Netflix Stock Analysis: Strong Gain Meets Afternoon Stalemate, What to Watch for Monday

Netflix Inc. (NFLX) stock closed a dynamic trading session on Friday, July 3rd, with a healthy gain, but a story of stalled momentum in the afternoon has left traders with a mixed set of signals heading into the new week. Understanding the day’s price action is crucial for anyone looking to trade the streaming giant on Monday.

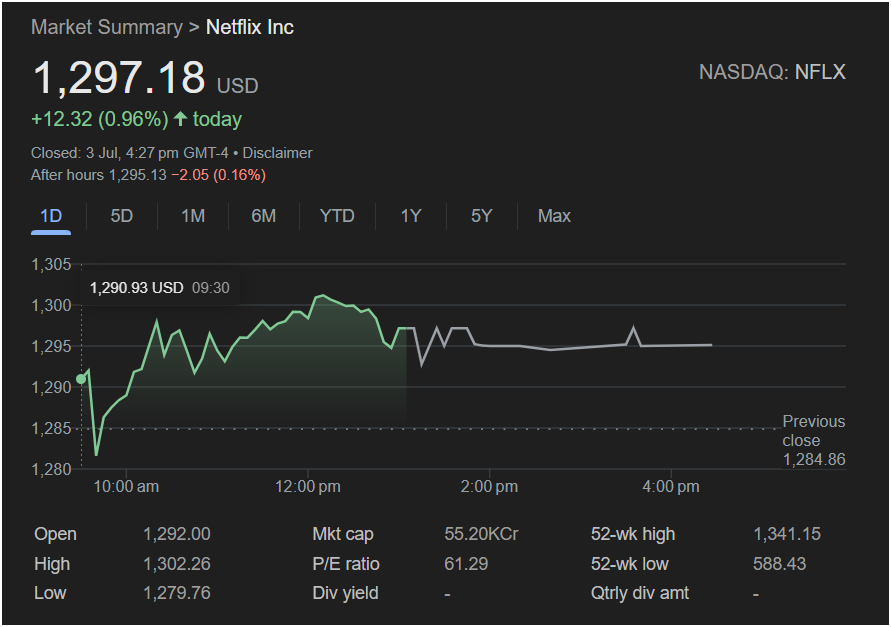

Netflix stock concluded the official trading day at

12.32 (0.96%). However, the intraday chart reveals a narrative of two distinct halves, capped by a minor dip in post-market trading.

A Day of Rally and Range

Friday’s session for Netflix was a tale of two parts. After opening at $1,292.00, the stock saw a brief dip to its low of the day at

1,302.26** around midday.

This is where the story changed. Instead of continuing its ascent or experiencing a sharp sell-off, the stock entered a prolonged period of consolidation. For the entire afternoon, the price action went sideways, trading within a tight range and showing clear indecision in the market. It successfully held onto most of its gains but failed to show the momentum needed to push higher.

The after-hours session confirmed this lack of immediate follow-through, with the stock ticking down

1,295.13. This suggests that neither buyers nor sellers had a decisive edge as the week came to a close.

Key Metrics Every Trader Needs to Know

To formulate a strategy for Monday, traders must consider these key data points:

-

Intraday High as Resistance: The peak of $1,302.26 now serves as the most immediate resistance level. The inability to hold above this level in the afternoon is a key technical point.

-

52-Week High Target: The stock is still trading below its 52-week high of $1,341.15. This remains the larger upside target for bulls.

-

Valuation (P/E Ratio): Netflix’s P/E ratio is 61.29. This is a high valuation that reflects strong investor expectations for future growth. Stocks with high P/E ratios can be more volatile, especially around earnings reports or market shifts.

-

No Dividends: As a growth-focused company, Netflix does not pay a dividend. Returns are entirely dependent on the stock’s price appreciation.

Will the Market Go Up or Down on Monday?

The technical signals from Friday’s trading are mixed, suggesting that Netflix stock may open with uncertainty on Monday.

The strong overall gain is a bullish sign, indicating that buyers were in control for the first half of the day. However, the complete stall in momentum and the sideways consolidation in the afternoon is a neutral-to-bearish signal, suggesting buying pressure was exhausted.

Monday’s price action will likely be dictated by the range established during Friday afternoon (roughly $1,295 to $1,300).

-

Bullish Scenario: If the stock opens and breaks decisively above the day’s high of $1,302.26, it could signal a continuation of the uptrend.

-

Bearish Scenario: If the stock breaks below the afternoon support around $1,295, it could indicate that the sellers are taking control, potentially leading to a test of the day’s low near $1,280.

The most likely scenario is a range-bound open, with the stock looking for a catalyst to break out of its state of indecision.

Is It Right to Invest Today?

Given the mixed signals, a cautious approach may be warranted for Monday’s open.

-

For the Prudent Trader: It would be wise to wait for a clear directional move. Investing while the stock is in a “chop zone” or trading sideways can be risky. Wait for a confirmed break above resistance ($1,302.26) or a bounce off a clear support level before entering.

-

For the Active Trader: The defined range from Friday afternoon could present short-term trading opportunities. However, this strategy requires active management and a clear understanding of the risks involved in trading a sideways market.

In conclusion, while Netflix stock posted a solid gain on Friday, the loss of momentum is a significant development. Traders should be on high alert on Monday, watching to see if the stock can break out of its newly formed range to establish a clear trend for the week.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified financial advisor before making any investment decisions.