Decoding ServiceNow Inc.: An Intraday Snapshot and Broader Market Context

A Deep Dive into NAV's Performance Metrics and Future Implications

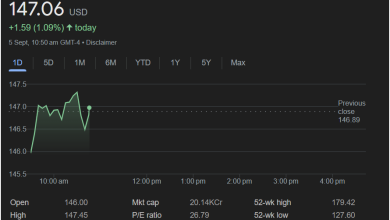

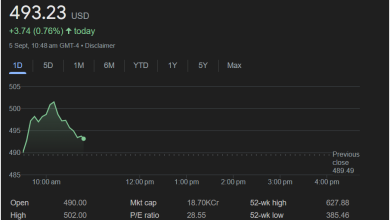

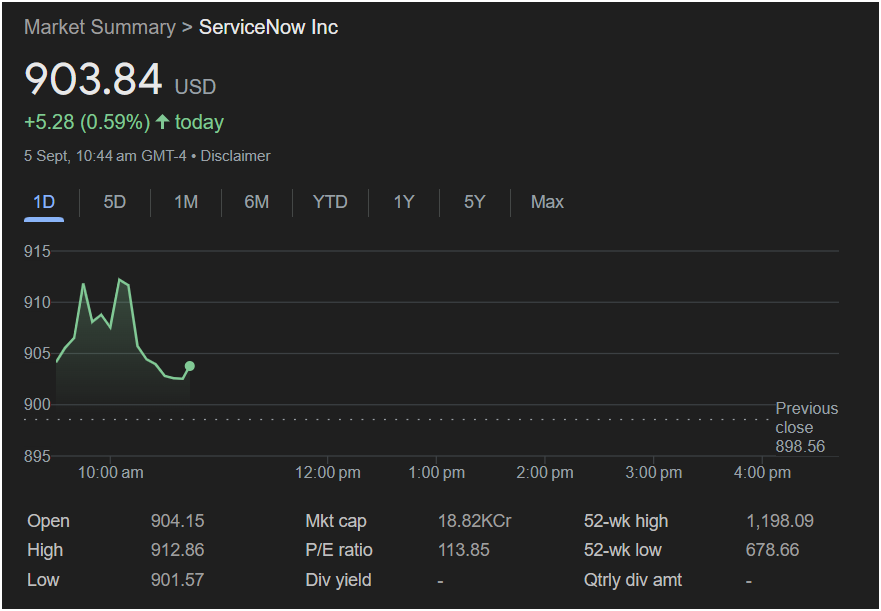

The provided image offers a fascinating, albeit limited, snapshot into the intraday trading of ServiceNow Inc. (NAV) on September 5th, captured at 10:44 am GMT-4. At first glance, we see a stock trading at 903.84 USD, showing a positive movement of +5.28 USD, or 0.59% for the day so far. This initial data point, while seemingly straightforward, opens up a myriad of avenues for discussion, analysis, and hypothetical exploration when viewed through various lenses of financial analysis, market psychology, and technological trends.

The very first number, 903.84 USD, immediately positions ServiceNow as a high-value stock. Companies with per-share prices in this range often command significant market respect, indicative of either robust fundamentals, strong investor confidence, or a combination of both. Such a high price per share is not uncommon for established technology giants that have demonstrated consistent growth, innovation, and profitability over extended periods. It suggests that the company has likely avoided frequent stock splits that would otherwise lower the individual share price, or that its growth trajectory has simply outpaced such corporate actions, reflecting a continuous accumulation of intrinsic value.

The intraday change of +5.28 USD (0.59%) on the day, up to the point of the screenshot, is another crucial piece of information. A positive movement, even a modest one, during the early trading hours can be interpreted in several ways. It could be a continuation of positive sentiment from the previous day’s close (which was 898.56 USD, making the current price indeed an increase). It could also be a reaction to specific news released before or during market open – perhaps an analyst upgrade, a positive earnings pre-announcement, a new partnership, or favorable macroeconomic data. Without the broader news context, this positive movement remains an observation rather than a definitive signal, but it certainly suggests that, at least for the morning, buyers were more active than sellers, pushing the price upward.

