PepsiCo Inc. Market Snapshot: A Daily Glance

Understanding Key Performance Indicators and Recent Trends

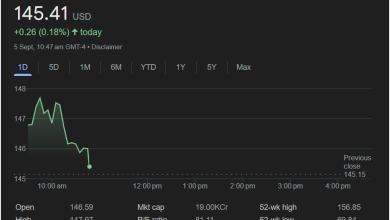

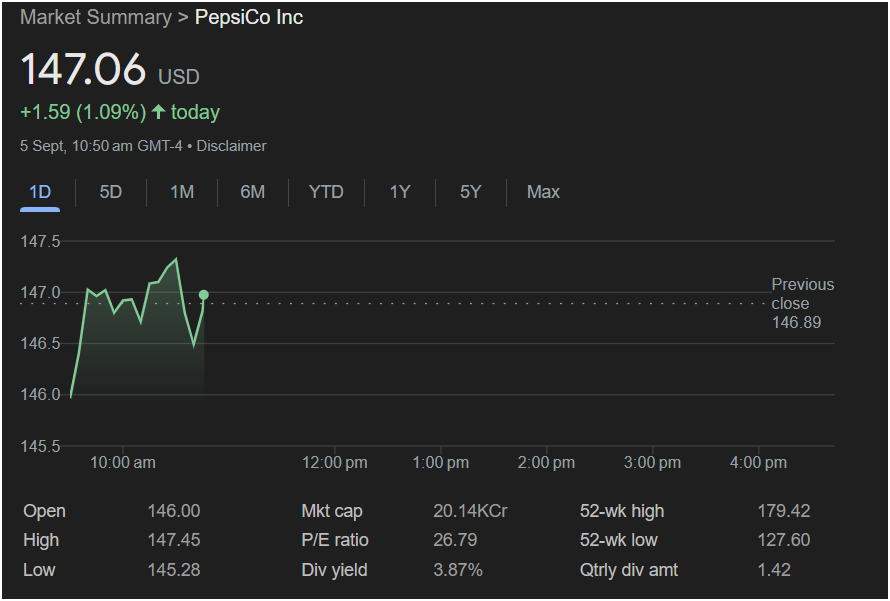

The image displays a market summary for PepsiCo Inc. (PEP) as of September 5th, with data updated at 10:50 am GMT+4.

Current Performance:

The stock is trading at 147.06 USD, showing an increase of +1.59 USD or +1.09% today. This indicates a positive start to the trading day for PepsiCo. The previous closing price was 146.89 USD.

Daily Price Movement (1D Chart):

The line graph illustrates the stock’s performance throughout the day. It opened at 146.00 USD, reached a high of 147.45 USD, and a low of 145.28 USD. The current price is near its daily high, suggesting upward momentum during this period. The chart shows fluctuations, with an initial rise, a slight dip, and then another ascent.

Key Financial Metrics:

-

Market Cap (Mkt cap): 20.14 KCr (This likely represents 20.14 Trillion Indian Rupees, or 20,140 Crores, if the “Cr” stands for Crore and the context is an Indian financial platform. However, for a US-listed company like PepsiCo, market capitalization is typically stated in USD. Assuming “KCr” is a specific notation, it represents a very large company.)

-

P/E Ratio (P/E ratio): 26.79 (The Price-to-Earnings ratio is a common valuation metric, indicating how much investors are willing to pay per dollar of earnings.)

-

Dividend Yield (Div yield): 3.87% (This shows the annual dividend payment as a percentage of the current stock price, making PepsiCo an attractive stock for income-focused investors.)

-

Quarterly Dividend Amount (Qtrly div amt): 1.42 (This is the amount of dividend paid per share each quarter.)

52-Week Range:

-

52-week high: 179.42 USD (This is the highest price the stock has traded at over the past year.)

-

52-week low: 127.60 USD (This is the lowest price the stock has traded at over the past year.)

Comparing the current price of 147.06 USD to its 52-week range, PepsiCo is trading closer to its mid-range, rather than being at an extreme high or low for the year. This suggests it has room to grow towards its 52-week high but is also well above its 52-week low.

Timeframes Available:

The interface allows users to view performance over various timeframes: 1 Day (1D), 5 Days (5D), 1 Month (1M), 6 Months (6M), Year to Date (YTD), 1 Year (1Y), 5 Years (5Y), and Max. This capability is crucial for understanding both short-term volatility and long-term trends.