QuantumScape (QS) Stock Surges on High Volume: A Technical and Fundamental Snapshot

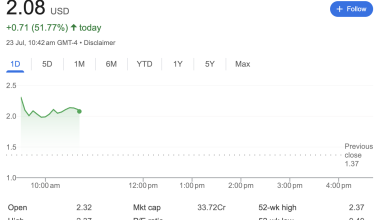

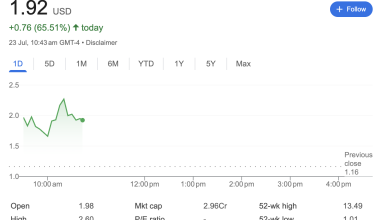

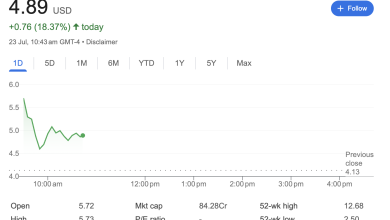

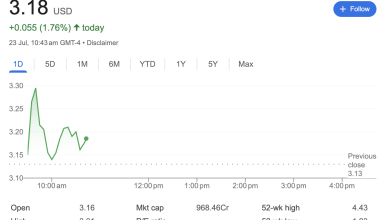

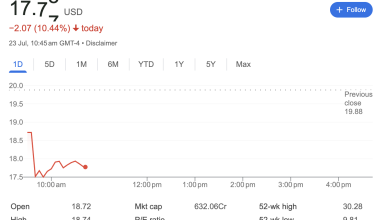

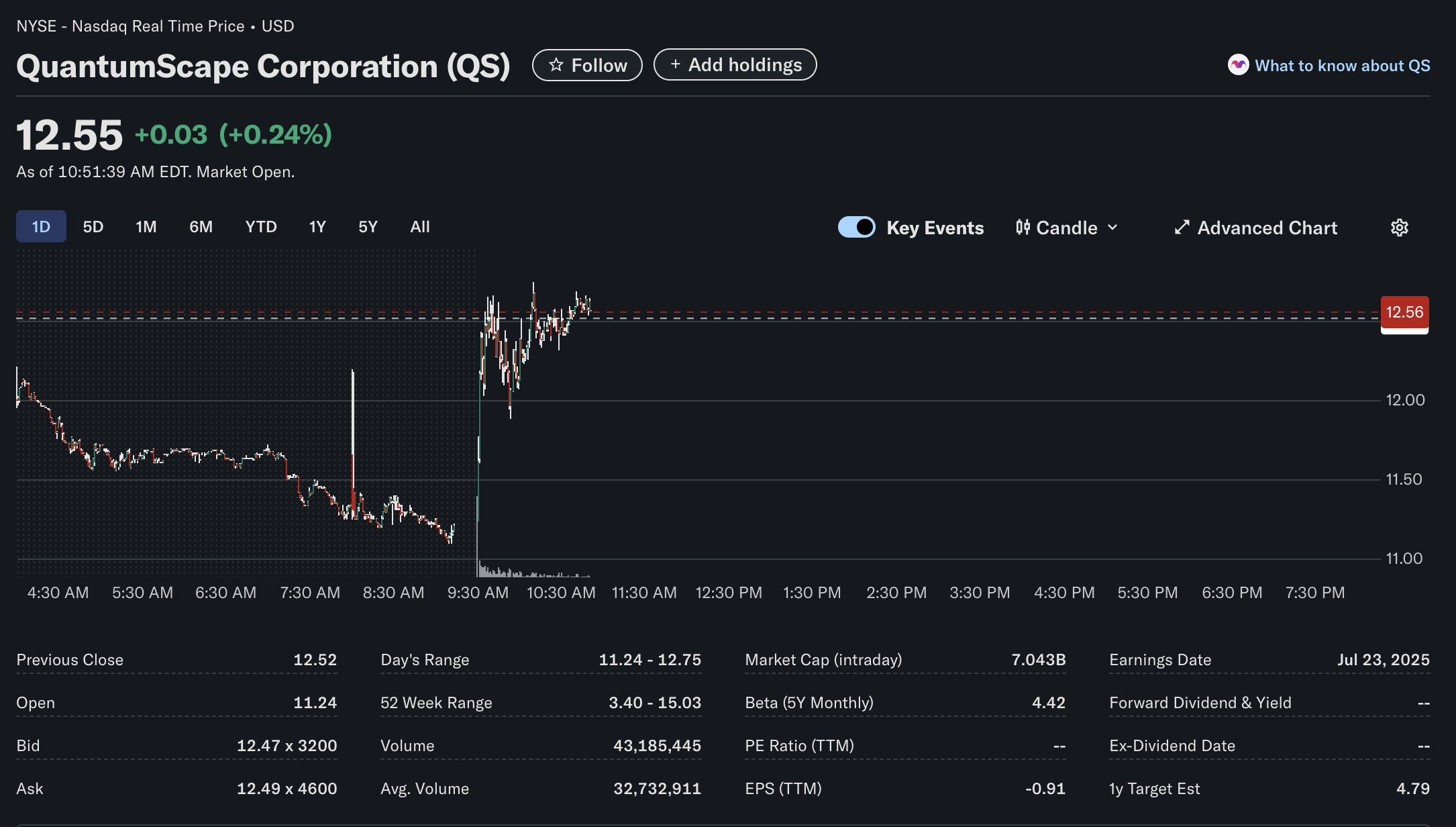

QuantumScape Corporation (NYSE: QS) is experiencing a highly volatile trading session, marked by a significant price surge at the market open on unusually high trading volume. As of 10:51 AM EDT, the stock was trading at $12.55, up 0.24% for the day. This article provides a snapshot of the stock’s performance based on technical, fundamental, and sentiment analysis from the available data.

Based on the provided market data, QuantumScape opened the day significantly lower than its previous close but immediately reversed course. The stock’s journey from a day’s low of $11.24 to a high of $12.75 reflects strong intraday interest from traders.

Technical Analysis: A Story of a Sharp Reversal

The intraday chart for QS paints a picture of intense market dynamics.

-

Pre-Market Action: The stock showed a bearish trend in pre-market hours, declining from its previous close of $12.52 to the day’s low point.

-

Market Open Surge: At the 9:30 AM EDT market open, the stock saw a dramatic reversal. A massive spike in volume propelled the price from its opening mark of $11.24 to a daily high of $12.75 within minutes. This type of price action often indicates a reaction to a catalyst or a surge of coordinated buying pressure.

-

High Volume: The trading volume at 43.18 million shares had already surpassed the average volume of 32.73 million well before midday. High volume accompanying a strong price move can suggest conviction behind the trend.

-

Key Levels: The day’s high of $12.75 currently acts as the primary resistance level. The previous close of $12.52 appears to be a key pivot point, with the stock currently trading just above it.

Fundamental Analysis: A Look Under the Hood

The fundamental data presented provides a mixed but insightful view of the company’s financial standing.

-

Market Capitalization: With an intraday market cap of $7.043 billion, QuantumScape is a significant player in its sector.