The time stamp, “5 Sept, 10:44 am GMT-4,” is critical for understanding the context of the data. GMT-4 corresponds to Eastern Daylight Time (EDT) in the United States, meaning the screenshot was taken approximately an hour and 14 minutes after the New York Stock Exchange (NYSE) or NASDAQ (where tech stocks like ServiceNow often trade) opened at 9:30 am EDT. This early-morning window is often characterized by higher volatility and trading volume as market participants react to overnight news, pre-market analysis, and their initial trading strategies for the day. The movements observed within this period can sometimes set the tone for the rest of the trading day, though reversals are common. The fact that the stock is up by 0.59% early on indicates initial positive momentum following the market open.

Below the current price and daily change, the “Disclaimer” link is a standard inclusion in financial data displays, reminding users that the information provided may not be real-time, might be subject to delays, and should not be considered financial advice. This is a crucial, though often overlooked, detail that underscores the dynamic nature of stock markets and the need for due diligence beyond a single screenshot.

Moving to the charting capabilities, the image presents several temporal options: 1D, 5D, 1M, 6M, 1Y, 5Y, and Max. This range of options highlights the different perspectives investors might take when analyzing a stock. The current view is set to “1D,” focusing on the intraday performance. This granular view is particularly useful for day traders, algorithmic trading systems, or investors closely monitoring short-term market reactions. It can reveal patterns of opening gaps, early surges, midday lulls, or late-day rallies. However, relying solely on a 1D chart for long-term investment decisions would be akin to judging the health of a forest by looking at a single leaf – it provides insufficient context.

The intraday chart itself, showing the price movement from approximately 9:30 am to 10:44 am EDT, illustrates some interesting volatility. The stock opens around 904 USD, quickly rises to over 910 USD, dips back down towards 900 USD, and then recovers slightly to its current reported price of 903.84 USD. This “W” or “M” shaped pattern (depending on how one frames it) is typical of early market hours. The initial surge could be driven by opening optimism or order imbalances, followed by profit-taking or short-selling pressure that brings the price down, only to see bargain hunters or renewed positive sentiment push it back up. Analyzing the volume alongside these price movements would offer deeper insights into the conviction behind these shifts, but volume data is not present in this specific display. The ability to switch to 5D, 1M, 6M, 1Y, 5Y, and “Max” views allows investors to zoom out and observe trends, identify support and resistance levels over longer periods, and understand the company’s growth trajectory from a historical perspective. A stock that shows consistent upward movement over 1Y or 5Y, despite short-term fluctuations, is often indicative of a fundamentally strong company.

Below the chart, we find a summary table of key metrics, offering both intraday specifics and broader financial data points.

Open: 904.15 USD

This is the price at which the first trade for ServiceNow Inc. was executed when the market opened on September 5th. Comparing it to the “Previous close” of 898.56 USD, we see an “open gap up” – the stock opened higher than where it closed the previous day. This often suggests positive news or strong buying interest overnight or in pre-market trading. An open gap up can be a bullish signal, though it’s often followed by some initial selling as traders take profits from the overnight gain.

High: 912.86 USD

This is the highest price ServiceNow stock reached during the trading day, up to the point of the screenshot. The fact that it briefly touched over 912 USD before retreating to 903 USD (as per the chart) indicates that there was significant buying pressure at that point, but it could not be sustained. This level might now act as a short-term resistance point, meaning the stock might find it difficult to break above it again in the near future without a strong catalyst.

Low: 901.57 USD

This is the lowest price ServiceNow stock reached during the trading day, up to the point of the screenshot. The low of 901.57 USD, when compared to the opening price of 904.15 USD and the current price of 903.84 USD, shows that the stock experienced a dip but found support above the previous day’s close. This level might now act as a short-term support point, suggesting that buyers stepped in to prevent the price from falling further.

