Joby Aviation (JOBY) Stock Under Pressure: Analyzing Volatility, Fundamentals, and Analyst Sentiment

Joby Aviation, Inc. (NYSE: JOBY), a frontrunner in the emerging electric vertical take-off and landing (eVTOL) aircraft industry, is experiencing a volatile trading session, highlighting the speculative nature of this futuristic market. A closer look at the data reveals a company with significant market valuation but challenging fundamental metrics and analyst outlooks.

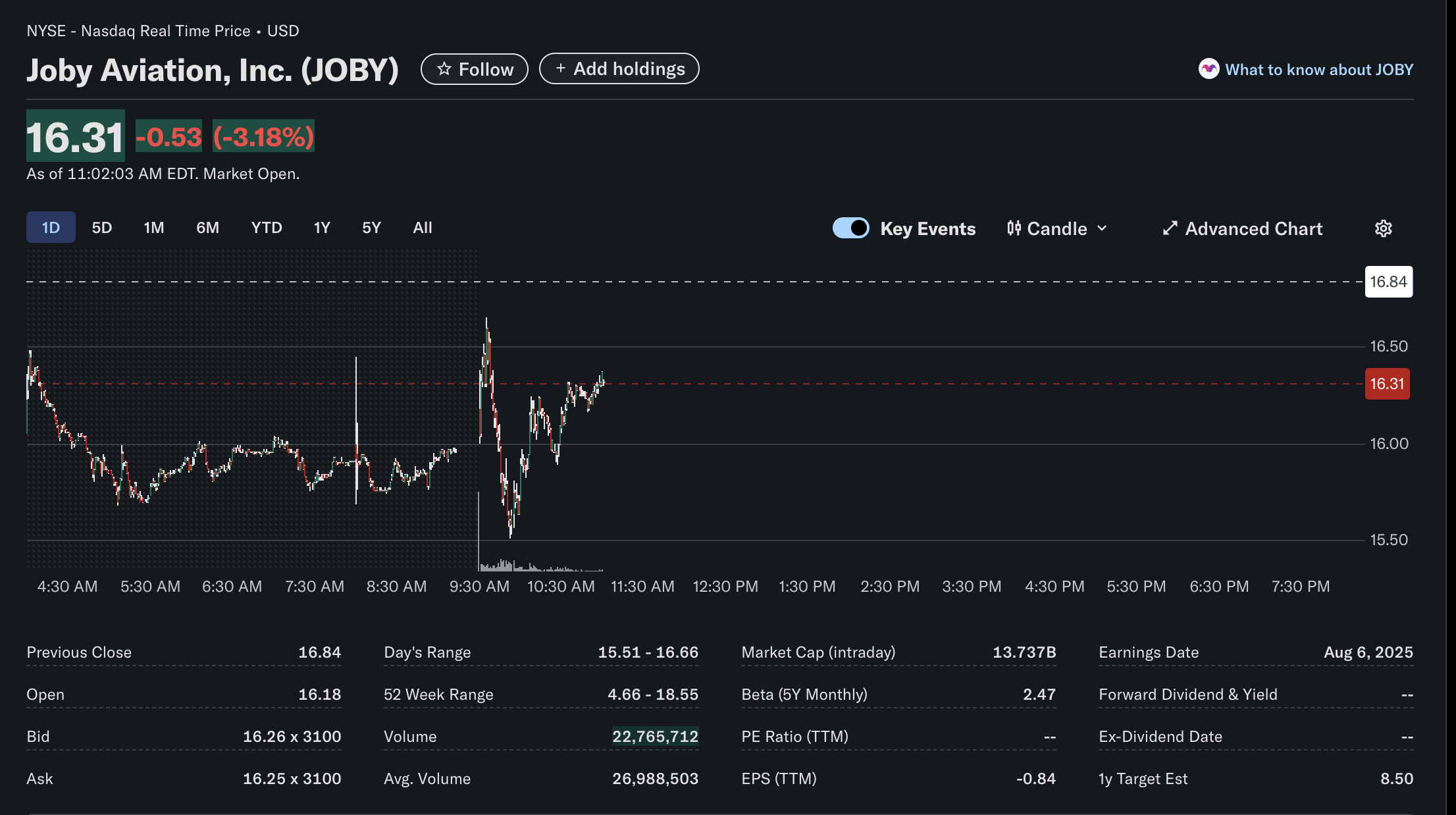

As of 11:02:03 AM EDT, shares of Joby Aviation were trading at 0.53, or 3.18%, for the day. The stock’s performance reflects the high-risk, high-reward profile that characterizes many pre-revenue technology companies.

