Tesla Stock Watch: Analyzing Friday’s Volatile Close, What’s Next for Monday

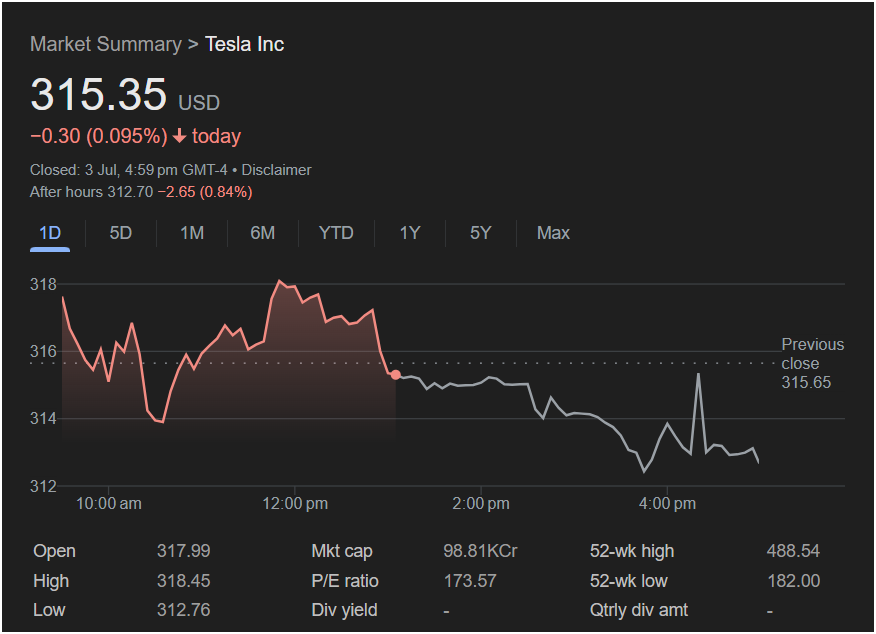

Tesla Inc. (TSLA) stock concluded a volatile trading day on Friday, July 3rd, with a marginal loss, but a more significant dip in after-hours trading has traders on high alert for Monday’s market open. As investors and traders plan their strategy for the upcoming week, a closer look at Friday’s performance provides critical clues.

Tesla’s stock closed the official trading session at

0.30 (0.095%). While this seems like a relatively flat end to the day, the intraday journey and post-market activity tell a more complex story.

A Day of Swings and a Weak Finish

The 1-day chart reveals a battle between bulls and bears. The stock opened the day higher at

318.45. However, this early strength faded, leading to a dip before a recovery rally peaked around midday. The second half of the trading session was defined by a steady decline, with the stock ultimately breaking below its previous close of

312.76** before a minor rebound into the closing bell.

The most telling sign for what Monday might hold comes from the after-hours session. The stock continued its downward trajectory, falling another

312.70. This suggests that negative sentiment carried over after the market closed, often pointing to a lower opening price for the next trading session.

Key Metrics Every Trader Needs to Know

To make an informed decision, traders should consider these key data points from the market summary:

-

After-Hours Pressure: The drop to $312.70 is the most immediate bearish indicator. This level will likely act as a key support level to watch at Monday’s open.

-

52-Week Range: With a high of

182.00, Tesla’s stock is famously volatile. This wide range highlights the potential for significant price swings in either direction, underscoring the need for risk management.

-

Valuation (P/E Ratio): At 173.57, Tesla’s Price-to-Earnings ratio is exceptionally high. This indicates that investors have priced in substantial future growth. High P/E stocks can be more sensitive to negative news or missed expectations, which can amplify downward movements.

-

No Dividends: As a growth-focused company, Tesla does not offer a dividend, meaning investors rely solely on capital appreciation for returns.

Will the Market Go Up or Down on Monday?

Based on the available data, the indicators lean towards a bearish start for Tesla on Monday.

The combination of a close below the previous day’s price and, more importantly, the significant negative move in after-hours trading, suggests that sellers had the upper hand at the end of the week. Traders should anticipate a potential gap down at the open on Monday, with the stock possibly testing the support level around the after-hours low of ~$312.70. A break below this level could see the stock explore further lows.

Conversely, any positive news over the weekend could reverse this sentiment. Bulls will be looking to see if buyers step in to defend the

313 price level, which was the low point of Friday’s session. A strong defense of this level could lead to a bounce, but the stock would need to reclaim the $315 mark to regain any bullish momentum.

Is It Right to Invest Today?

Deciding whether to invest requires careful consideration of the current technical picture and your personal risk tolerance.

-

For the Cautious Trader: The current momentum is negative. It may be wise to wait and observe the price action at Monday’s open. See if the stock establishes a clear support level or if the selling pressure continues before committing capital.

-

For the Aggressive Trader: The dip could be viewed as a buying opportunity, but it comes with high risk. Initiating a position would require a clear stop-loss strategy, perhaps placed just below the Friday low of $312.76, to protect against further downside.

In conclusion, Friday’s session ended on a note of weakness for Tesla stock, which was amplified in post-market trading. The technicals suggest a challenging start to the week. All eyes will be on the pre-market and opening bell on Monday to see if buyers can counter the prevailing negative sentiment.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified financial advisor before making any investment decisions.