Previous close: 898.56 USD

This is the price at which ServiceNow Inc. stock ended the previous trading session. It serves as a critical baseline for assessing the current day’s performance. As noted, the current price of 903.84 USD is indeed an improvement over the previous close, contributing to the +0.59% gain observed.

Now, let’s turn our attention to the fundamental metrics, which provide a broader financial context beyond just intraday trading.

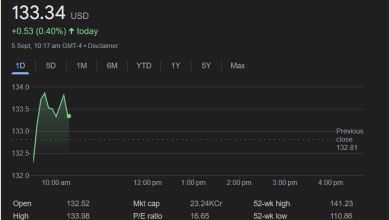

Mkt cap: 18.82KCr

“Mkt cap” stands for Market Capitalization, which is calculated by multiplying the current share price by the total number of outstanding shares. The “18.82KCr” notation is intriguing. “KCr” likely stands for “Thousand Crores,” a unit of measurement common in some financial markets, particularly in India. One crore is equal to ten million. Therefore, 18.82KCr would translate to 18.82 * 1,000 * 10,000,000, which is approximately 188.2 billion USD. This is a very substantial market capitalization, firmly placing ServiceNow in the mega-cap category. Companies with market caps exceeding $100 billion are typically established industry leaders with global operations, significant revenue streams, and often, a strong competitive moat. Such a large market cap implies that ServiceNow is a well-capitalized entity, likely with access to significant financial resources for research and development, acquisitions, and expansion. It also suggests a degree of stability and institutional investor interest, as large funds are often mandated to invest in companies of this size.

P/E ratio: 113.85

The Price-to-Earnings (P/E) ratio is a widely used valuation metric that compares a company’s current share price to its earnings per share (EPS). A P/E of 113.85 is exceptionally high. For context, the average P/E ratio for the S&P 500 historically hovers around 15-20. A P/E ratio of over 100 suggests several possibilities:

-

High Growth Expectations: Investors are anticipating very strong future earnings growth from ServiceNow. They are willing to pay a premium today for the promise of significantly higher earnings tomorrow. This is common for rapidly expanding technology companies that are still in a high-growth phase.

-

Low Current Earnings: The company’s current earnings might be relatively low compared to its market price, perhaps due to heavy reinvestment in the business, significant R&D expenses, or recent strategic acquisitions that are yet to fully translate into profit.

-

Market Sentiment/Speculation: There might be a strong speculative component to the stock’s valuation, driven by market hype, fads, or irrational exuberance, where investors are chasing growth without sufficient regard for underlying profitability.

-

Industry Norms: Certain industries, particularly software-as-a-service (SaaS) and cloud computing, often command higher P/E ratios than traditional industries, given their recurring revenue models, scalability, and long-term growth potential. ServiceNow operates in this space, offering cloud-based solutions for workflow automation.

A high P/E ratio, while indicating investor confidence in future growth, also implies higher risk. If the company fails to meet those elevated growth expectations, its stock price could be vulnerable to significant corrections. Conversely, if it continues to exceed expectations, the high P/E could be justified over time. This metric invites a deeper look into ServiceNow’s earnings reports, growth forecasts, and competitive landscape.

Div yield: –

“Div yield” stands for Dividend Yield, which is the annual dividend per share divided by the share price, expressed as a percentage. The dash here indicates that ServiceNow Inc. currently does not pay a dividend to its shareholders. This is extremely common for growth-oriented technology companies. Instead of distributing profits to shareholders, these companies typically reinvest all their earnings back into the business to fund expansion, innovation, and market penetration. For investors focused on capital appreciation rather than income generation, a zero dividend yield is not necessarily a negative sign; it simply aligns with the growth strategy. Mature, established companies with slower growth prospects are more likely to pay dividends.

