the stock data presented in the image as of 10:21 AM EDT. It does not constitute financial advice, an endorsement, or a recommendation to buy or sell any security. Stock prices are highly volatile, and this information reflects a specific point in time. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.