Visa Stock Surges on Bullish Momentum: Key Levels for Traders to Watch Monday

Visa Inc. (NYSE: V) capped the week with a powerful rally, closing with a significant gain and demonstrating clear buyer control throughout the trading session. As traders prepare for the new week, the strong performance of this financial technology stock offers compelling clues about its potential direction.

This analysis breaks down Friday’s trading activity and key metrics to help you determine if Visa is a smart investment ahead of Monday’s market open.

Friday’s Market Action: A Display of Strength

Friday’s Market Action: A Display of Strength

Visa’s performance on Friday, July 3rd, was unequivocally bullish. Here are the essential takeaways for any trader:

-

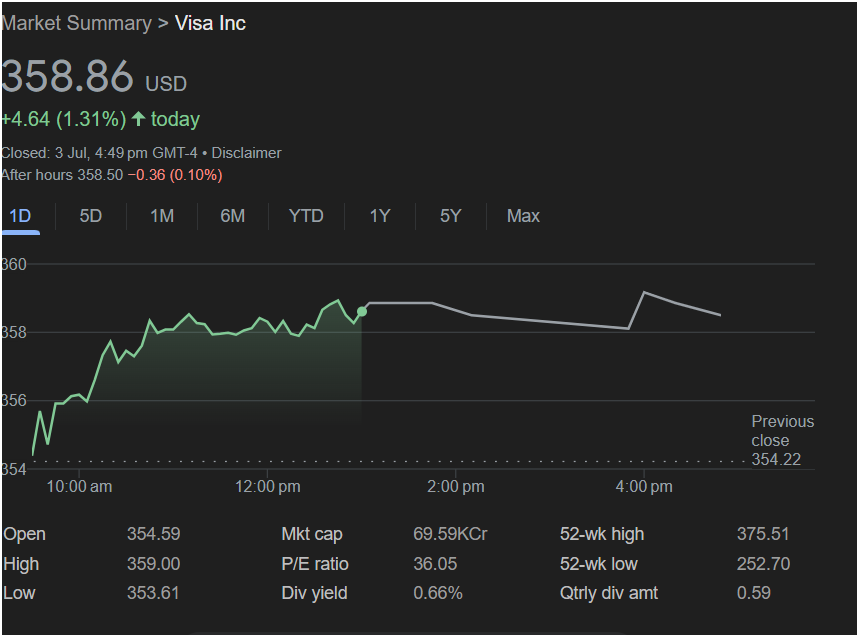

Strong Closing Gain: The stock closed at

4.64 (1.31%). This indicates strong positive sentiment.

-

Minor After-Hours Pullback: After the market closed, the stock dipped slightly by $0.36 (0.10%). This is a very small pullback, likely due to minor profit-taking, and does not negate the day’s strong upward trend.

-

Dominant Intraday Trend: Visa opened at $354.59, gapping up from the previous close of

359.00**, and successfully held onto most of those gains into the close.

-

Valuation: The P/E ratio stands at 36.05, typical for a high-quality growth company with a dominant market position.

Will Visa Stock Go Up on Monday? The Bull vs. Bear Case

The data from Friday strongly favors a bullish outlook, but traders should remain aware of potential resistance.

The Bullish Case (Why the Stock Could Rise):

The technical picture is very positive. The primary driver for an upward move on Monday is momentum.

-

Sustained Buying Pressure: Unlike a stock that spikes and fades, Visa climbed steadily and consolidated at higher levels. This pattern shows that buyers were in control for the entire session, a powerful bullish signal.

-

Key Level Test: The stock nearly touched the $359.00 mark. For momentum traders, a decisive break above this intraday high on Monday would be a very strong signal that the rally has more room to run.

-

Fundamental Strength: As a market leader in global payments, Visa’s underlying business is robust. The P/E of 36, while not cheap, is reasonable for a company of its caliber and growth prospects, attracting long-term investors.

The Cautious Case (Why It Might Pause):

The reasons for caution are minimal but still worth noting.

-

Slight After-Hours Dip: The minor drop after the bell could indicate that some short-term resistance is forming around the $359 level. The market may need to digest Friday’s gains before pushing higher.

-

Psychological Resistance: Round numbers can often act as psychological barriers. The move towards $360 could trigger some selling from traders looking to lock in profits after the run-up.

Verdict for Traders: Should You Invest?

Your investment decision for Visa stock on Monday should align with your trading strategy and risk appetite.

-

For Momentum and Short-Term Traders: The trend is clearly bullish. The most logical strategy is to watch for a break above Friday’s high of $359.00. A sustained move above this level, particularly with strong trading volume, would confirm the upward trend and present a buying opportunity.

-

For Long-Term Investors: Friday’s performance reinforces Visa’s status as a top-tier growth stock. For those investing for the long haul, this strength is a positive sign. The current price represents a solid entry point into a market-leading company, and the day’s action confirms strong institutional interest.

In conclusion, Visa stock is heading into Monday with significant bullish tailwinds. The path of least resistance appears to be higher, with the key level to watch being $359.00. A break above that could unleash the next wave of buying pressure.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investment decisions should be made based on your own research and financial situation.