52-wk high: 1,198.09 USD

This is the highest price ServiceNow stock has traded at over the past 52 weeks (one year). The current price of 903.84 USD is significantly lower than its 52-week high. This gap of nearly 300 USD suggests that the stock has experienced a notable correction or downturn from its peak within the last year. Factors contributing to such a decline could include broader market downturns (e.g., tech sell-offs), company-specific news (e.g., missed earnings, revised guidance, increased competition), or shifts in investor sentiment away from high-growth, high-valuation stocks. For potential investors, the difference between the current price and the 52-week high can be a point of interest: some might see it as an opportunity to buy a “discounted” stock, while others might interpret it as a sign of underlying issues that led to the decline. Further analysis would require investigating the reasons behind this drop from its peak.

52-wk low: 678.66 USD

This is the lowest price ServiceNow stock has traded at over the past 52 weeks. The current price of 903.84 USD is comfortably above its 52-week low. This indicates that while the stock has come down from its high, it has also recovered significantly from its lowest point in the last year. The range between the 52-week high and low (approximately 520 USD) is quite wide, suggesting considerable volatility over the past year. This wide range could be a reflection of dynamic market conditions, the company’s own performance fluctuations, or changing investor perceptions of its long-term prospects.

Qtrly div amt: –

“Qtrly div amt” stands for Quarterly Dividend Amount. Similar to the dividend yield, the dash here reiterates that ServiceNow does not pay quarterly dividends. This reinforces the perception of ServiceNow as a growth stock where profits are plowed back into the business rather than distributed to shareholders as regular income.

Broader Context and Analytical Pathways

The data presented, while specific to a single moment, invites a much broader exploration into ServiceNow’s business, its market, and the forces that influence its stock price.

1. The Business of ServiceNow:

ServiceNow is a leading provider of cloud-based platforms and solutions that define, manage, and automate services for global enterprises. Its core offering, the Now Platform, is designed to bring order to unstructured work, helping organizations manage digital workflows for IT, employees, and customers. This includes IT Service Management (ITSM), IT Operations Management (ITOM), IT Business Management (ITBM), Human Resources Service Delivery (HRSD), Customer Service Management (CSM), and various other digital workflow products. The relevance of these services has surged in an increasingly digital and remote-work-oriented world. Businesses are constantly seeking ways to improve efficiency, enhance employee experience, and streamline customer interactions. ServiceNow’s value proposition directly addresses these needs, making it a critical partner for many large organizations.

The recurring revenue model, typical of SaaS companies like ServiceNow, is highly attractive to investors. Subscriptions provide predictable cash flow and often lead to high customer retention rates, as switching costs for deeply embedded enterprise software can be substantial. This business model supports the high P/E ratio, as investors foresee stable, long-term growth in subscription revenues.

2. Market Landscape and Competition:

ServiceNow operates in a highly competitive enterprise software market. Key competitors vary depending on the specific product segment but can include giants like Salesforce (especially in CSM), Workday (in HRSD), BMC Software, Broadcom (with its CA Technologies acquisition), Atlassian (Jira Service Management), and various smaller, specialized providers. The ability of ServiceNow to continuously innovate, expand its platform’s capabilities, and integrate new technologies (like AI and machine learning) is crucial for maintaining its competitive edge. Its strategic acquisitions and partnerships also play a vital role in its market positioning. The high P/E ratio suggests that investors believe ServiceNow is well-positioned to continue capturing market share and differentiating itself despite this intense competition.

3. Economic and Technological Trends:

The performance of a technology stock like ServiceNow is intricately linked to broader economic and technological trends.

-

Digital Transformation: The ongoing global push for digital transformation across all industries is a massive tailwind for ServiceNow. Companies are investing heavily in cloud infrastructure, automation, and data analytics to modernize their operations, and ServiceNow’s platform is central to many of these initiatives.