-

Profitability: The company is currently unprofitable, as indicated by a negative Earnings Per Share (EPS) of -$0.91 and an unavailable Price-to-Earnings (P/E) ratio. This is common for companies in the research and development phase, particularly in the technology and automotive sectors.

-

Volatility: The stock has a Beta of 4.42, which suggests it is significantly more volatile than the overall market. This high beta is reflected in the wide 52-week range of $3.40 to $15.03.

-

Analyst Outlook: A key point of consideration is the 1-year target estimate of $4.79. This figure is substantially lower than the current trading price of $12.55, suggesting that, on average, analyst valuations are more conservative than the current market sentiment.

-

Dividends: The company does not currently offer a dividend to shareholders.

Sentiment Analysis: Bullish Intraday Momentum vs. Cautious Long-Term Outlook

The sentiment surrounding QuantumScape appears to be split between the short-term and the long-term.

-

Short-Term Sentiment: The powerful upward move at the market open on exceptional volume indicates strong positive or bullish sentiment for the day. Traders are actively buying the stock, driving its price higher and demonstrating confidence in its near-term performance.

-

Long-Term Sentiment: The fundamental data introduces a more cautious tone. The lack of profitability and, most notably, the low 1-year analyst price target, suggest that the long-term valuation is a point of concern for market analysts. This creates a disconnect between the current trading excitement and long-term financial projections.

In summary, QuantumScape (QS) is showcasing a classic battle between short-term trading momentum and long-term fundamental valuation. While intraday traders are driving the price up on high volume, the underlying financial metrics and analyst targets suggest a more cautious long-term path.

Disclaimer: This article is for informational purposes only and is based on real-time data from the provided image as of 10:51 AM EDT. It should not be considered financial or investment advice. Investors should conduct their own research and consult with a financial professional before making any investment decisions.