Palantir Stock Dips Below $150: Analyzing the Key Metrics Behind PLTR’s Volatile Day

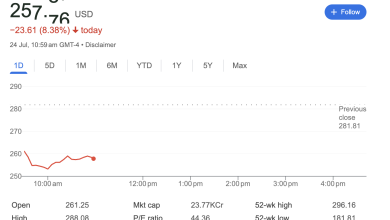

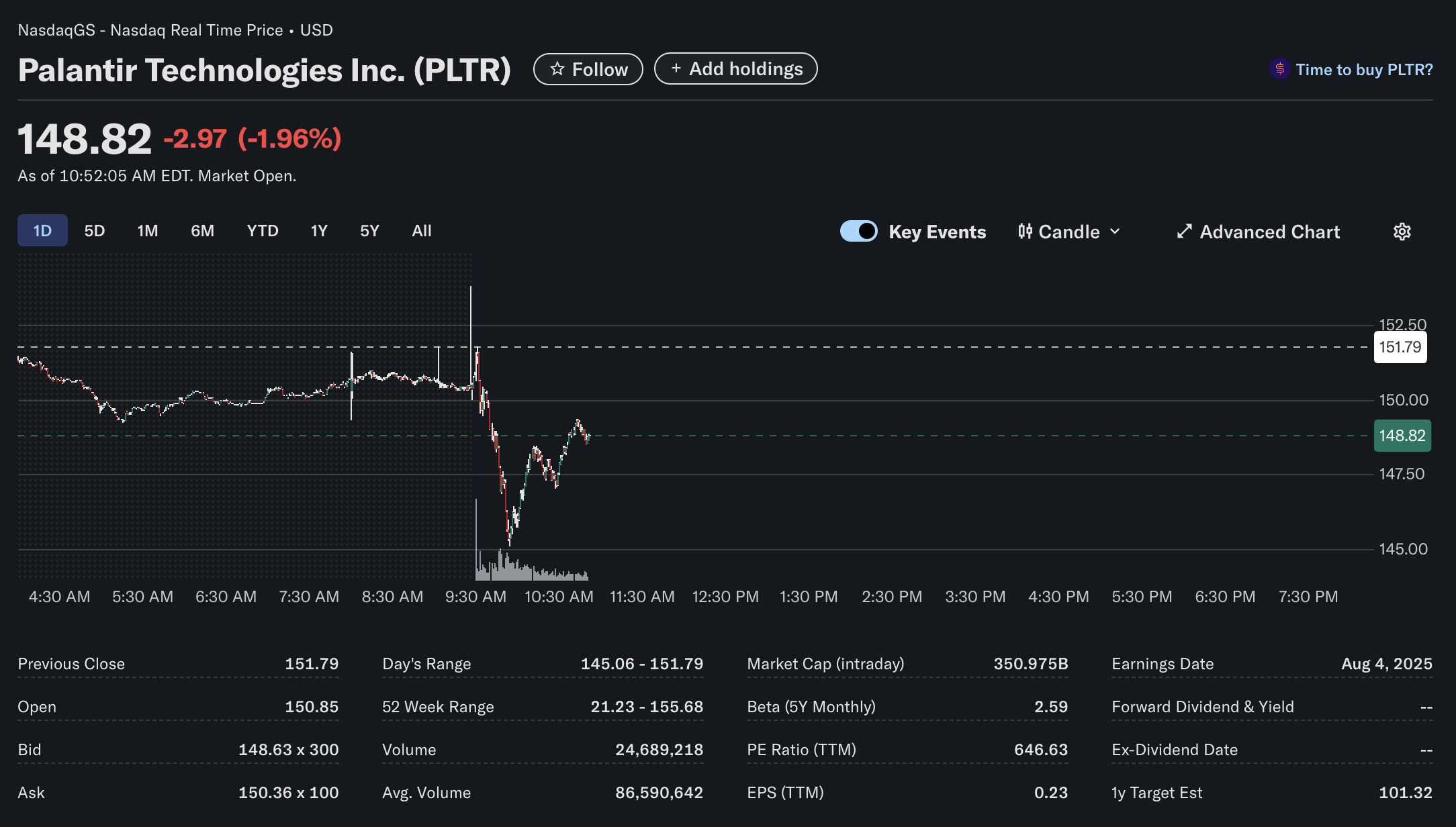

Palantir Technologies Inc. (PLTR) experienced a notable downturn in Tuesday’s trading session, with its share price falling as investors assessed the high-flying tech stock’s current valuation. As of 10:52 AM EDT, the stock was trading at 2.97 or 1.96% for the day. This move has drawn attention to the company’s underlying metrics. Here’s a breakdown based on technical, fundamental, and sentiment analysis from the day’s data.

Technical Analysis

A look at the intraday chart reveals significant volatility. After closing the previous day at $151.79, PLTR opened lower at $150.85 and saw a sharp sell-off at the 9:30 AM market open. This drop was accompanied by a significant spike in trading volume, indicating strong selling pressure as the session began.

The stock hit a day’s low of $145.06 before staging a partial recovery to its current level of $148.82. Despite this bounce, the price remains well below its previous close.

Key Technical Points:

-

Price Action: The stock is in a clear intraday downtrend, though it has found some support above the $145 mark.

-

Key Levels: The previous close of 155.68** than its low of $21.23, highlighting a strong performance over the past year.

-

Volume: The current volume stands at over 24.6 million shares. The spike at the market open suggests a decisive move by sellers.

Fundamental Analysis

The fundamental data presented provides a picture of a classic growth company with a premium valuation.

-

Valuation: Palantir’s Price-to-Earnings (P/E) Ratio (TTM) is exceptionally high at 646.63. This suggests that investors have priced in significant future earnings growth. The company’s Market Cap is listed at $350.975B.

-

Profitability: The company is profitable on a trailing twelve-month basis, with an Earnings Per Share (EPS) of $0.23.

-

Volatility: With a Beta (5Y Monthly) of 2.59, PLTR is significantly more volatile than the broader market. A beta above 1 indicates a stock that tends to move more than the market index.

-

Analyst Outlook: A critical point of interest is the 1-year Target Estimate of $101.32. This average analyst price target is considerably lower than the stock’s current trading price, suggesting that Wall Street analysts, on average, view the stock as overvalued at these levels.

-

Dividends: The company does not currently offer a dividend, which is common for technology firms that prefer to reinvest capital back into growth.

-

Future Events: The provided data lists an Earnings Date of August 4, 2025.

Sentiment Analysis

The sentiment surrounding Palantir appears to be mixed and reflects a tug-of-war between different market perspectives.

-

Bearish Short-Term Sentiment: The sharp price drop on high volume points to negative sentiment in the current trading session. This could be driven by profit-taking after a strong run-up or broader market concerns.

-

Cautious Analyst Sentiment: The analyst 1-year target price being well below the current market price indicates a cautious, if not bearish, professional outlook on the stock’s valuation.

-

Bullish Investor Sentiment: The extremely high P/E ratio is a direct reflection of bullish investor sentiment. Market participants who have pushed the price near its 52-week high are betting heavily on the company’s long-term growth story, particularly in the field of AI and data analytics.

In summary, Palantir (PLTR) presents the profile of a high-conviction growth stock. While its recent performance and long-term potential have fueled strong investor optimism, its premium valuation is being challenged by short-term market dynamics and a more conservative analyst community.

Disclaimer: This article is for informational purposes only and is based on data from the provided image at a specific point in time. It does not constitute financial, investment, or trading advice. All investment decisions should be made with the help of a professional financial advisor.