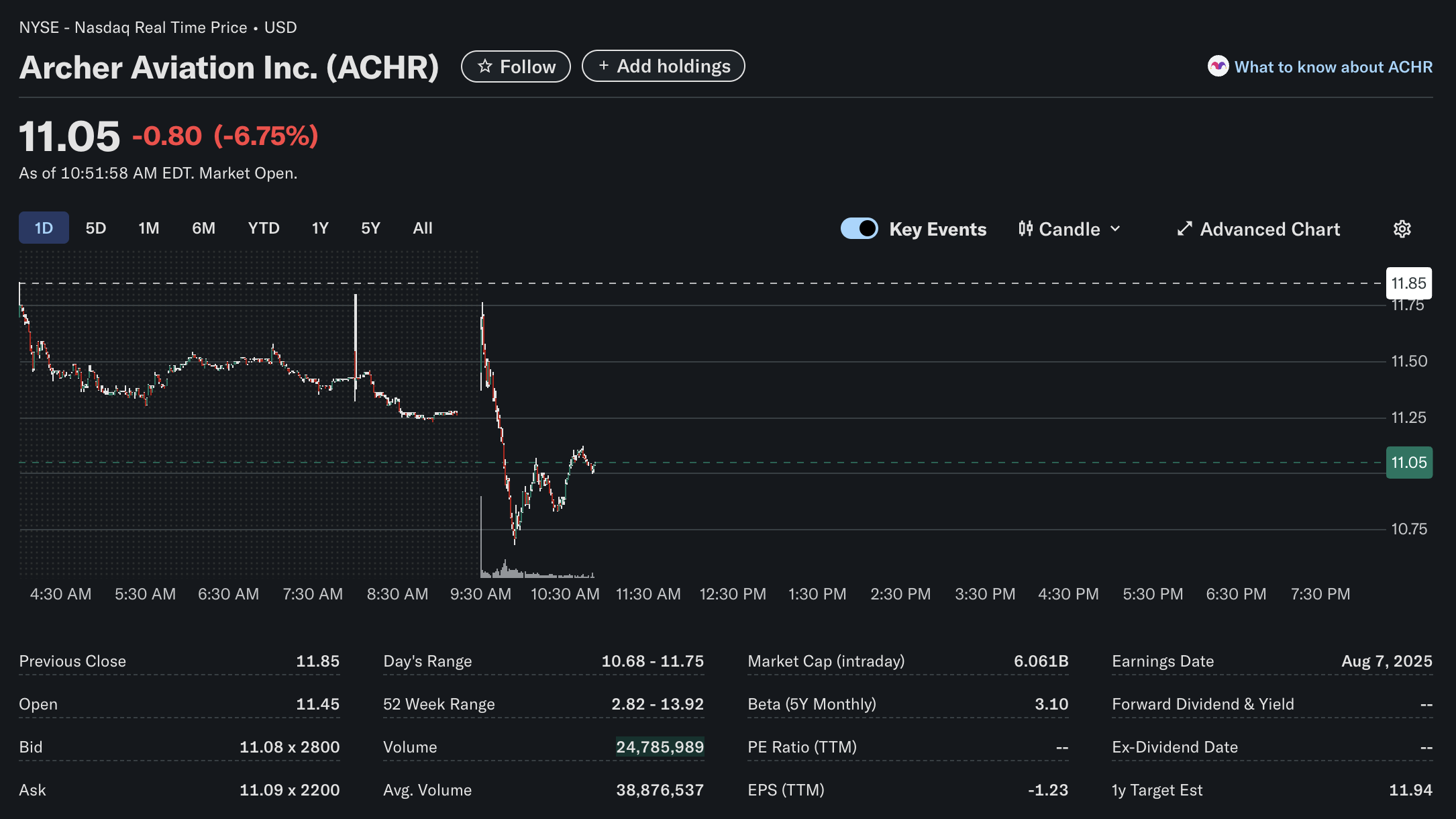

Archer Aviation (ACHR) Stock Under Pressure: A Deep Dive into Intraday Performance and Key Metrics

Archer Aviation Inc. (ACHR), a prominent player in the burgeoning electric vertical takeoff and landing (eVTOL) aircraft industry, experienced significant downward pressure on its stock price during early trading hours today. As of 10:51:58 AM EDT, ACHR shares were trading at $11.05, marking a decline of $0.80, or 6.75%, from its previous close. This intraday movement warrants a closer look at the technical and fundamental indicators available.

