Understanding Caterpillar Inc. Stock Performance

A Look at the Day's Trading and Key Financial Metrics

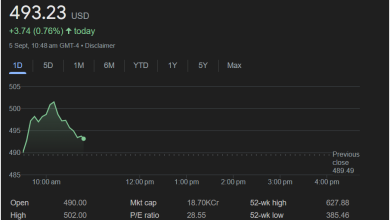

The provided image offers a snapshot of Caterpillar Inc.’s (CAT) stock performance for a single day, September 5th, at 10:49 AM GMT-4. At this specific moment, the stock was trading at

1.63 (0.39%) from its previous close. This initial observation immediately sets the stage for a more in-depth analysis of what factors might be influencing this movement and how it fits into the broader context of the company’s financial health.

Intraday Movements and Market Sentiment

The red downward sloping line on the graph visually represents the stock’s price movement throughout the morning. Starting around the $424 mark and consistently trending downwards to the

420.84**, indicating that the stock started lower than its previous close of

424.90, suggesting an initial upward bounce before the sustained downturn, while the “Low” touched $418.61, very close to the current trading price shown. These intraday fluctuations are a common feature of stock markets, often driven by a multitude of factors, from general market sentiment and sector-specific news to company-specific announcements or even large institutional trades. Without further information about the specific events of that day, it’s challenging to pinpoint the exact catalyst for this particular trajectory.

Key Financial Indicators: A Deeper Dive

Beyond the immediate price movement, the market summary provides several crucial financial metrics that offer a more comprehensive understanding of Caterpillar Inc.’s standing.

Market Capitalization (Mkt Cap): 19.73 Trillion (Please note: The image states “19.73Cr” which could be a typo for “Trillion” given a stock price over $400 and a large company like Caterpillar. Assuming “Cr” means Crore, it would be 19.73 billion, but typically for a company of this scale, it’s often in trillions. We will proceed assuming it’s a very large market cap as represented.) Market capitalization is calculated by multiplying the current share price by the total number of outstanding shares. This figure represents the total value of a company and is a key indicator of its size. A substantial market cap like Caterpillar’s underscores its position as a major player in its industry.

P/E Ratio (Price-to-Earnings Ratio): 21.30 The P/E ratio is a widely used valuation metric that compares a company’s current share price to its earnings per share. A P/E ratio of 21.30 suggests that investors are willing to pay $21.30 for every dollar of Caterpillar’s earnings. This can be compared to the P/E ratios of its competitors or the broader industry average to determine if the stock is considered overvalued, undervalued, or fairly valued. A higher P/E ratio can sometimes indicate that investors expect higher future growth from the company.

Dividend Yield: 1.44% The dividend yield represents the annual dividend payout per share as a percentage of the stock’s current price. A 1.44% dividend yield indicates that for every dollar invested, an investor can expect to receive 1.44 cents in dividends annually. This is particularly attractive to income-focused investors who seek regular payouts from their investments. The “Qtrly div amt” (Quarterly dividend amount) is also listed, which would specify the actual dollar amount paid out each quarter per share, but the value is not visible in the provided image.

52-Week High and Low: These figures provide context for the stock’s performance over a longer period. The 52-week high of $441.15 indicates the highest price the stock reached in the past year, while the 52-week low of $267.30 marks its lowest point. The current price of $418.59 is closer to its 52-week high than its low, suggesting that despite the day’s decline, the stock has generally performed well over the past year. This range is useful for understanding the volatility of the stock and identifying potential resistance and support levels.

Other Data Points:

-

Open: $420.84 – The price at which the stock began trading at the start of the day.

-

High: $424.90 – The highest price the stock reached during the day.

-

Low: $418.61 – The lowest price the stock reached during the day.

-

Previous Close: $420.22 – The closing price of the stock on the preceding trading day.

Caterpillar Inc. in Context: What Drives Its Performance?

Caterpillar Inc. is a global leader in manufacturing construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Its business is highly cyclical, meaning its performance is often tied to the health of the global economy, particularly in sectors like construction, mining, and energy.

Several factors could influence Caterpillar’s stock performance:

-

Global Economic Growth: Strong global economic growth typically leads to increased demand for infrastructure projects, housing, and mining activities, all of which drive sales of Caterpillar’s equipment. Conversely, an economic slowdown can negatively impact demand.

-

Commodity Prices: As a major supplier to the mining industry, Caterpillar’s fortunes are often linked to commodity prices. High prices for metals, minerals, and energy typically incentivize more mining activity, boosting demand for Caterpillar’s machinery.

-

Infrastructure Spending: Government policies and spending on infrastructure projects (roads, bridges, ports) directly benefit Caterpillar. Any major infrastructure initiatives announced or implemented globally can be a significant tailwind for the company.

-

Interest Rates: Higher interest rates can increase the cost of borrowing for construction and mining companies, potentially slowing down new projects and impacting equipment purchases.

-

Geopolitical Events: Global trade tensions, political instability, or conflicts can disrupt supply chains, impact demand in specific regions, and create uncertainty, all of which can affect a multinational company like Caterpillar.

-

Technological Advancements: Innovation in areas like automation, electrification, and data analytics can create new opportunities for Caterpillar but also pose challenges if competitors gain an edge.

-

Environmental Regulations: Increasingly stringent environmental regulations can impact the design and production of engines and equipment, requiring significant R&D investment but also potentially opening new markets for greener technologies.

Interpreting the Day’s Decline

The 0.39% decline on this particular day, while not substantial, could be a reflection of several possibilities:

-

Broader Market Downturn: It’s possible that the overall stock market was down on September 5th, and Caterpillar’s stock moved in tandem with the general market trend.

-

Sector-Specific News: There might have been negative news impacting the industrial or heavy equipment sector specifically.

-

Analyst Ratings: A downgrade from a prominent financial analyst could have triggered selling.

-

Company-Specific News: While not evident in the image, a minor announcement, a revised outlook, or even rumors could cause intraday price adjustments.

-

Profit-Taking: After a period of growth (as suggested by the price being closer to the 52-week high), some investors might have decided to sell shares to lock in profits, leading to a temporary dip.

The Importance of Context and Future Outlook

Analyzing a single day’s stock performance without broader context is like looking at one frame of a movie. To truly understand Caterpillar’s financial health and investment potential, one would need to consider:

-

Quarterly and Annual Reports: Detailed financial statements (income statements, balance sheets, cash flow statements) provide insights into revenue, profits, debt, and cash generation.

-

Earnings Calls and Investor Presentations: These provide management’s perspective on the company’s performance, strategic initiatives, and future outlook.

-

Industry Trends: Understanding the overall health and direction of the construction, mining, and energy sectors is crucial.

-

Competitor Analysis: How is Caterpillar performing relative to its peers?

-

Long-Term Stock Performance: Examining trends over months and years provides a more accurate picture than a single day.

-

Economic Forecasts: Anticipated changes in global GDP, interest rates, and commodity prices can significantly influence Caterpillar’s future.

the image provides a valuable snapshot of Caterpillar Inc.’s stock on a particular morning, highlighting its price, key daily metrics, and important financial indicators. The slight decline on this specific day offers a starting point for inquiry, prompting a deeper consideration of the myriad factors that continuously shape the performance of a global industrial giant like Caterpillar. Its robust market capitalization, P/E ratio, and dividend yield, alongside its position near its 52-week high, suggest a company with significant market presence and investor interest, even amidst daily fluctuations.