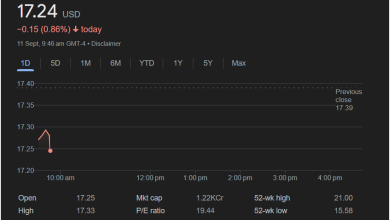

Technical Analysis: A Day of Sharp Swings

The intraday chart for JOBY paints a picture of significant volatility, a hallmark of this particular stock.

-

Price Action and Key Levels: The stock opened at $16.18, below its previous close of $16.84. A dramatic sell-off occurred at the market open (9:30 AM), plunging the price to its day’s low of $15.51. Since then, the stock has attempted a recovery, climbing back above its opening price but still trading well below the previous day’s close.

-

Volume: At the time of the snapshot, trading volume stood at 22,765,712 shares. This is slightly below its average volume of 26,988,503, but the volume spike visible on the chart during the initial morning drop indicates a significant burst of selling activity.

-

Volatility: Joby’s high-risk nature is quantified by its Beta of 2.47. This figure indicates that the stock is historically 147% more volatile than the overall market, a characteristic clearly demonstrated by its wide day’s range of $15.51 to $16.66.

Fundamental Analysis: A Bet on the Future

Joby’s fundamental data underscores that its valuation is based on future potential rather than current financial performance.

-

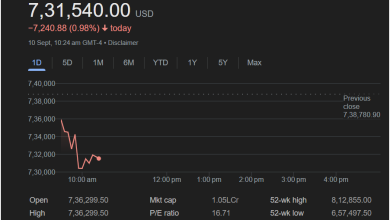

Valuation and Profitability: The company commands an impressive intraday market capitalization of 0.84, and consequently, there is no Price-to-Earnings (P/E) ratio to display. This is typical for a company still in the development and certification phase of its product.

-

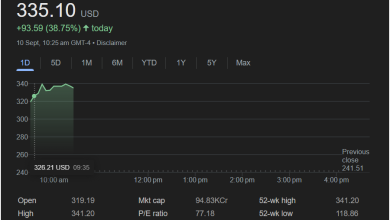

Performance and Dividends: Despite the lack of profitability, the stock is trading near the high end of its 52-week range of $4.66 – $18.55, signaling strong investor optimism over the past year. As expected for a company reinvesting heavily in research and development, JOBY does not pay a dividend.

Sentiment Analysis: A Tale of Two Outlooks

Market sentiment towards Joby Aviation appears deeply divided, presenting a classic conflict between retail/institutional enthusiasm and analyst caution.

-

Bullish Sentiment: The primary bullish signal is the stock’s price itself. Trading near its 52-week high indicates that a large segment of the market is willing to look past the current lack of earnings and bet on Joby’s long-term vision of revolutionizing urban transportation.

-

Bearish Sentiment: In stark contrast, the 1-year analyst target estimate is $8.50. This consensus price target is nearly 50% below the current trading price of $16.31. This significant discrepancy suggests that, on average, financial analysts believe the stock is highly overvalued at its current level and could be due for a major correction.

Summary

Joby Aviation (JOBY) is a quintessential speculative growth stock. Its valuation is driven by the promise of future technology and market disruption in the air taxi space. However, investors must weigh this exciting potential against the fundamental reality of a company that is not yet profitable and a consensus analyst view that suggests the stock is significantly overpriced. The intraday volatility is a direct reflection of this ongoing tug-of-war between long-term belief and short-term valuation concerns.

Disclaimer: This article is for informational purposes only and is based on a snapshot of market data at a specific point in time. It should not be considered financial or investment advice. All investors should conduct their own research and consult with a qualified financial professional before making any investment decisions.