IBM Common Stock Soars Near 52-Week High: What Should Investors Expect on Monday

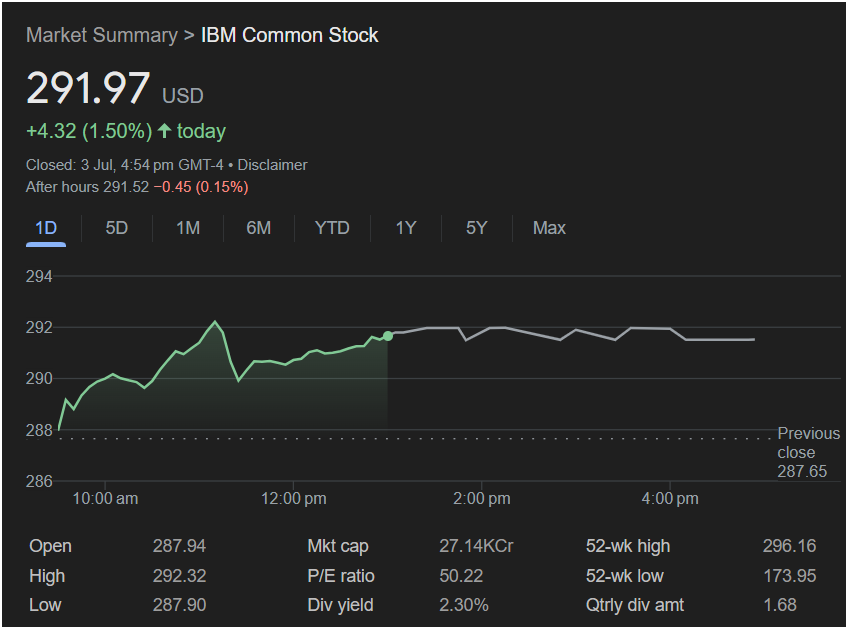

International Business Machines Corp. (IBM) common stock finished the trading session on a powerful upward trajectory, closing near a yearly high and drawing significant attention from the investment community. For traders evaluating their next move, a deep dive into the July 3rd session provides critical clues about potential market direction for Monday.

A Strong Bullish Close for IBM

IBM’s stock closed the day at

4.32, or 1.50%. This strong performance reflects confident buying pressure throughout the day.

However, in the after-hours market, the stock saw a minor correction, trading at

0.45 (0.15%). This could indicate some light profit-taking after a strong run-up but is not a significant bearish signal on its own.

Intraday Performance: A Story of Strength

The intraday chart for IBM reveals a day dominated by buyers:

-

Open: The stock opened at

287.90.

-

Morning Rally: From the open, IBM stock rallied significantly, reaching its daily high of $292.32 before noon.

-

Afternoon Consolidation: The stock spent the rest of the day consolidating its gains, trading in a stable range and closing strong, well above the previous day’s close of $287.65.

Key Financial Metrics for Your Radar

To fully understand IBM’s current position, traders should consider these fundamental data points:

-

Market Cap: At 27.14K Cr (an international notation that translates to approximately $271.4 Billion USD), IBM is a well-established blue-chip technology giant.

-

P/E Ratio: The Price-to-Earnings ratio is 50.22. This is a relatively high valuation, suggesting that investors have strong expectations for future earnings growth, possibly fueled by its AI and hybrid cloud strategies.

-

Dividend Yield: IBM offers a respectable 2.30% dividend yield, with a quarterly dividend of $1.68 per share. This makes it an attractive option for investors seeking a combination of growth and income.

-

52-Week Range: This is a crucial metric. The stock is currently trading very close to its 52-week high of $296.16, having rallied significantly from its 52-week low of $173.95.

Outlook for Monday: Breakout or Pullback?

Disclaimer: This analysis is based on the provided image data and does not constitute financial advice. Market conditions can change, and all trading decisions should be made based on your own research and risk tolerance.

Based on the strong close on July 3rd, here are the potential scenarios for Monday:

The Bullish Case:

The stock’s powerful 1.50% gain and its close near the day’s high are strong bullish signals. It is currently knocking on the door of its 52-week high (

292.32** could attract more buyers and fuel a move to test, and potentially break through, the $296.16 resistance level. This would be a significant technical breakout.

The Bearish Case:

The 52-week high is a natural point of resistance where sellers often emerge to take profits. The high P/E ratio of over 50 might also cause some investors to view the stock as overvalued, making a pullback more likely. If the stock fails to push past its recent highs on Monday, it could fall back to test support levels, starting with the previous close of $287.65.

Conclusion for Traders and Investors:

Is it the right time to invest in IBM? The answer depends on your strategy.

-

For Short-Term and Momentum Traders: The situation is compelling. A move above $292.32 could be a strong buy signal for a potential breakout. Conversely, a failure to break that level could present a shorting opportunity. Monday’s opening price action will be critical.

-

For Long-Term Investors: The key is balancing the strong upward momentum and solid dividend against the high valuation. For those who believe in IBM’s long-term transformation story in AI and cloud computing, buying on dips might be a viable strategy. Those focused purely on value might wait for a better entry point.

In summary, IBM stock is at a critical juncture. It has the momentum to reach new highs, but it also faces significant technical and valuation hurdles. All eyes will be on whether the bulls can maintain control on Monday.