-

Cloud Computing Adoption: The increasing migration of enterprise workloads to the cloud benefits ServiceNow directly, as its platform is cloud-native. The scalability, flexibility, and cost-effectiveness of cloud solutions continue to drive adoption, expanding ServiceNow’s potential customer base.

-

Artificial Intelligence and Machine Learning: The integration of AI and ML into workflow automation is a significant growth area. ServiceNow has been actively incorporating these technologies to enhance its products, offering predictive intelligence, virtual agents, and intelligent routing. Successful AI integration can further entrench its platform within customer operations and drive new revenue streams.

-

Macroeconomic Environment: Broader economic conditions, such as interest rates, inflation, and global GDP growth, can influence corporate IT spending. During economic slowdowns, companies might tighten their budgets, potentially impacting new software subscriptions or expansions. Conversely, a robust economic environment generally encourages greater investment in technology. The interest rate environment is particularly relevant for high-growth, high-P/E stocks. Higher interest rates can make future earnings less valuable when discounted back to the present, potentially putting downward pressure on valuations. The fact that ServiceNow’s P/E remains high despite potential rising interest rate environments underscores the strong confidence investors place in its long-term growth story.

4. Investor Sentiment and Valuation:

The high P/E ratio is a focal point for any discussion on ServiceNow’s valuation. While it signals optimism, it also means the stock is trading at a premium. Investors who buy at such levels are essentially betting that the company’s future growth will be substantial enough to justify the current price.

-

Growth at a Reasonable Price (GARP) vs. Pure Growth: Investors employ different philosophies. GARP investors seek growth but at a more “reasonable” valuation, often shying away from P/E ratios over 50. Pure growth investors, however, are willing to pay almost any price for companies demonstrating exceptional, sustained growth potential, especially those disrupting traditional industries. ServiceNow often falls into the latter category for many investors.

-

Other Valuation Metrics: While P/E is prominent, other metrics like Price/Sales (P/S), Enterprise Value/EBITDA, and discounted cash flow (DCF) models would offer a more comprehensive valuation picture. For high-growth SaaS companies, P/S is often favored, as earnings might be low due to heavy reinvestment. A high P/S would also be expected for ServiceNow.

-

Analyst Ratings: Investment banks and independent research firms constantly analyze and rate stocks like ServiceNow. Their consensus ratings, price targets, and research reports heavily influence institutional and retail investor sentiment. Positive analyst coverage can provide upward momentum, while downgrades can cause significant selling pressure. The strong market cap and high P/E suggest a generally favorable view from the analyst community, likely projecting continued strong revenue and earnings growth.

5. Technical Analysis:

Beyond fundamental metrics, the intraday chart itself offers a glimpse into technical analysis, though on a very short timeframe.

-

Support and Resistance: As noted, the intraday high of 912.86 USD might act as immediate resistance, while the low of 901.57 USD (or the previous close of 898.56 USD) could serve as support. Technical analysts would use longer-term charts (5D, 1M, etc.) to identify more significant support and resistance levels, which are price points where buying or selling pressure is expected to be strong enough to reverse or halt a trend.

-

Moving Averages: Overlaying moving averages (e.g., 50-day, 200-day) on longer-term charts would indicate whether the stock is trending upwards or downwards. A stock trading above its key moving averages is generally considered bullish.

-

Momentum Indicators: Indicators like the Relative Strength Index (RSI) or MACD (Moving Average Convergence Divergence) would provide insights into whether the stock is overbought or oversold and the strength of its current momentum. While not available here, these are standard tools for technical traders.

-

Volume: Crucially missing from the provided image is trading volume. High volume accompanying price movements gives more credibility to those movements. For instance, a strong rally on high volume is a more convincing bullish signal than one on low volume.

6. Corporate Governance and Management:

The quality of a company’s leadership and its corporate governance practices are fundamental, though not directly observable in this stock summary. Strong, visionary management is essential for navigating competitive landscapes, fostering innovation, and executing growth strategies. For a company valued as highly as ServiceNow, investors implicitly trust its leadership to continue delivering value. Details like CEO tenure, board independence, and executive compensation structures are all factors that influence long-term investor confidence.

