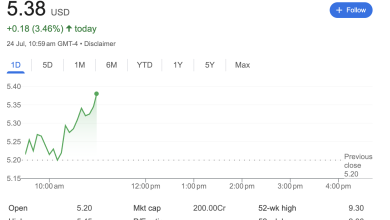

Lucid Stock (LCID) Surges Over 4% in Early Trading on Heavy Volume

Lucid Group, Inc. (LCID) experienced a significant surge in its stock price during early market hours, with shares jumping on the back of unusually high trading volume. The move highlights a spike in investor interest, though key financial metrics suggest a complex outlook for the electric vehicle manufacturer.

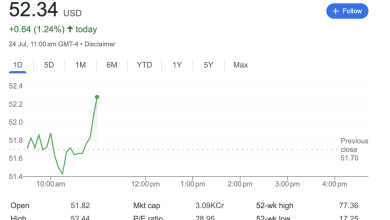

As of 10:21 AM EDT, shares of Lucid Group were trading at 2.9450 USD, an increase of +0.1250 USD or +4.43% for the session. The stock’s activity signals a dynamic start to the trading day for the Nasdaq-listed company.

Technical Analysis

The intraday chart for LCID reveals a dramatic price movement concentrated around the market open at 9:30 AM EDT. After trading in a relatively tight range during pre-market hours, the stock saw a massive and immediate spike as soon as the opening bell rang.

This surge propelled the price from its opening level of 2.7600 to a day’s high of 2.9700 within minutes. The move was supported by a significant spike in trading volume, with over 65 million shares changing hands in the first hour of trading alone. While the volume is high, it is still below the three-month average of approximately 148 million shares, indicating that while interest is strong, the day’s full trading story is yet to unfold. The price action points to strong, aggressive buying pressure at the start of the session.

Fundamental Analysis

A look at Lucid’s fundamental data presents the picture of a growth-stage company yet to achieve profitability.

-

Market Capitalization: The company commands an intraday market cap of 9.013 billion USD.

-

Profitability: Lucid is not currently profitable, as indicated by a negative Earnings Per Share (EPS) (TTM) of -1.1900 and the absence of a Price-to-Earnings (P/E) ratio.

-

Dividends: As is common for companies in a high-growth phase, Lucid does not pay a dividend.

-

Volatility: The stock has a 5-year monthly Beta of 0.79, suggesting it has historically been less volatile than the broader market index.

-

52-Week Range: The stock has traded between 1.9300 USD and 4.4300 USD over the past year. The current price sits within the upper half of this range but is still well below its 52-week high.

Sentiment Analysis

The market sentiment for Lucid appears to be a mix of short-term optimism and long-term caution.

-

Bullish Sentiment: The strong intraday rally of over 4% on high volume is a clear indicator of positive short-term sentiment. Traders are actively buying the stock, driving its price higher. The prompt in the corner of the interface, “LCID: Risk or rebound?”, suggests that this rebound is a key topic of interest for investors.

-

Bearish Counterpoint: A significant point of caution comes from the analyst community. The 1-year target estimate for LCID is 2.68 USD. This consensus forecast is notably below the current trading price of 2.9450 USD, suggesting that, on average, Wall Street analysts believe the stock may be overvalued at its current level and could see a decline over the next 12 months.

In conclusion, while Lucid Group’s stock is experiencing a strong bullish intraday move, this is set against a fundamental backdrop of unprofitability and a cautious long-term outlook from market analysts.

Disclaimer: This article is for informational purposes only and is based solely on the data presented in the provided image. It should not be considered financial advice. All investors should conduct their own thorough research and/or consult with a qualified financial advisor before making any investment decisions.