Apple Stock Shows Mixed Signals: What Traders Should Watch on Monday

Apple Inc. (AAPL) stock finished the last trading session in the green, but a closer look at the intraday chart reveals a more complex picture that traders must analyze before Monday’s opening bell. While the tech giant secured a positive close, signs of afternoon weakness could signal a potential battle between buyers and sellers in the upcoming session.

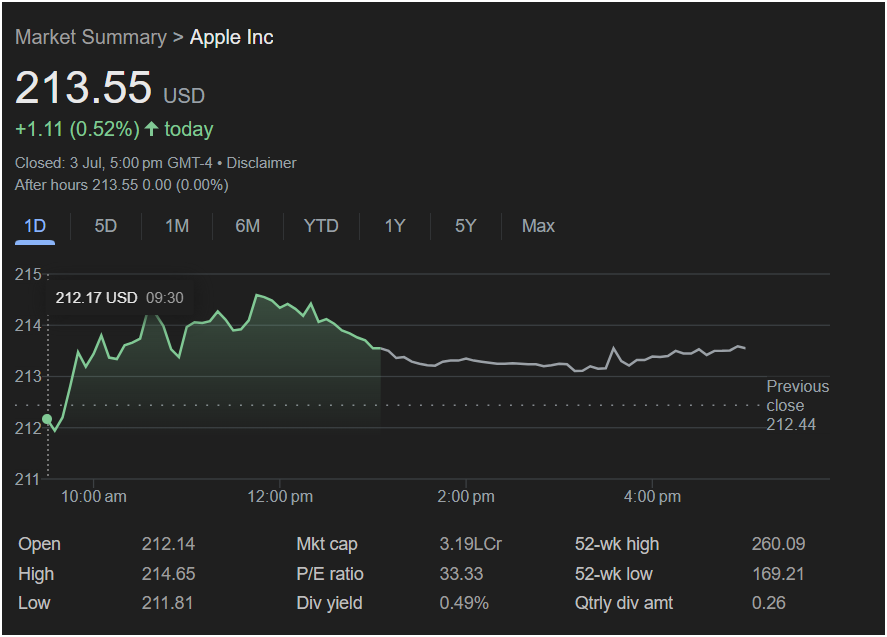

On July 3rd, Apple stock closed at

1.11 (0.52%) for the day. However, the story isn’t just in the closing price. The stock’s performance throughout the day offers critical clues about its near-term direction.

Key Performance Breakdown for Traders

To prepare for Monday, let’s dissect the key data points from the latest session:

-

Intraday Price Action: The stock opened at $212.14, just below the previous close of $212.44. Buyers quickly stepped in, driving a strong morning rally that saw the stock hit a day’s high of $214.65 around noon. However, it failed to hold these gains. The second half of the day was marked by a consistent fade, with the stock giving back over a dollar from its peak before closing. This “fading rally” is a crucial technical signal.

-

Key Levels to Watch: The high of

211.81, which could serve as an initial support level.

-

After-Hours Trading: After-hours trading was completely flat, closing at $213.55 with no change. This suggests a neutral pause, with the market waiting for a new catalyst on Monday.

-

Wider Context: Apple is currently trading well below its 52-week high of $260.09, indicating it is not in breakout territory. The P/E ratio of 33.33 reflects a high-growth valuation that investors have come to expect from the company.

Market Outlook: What to Expect on Monday

The mixed signals from Friday’s session present two clear scenarios for Apple stock.

The Bullish Case (Higher Prices):

The bulls can point to the fact that the stock still closed positive, absorbing the afternoon selling pressure without turning negative for the day. If buying volume returns on Monday and pushes the stock decisively above the key resistance level of $214.65, it would invalidate the afternoon fade and suggest that the uptrend is ready to resume.

The Bearish Case (A Potential Pullback):

The bears will focus on the failure to hold the day’s highs. This pattern often indicates that early momentum has been exhausted and profit-takers are stepping in. The inability to close near the peak suggests a lack of conviction from buyers at higher prices. If the stock opens weak on Monday and breaks below support levels around $212, it could signal a further pullback.

The Verdict for Traders

Given the fading rally, the outlook for Apple stock on Monday is neutral with a slight bearish caution. While the stock ended the day up, the momentum is not clearly defined.

Investing today requires careful observation. Traders should closely monitor the

212 mark, could confirm that sellers are in control and a period of consolidation or a slight downturn is more likely. The first hour of trading on Monday will be critical in determining which side has the upper hand.

Disclaimer: This article is an analysis based on the provided image and does not constitute financial advice. All investment decisions should be made with the consultation of a qualified financial advisor, considering your own risk tolerance. Past performance is not indicative of future results.