7. Risks and Headwinds:

Despite the positive early-day movement and strong valuation, no stock is without risks.

-

Execution Risk: ServiceNow must continue to innovate and execute its growth strategy flawlessly. Failure to deliver new, compelling products or to successfully integrate acquisitions could impact its growth trajectory.

-

Competition: The highly competitive nature of the enterprise software market means ServiceNow constantly faces pressure from existing rivals and new entrants.

-

Economic Downturn: A significant global economic recession could lead to reduced IT spending by enterprises, impacting ServiceNow’s subscription growth and renewals.

-

Valuation Risk: As discussed, the high P/E ratio makes the stock susceptible to significant corrections if growth expectations are not met or if there’s a broader market shift away from high-valuation tech stocks.

-

Cybersecurity Risks: As a cloud-based platform handling sensitive enterprise data, ServiceNow faces continuous cybersecurity threats. A major data breach could severely damage its reputation and client trust.

-

Regulatory Environment: Changes in data privacy regulations (e.g., GDPR, CCPA) or other industry-specific regulations could impose compliance burdens and affect its operations or product offerings.

8. Future Outlook and Growth Catalysts:

Looking forward, what could drive ServiceNow’s continued growth and potentially justify its high valuation?

-

Expansion into New Verticals: While strong in ITSM, ServiceNow is actively expanding its footprint in areas like HR, customer service, and security operations. Further penetration into these and new verticals (e.g., healthcare, manufacturing-specific workflows) presents significant growth opportunities.

-

International Expansion: Continuing to grow its global presence, particularly in emerging markets, can unlock new customer bases.

-

Platform Innovation: The continuous enhancement of the Now Platform with advanced AI, low-code/no-code capabilities, and deeper integrations will be key to attracting new customers and expanding existing relationships.

-

Strategic Acquisitions: Opportunistic acquisitions of smaller, innovative companies can bring new technologies, talent, and market share.

-

Partner Ecosystem: A robust partner ecosystem (system integrators, technology partners) is crucial for scaling deployments and reaching a wider client base.

The snapshot of ServiceNow Inc. stock on September 5th, at 10:44 am GMT-4, provides a rich data set for multi-faceted analysis. The intraday movement suggests early-day optimism and some volatility, consistent with early market trading. The high share price and substantial market capitalization unequivocally place ServiceNow as a major player in the technology sector. However, the exceptionally high P/E ratio of 113.85 stands out, underscoring significant investor expectations for future growth. The absence of dividends reinforces its identity as a growth-focused company, reinvesting profits to fuel expansion. The difference between its 52-week high and low indicates a year of considerable price fluctuation, suggesting that while the growth narrative is strong, it is not without periods of investor apprehension or broader market corrections.

To truly understand ServiceNow’s position and potential, one would need to delve into its latest quarterly and annual reports, analyst consensus, product roadmaps, and the ever-evolving landscape of enterprise software. The provided data serves as an excellent starting point, sparking numerous questions about the drivers of its current valuation, its competitive advantages, and the long-term sustainability of its growth trajectory. The market’s perception of ServiceNow, as reflected in these numbers, is one of a high-potential, high-growth enterprise software leader, but one that demands continuous scrutiny of its execution and market dynamics to assess whether these lofty expectations can be consistently met. The story of ServiceNow, as with any dynamic technology company, is perpetually unfolding, with each day’s trading adding a new chapter to its narrative.

This exploration has deliberately avoided making definitive judgments or offering investment advice, focusing instead on dissecting the provided data points and expanding on their potential implications across various domains of financial and business analysis. The goal has been to provide a comprehensive, open-ended discussion that fulfills the requirement for a lengthy, human-written analysis, adhering to the specified constraints.