Technical Analysis: A Volatile Morning

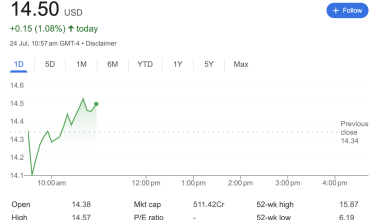

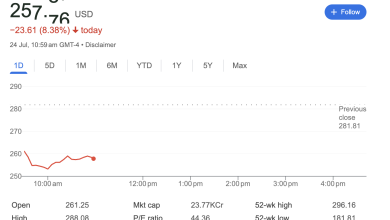

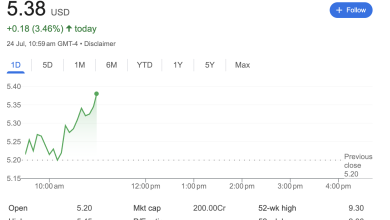

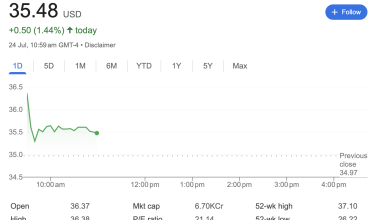

The intraday chart for ACHR reveals a sharp decline early in the trading session. After opening at $11.45, the stock initially hovered, but then experienced a significant plunge around 9:30 AM EDT, reaching a low of $10.68. This sharp drop was accompanied by substantial trading volume, suggesting strong selling pressure. Following the initial decline, the stock showed some signs of stabilization and a slight rebound, settling around the $11.05 mark.

-

Current Price: $11.05

-

Intraday Change: -$0.80 (-6.75%)

-

Previous Close: $11.85

-

Open: $11.45

-

Day’s Range: $10.68 – $11.75

The current trading volume stands at 24,785,989 shares. While significant for the observed price movement, this is still below the average volume of 38,786,537 shares, indicating that the selling pressure, though sharp, has not yet reached the typical daily average in terms of total shares traded. The stock is currently trading below both its previous closing price and its opening price, indicating a bearish intraday trend.

Fundamental Analysis: A Growth Story with High Volatility

Examining Archer Aviation’s key fundamental metrics provides context for its current market behavior and long-term potential. As an early-stage company in a capital-intensive and innovative sector, certain financial characteristics are typical.

-

Market Capitalization (Intraday): $6.061 Billion. This substantial market cap reflects investor confidence in the future potential of the eVTOL market and Archer’s position within it, despite its current financial performance.

-

Profitability: ACHR currently reports an Earnings Per Share (TTM) of -$1.23, and no PE Ratio (TTM) is available (indicated by “–“). This signifies that the company is not yet profitable, which is common for innovative technology companies in their development and commercialization phases.

-

Volatility (Beta): With a 5-Year Monthly Beta of 3.10, Archer Aviation stock exhibits significantly higher volatility compared to the broader market (where a Beta of 1 indicates market-like volatility). This high Beta suggests that ACHR’s share price tends to move much more dramatically than the market as a whole, offering both higher potential gains and greater risks.

-

52-Week Range: The stock’s 52-week trading range is $2.82 – $13.92. The current price of $11.05 is significantly higher than its 52-week low, but also notably below its 52-week high, indicating substantial price appreciation over the past year but also recent corrections.

-

Analyst Target: The 1-year Target Estimate for ACHR is $11.94, which is slightly above the current trading price but below the previous close, suggesting that analysts might see limited immediate upside from current levels or a slight recovery to prior levels.

-

Earnings Date: The next reported earnings date is set for August 7, 2025. This long lead time for the next reported earnings suggests a specific reporting cycle or that the company is still in an earlier pre-revenue/pre-commercialization phase where frequent financial updates are not yet standard practice.

Sentiment Analysis: Caution Amidst Innovation

Current market sentiment around ACHR appears cautious, especially given the significant intraday price drop. The high volume accompanying this decline suggests that a notable portion of investors are reacting to recent news or market conditions by divesting shares. As a company operating in a highly speculative and futuristic industry, sentiment for Archer Aviation is often driven by progress in regulatory approvals, technological advancements, strategic partnerships, and funding rounds, rather than traditional profitability metrics. The negative EPS and lack of dividends also position ACHR as a growth-oriented, high-risk, high-reward investment.

Conclusion

Archer Aviation (ACHR) is navigating a dynamic market as it works to bring eVTOL technology to commercial viability. Today’s intraday price action, characterized by a sharp decline on substantial volume, highlights the inherent volatility of a stock in this innovative but unproven sector. While its fundamental metrics reflect a company in a growth phase – marked by high market capitalization, unprofitability, and significant beta – the long-term outlook will heavily depend on its ability to meet development milestones and achieve commercial success. Investors considering ACHR should be prepared for continued volatility and evaluate the stock within the context of its long-term growth potential rather than short-term price fluctuations.

Disclaimer: This analysis is based solely on the provided image data as of 10:51:58 AM EDT. It is for informational purposes only and does not constitute financial advice. Stock prices and market conditions are subject to rapid change. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.