Johnson & Johnson Stock Analysis: A Volatile Session Signals Caution for Monday

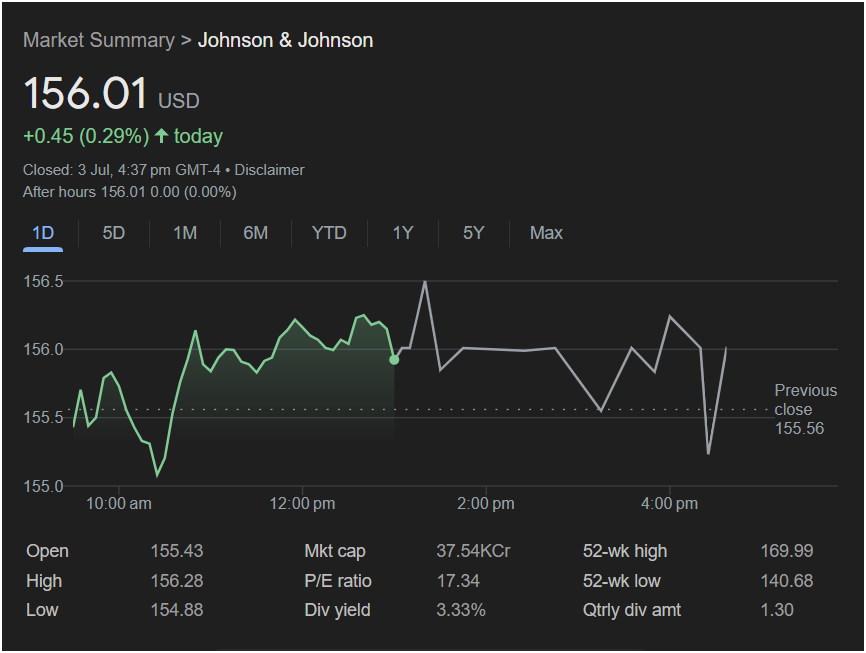

Johnson & Johnson (NYSE: JNJ) closed in positive territory on Friday, but the modest gain masks a day of significant price swings and market indecision. For traders analyzing the stock ahead of the new week, the choppy chart pattern suggests that a cautious approach may be warranted.

This article delves into the critical data points from Friday’s session to provide a clear outlook on whether Johnson & Johnson stock is poised for an upward move or a period of consolidation.

Friday’s Market Action: A Tale of Two Halves

A close examination of the trading day reveals a complex picture for Johnson & Johnson:

-

Positive Close: The stock finished the day at

0.45 (0.29%).

-

Flat After-Hours: Trading was completely flat after the market closed, indicating a lack of immediate momentum carrying into the weekend.

-

Significant Volatility: The intraday chart shows the real story. The stock opened at $155.43, dipped to a low of $154.88, then rallied to a high of $156.28. However, the afternoon session was marked by erratic, sharp up-and-down movements, indicating a fierce battle between buyers and sellers with no clear winner.

-

Key Price Level: The stock managed to close above its previous day’s close of $155.56, a small but positive sign for the bulls.

Will Johnson & Johnson Stock Rise on Monday? The Bull vs. Bear Case

The conflicting signals from Friday’s session present compelling arguments for both a potential rise and a period of stagnation.

The Bullish Case (Why the Stock Could Rise):

The primary argument for optimism lies in the company’s strong fundamentals, which are clearly visible in the data.

-

Attractive Valuation: With a P/E ratio of 17.34, Johnson & Johnson appears reasonably valued, especially compared to many other large-cap stocks. This suggests the stock is not overly expensive and has less room to fall due to valuation concerns.

-

Strong Dividend Yield: A robust dividend yield of 3.33% provides a significant incentive for long-term and income-focused investors. This steady income can provide a “floor” for the stock price, as investors are encouraged to buy on dips to lock in the high yield.

-

Resilience: Despite the afternoon volatility, the stock ultimately recovered from its intraday low and closed positive, showing a degree of resilience.

The Cautious Case (Why It Might Go Down or Stay Flat):

The technical picture painted by the chart urges caution.

-

Afternoon Indecision: The wild price swings in the latter half of the day are a classic sign of market uncertainty. A strong, trending stock typically sees a smooth ascent or consolidation, not the jagged pattern seen here. This suggests the stock could be stuck in a trading range.

-

Lack of Momentum: The flat after-hours trading and the failure to hold the day’s high of $156.28 show that buying pressure faded into the close. Without a catalyst, the stock may struggle to find direction on Monday.

Verdict for Traders: Should You Invest?

The decision to invest in Johnson & Johnson stock on Monday should be guided by your investment horizon and strategy.

-

For Short-Term Traders: The high volatility and lack of a clear trend make this a risky play. The stock appears to be in a consolidation phase. A prudent strategy would be to wait for a confirmed breakout above the day’s high of

155.56 for a potential short-term bearish move.

-

For Long-Term & Income Investors: The fundamentals are compelling. The reasonable P/E ratio and strong dividend yield make Johnson & Johnson an attractive holding for those with a longer time frame. For these investors, the current price and any potential dips could represent a good opportunity to accumulate shares of a blue-chip company.

In summary, Johnson & Johnson stock enters the week at a crossroads. While its fundamental strengths provide a solid foundation, the technical chart signals indecision. Expect potential range-bound trading on Monday unless a significant market catalyst pushes it decisively in one direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investment decisions should be made based on your own research and financial situation.