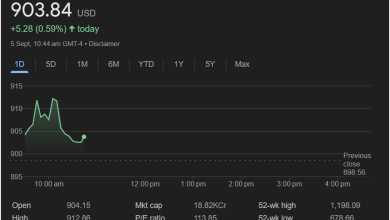

A Snapshot of Thermo Fisher Scientific Inc. (TMO) – Intraday Performance and Key Metrics

Examining the September 5th Market Summary and Valuation Indicators

The provided image offers a concise market summary for Thermo Fisher Scientific Inc. (TMO) as of September 5th, 10:48 am GMT-4. This data allows for an initial understanding of the company’s stock performance on that particular day, alongside several crucial valuation and market health indicators.

Intraday Performance Overview:

On September 5th, Thermo Fisher Scientific Inc. was trading at 493.23 USD. This represents a gain of +3.74 USD, or 0.76%, for the day at the time the snapshot was taken. This positive movement indicates an upward trend in the stock’s value during the early trading hours.

Looking at the intraday chart, we can observe the stock’s journey:

-

Opening Price: The day began with the stock opening at 490.00 USD.

-

Early Rally: Shortly after opening, the stock experienced a significant rally, peaking around 10:00 am (local time, likely EST based on the GMT-4 time zone) at its intraday high.

-

Intraday High: The highest point reached during the trading day, as indicated in the summary, was 502.00 USD. This shows that the stock had considerable upward momentum earlier in the session.

-

Subsequent Pullback: After reaching its high, the stock experienced a modest pullback, settling slightly lower by 10:48 am GMT-4, but still remaining above its opening price.

-

Intraday Low: The lowest point the stock touched during this period was 489.83 USD, which is just below its opening price, suggesting a brief dip before the main rally.

-

Previous Close: For context, the stock closed the previous trading day at 489.49 USD. Comparing the current price of 493.23 USD to the previous close further confirms the positive movement, showing a gain of 3.74 USD from the prior day’s closing.

The green shaded area on the chart visually represents the stock’s price fluctuations relative to the opening price, clearly illustrating the early surge and subsequent minor retracement.

Key Valuation and Market Metrics:

The summary also provides several important financial metrics that offer deeper insights into the company’s size, valuation, and investor returns:

-

Market Capitalization (Mkt cap): 18.70KCr

-

This figure, representing “18.70 Lakh Crore” (where 1 Lakh Crore is 100,000 Crores, and 1 Crore is 10 million), indicates a very large company. This notation is commonly used in Indian financial contexts. For clarity in a global context, 18.70 Lakh Crore rupees would be approximately 225 billion USD (at a rough exchange rate of 83 INR to 1 USD). This makes Thermo Fisher Scientific a mega-cap company, suggesting stability and a significant presence in its industry.

-

-

P/E Ratio (P/E ratio): 28.55

-

The Price-to-Earnings (P/E) ratio is a widely used valuation metric. A P/E of 28.55 suggests that investors are willing to pay 28.55 times the company’s annual earnings per share for its stock. This can be interpreted in several ways:

-

Growth Expectations: A higher P/E ratio often indicates that investors expect strong future earnings growth from the company.

-

Industry Comparison: To truly assess if this P/E is high or low, it needs to be compared against industry averages for the life sciences tools and services sector, as well as TMO’s historical P/E ratios. Without these comparisons, it’s hard to draw a definitive conclusion, but it generally implies a premium valuation.

-

Market Sentiment: It also reflects current market sentiment towards the stock and the broader market’s willingness to pay for earnings.

-

-

-

Dividend Yield (Div yield): 0.35%

-

The dividend yield represents the annual dividend income per share as a percentage of the stock’s current price. A 0.35% yield is relatively low, which is common for growth-oriented companies like those in the biotechnology or scientific instruments sector. It suggests that Thermo Fisher Scientific prioritizes reinvesting earnings back into the business for growth rather than distributing a large portion as dividends. Investors primarily seeking income might find this yield less attractive, while growth investors might see it as a positive sign of reinvestment.

-

-

Quarterly Dividend Amount (Qtrly div amt): 0.43

-

This indicates that the company pays a quarterly dividend of 0.43 USD per share. This small but consistent dividend payment further supports the idea that while not a primary income stock, it does return some capital to shareholders.

-

-

52-Week High: 627.88

-

This is the highest price the stock has traded at over the past 52 weeks. The current price of 493.23 USD is significantly below this high, suggesting the stock has experienced a considerable decline from its peak over the last year.

-

-

52-Week Low: 385.46

-

This is the lowest price the stock has traded at over the past 52 weeks. The current price of 493.23 USD is well above this low, indicating a recovery or sustained trading above its annual bottom.

-

The range between the 52-week high and low (627.88 – 385.46) is quite wide, suggesting volatility in the stock over the past year. The current price sits roughly in the middle, closer to the higher end of the 52-week low.

-

Timeframe Options:

The presence of “1D”, “5D”, “1M”, “6M”, “YTD”, “1Y”, “5Y”, and “Max” buttons indicates that users can view the stock’s performance over various timeframes, from a single day (as shown) to its entire history. This functionality is crucial for investors to assess long-term trends and short-term volatility.

Conclusion (Open-Ended):

The snapshot provides a concise yet informative look at Thermo Fisher Scientific Inc. on September 5th. The stock demonstrated positive intraday momentum, trading above its opening and previous close. Its large market capitalization and relatively high P/E ratio suggest it is a well-established company with perceived growth potential, consistent with its low dividend yield. The wide 52-week range indicates a dynamic year for the stock.

Further analysis would involve comparing these metrics to industry peers, examining historical performance over the longer timeframes indicated by the other buttons, and delving into the company’s financial statements and news to understand the drivers behind its stock movements and current valuation.