Thermo Fisher Scientific Stock at Critical 52-Week Low: A Bounce or Break Ahead

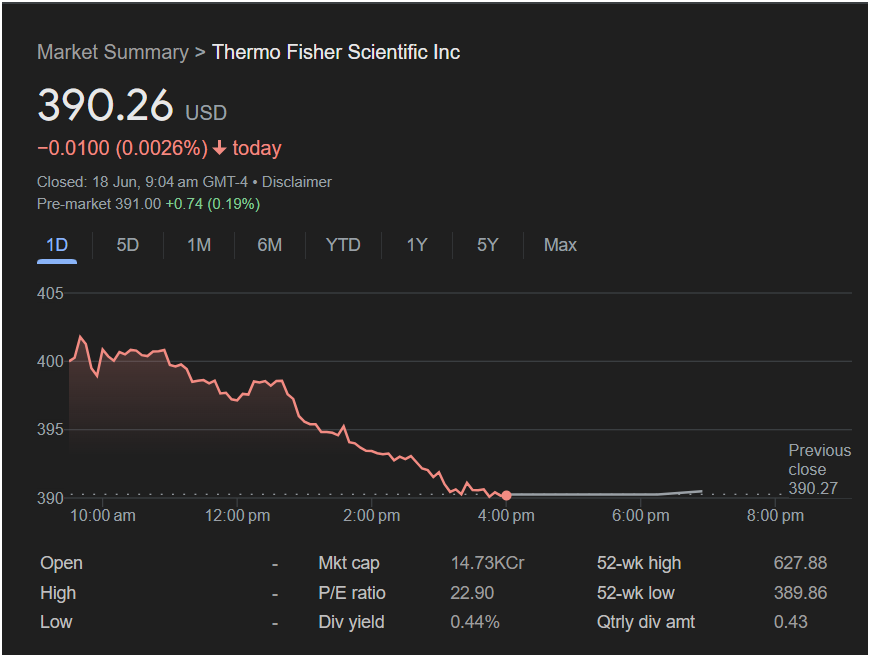

New York, NY – Thermo Fisher Scientific Inc. (NYSE: TMO) stock finds itself at a precarious crossroads heading into Monday’s trading session. After a day of heavy selling, the life sciences giant closed perilously close to its 52-week low, a critical technical level that has traders and investors on high alert. However, a slight uptick in pre-market activity suggests a battle between buyers and sellers is imminent.

Friday’s Sell-Off and Monday’s Key Signal

Based on the market data, Thermo Fisher Scientific stock ended Friday’s session at $390.26 USD, down a negligible 0.0026%. This seemingly flat close masks a day of significant downward pressure. The intraday chart shows the stock opened above the $400 mark before trending consistently lower throughout the day, finding no significant support until the closing bell.

Despite this bearish intraday action, pre-market data for Monday points to a potential rebound. The stock is indicated at $391.00, representing a gain of +0.74 (0.19%). This early positive signal is crucial as it comes at a make-or-break price level for the stock.

The Deciding Factor: The 52-Week Low

The Deciding Factor: The 52-Week Low

The entire narrative for Thermo Fisher stock on Monday revolves around one number: its 52-week low of $389.86. The stock’s Friday close is just cents above this critical support level.

-

The Bullish Case (A Potential Bounce): The pre-market gains suggest that “bargain hunters” may be stepping in, viewing the proximity to a yearly low as a major buying opportunity. If this support level holds and the stock bounces decisively on Monday, it could signal that the sell-off is exhausted, potentially triggering a significant relief rally. A move back above $395 would be a strong confirmation for bulls.

-

The Bearish Case (A Potential Breakdown): Friday’s relentless selling pressure shows that momentum is firmly to the downside. If the stock fails to hold the $389.86 support and breaks below it, it could trigger a wave of automated stop-loss orders and attract short-sellers. A break of a 52-week low is a powerful bearish signal that often precedes a further leg down.

Fundamental Health Check

For long-term investors evaluating the company’s health, the data provides a mixed view:

-

P/E Ratio: At 22.90, the stock’s valuation is reasonable for a blue-chip company in the healthcare and scientific sector. It doesn’t appear excessively overvalued.

-

Dividend Yield: The 0.44% yield is minimal. This is not a stock for income-focused investors; its appeal lies in growth potential.

-

Price History: The stock is trading drastically below its 52-week high of $627.88, highlighting the extent of the recent downturn but also the potential for recovery if sentiment shifts.

Verdict: Is It Time to Invest in Thermo Fisher Stock?

For Monday, Thermo Fisher Scientific is the definition of a high-stakes “watch list” stock.

For Short-Term Traders, the situation presents a high-risk, high-reward opportunity. The strategy is clear: watch the $389.86 level. A strong bounce off this support could be a buy signal for a quick trade. A decisive break below it would be a clear signal to go short or stay away.

For Long-Term Investors, caution is the key theme. While the stock is significantly off its highs and has a reasonable valuation, the old adage “don’t try to catch a falling knife” applies here. Buying a stock that is actively testing its yearly lows is risky. It may be prudent to wait for the stock to show signs of stabilization and build a new base of support before committing new capital.

The first hour of trading on Monday will be critical in determining whether Thermo Fisher Scientific has found a bottom or if a new chapter of its downtrend is about to begin.

Disclaimer: This article is for informational purposes only and is based on the data provided in the image. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified financial advisor before making any investment decisions.