Understanding Abbott Laboratories: A Market Snapshot

Exploring the Dynamics of a Healthcare Giant's Stock Performance

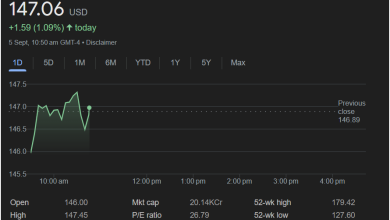

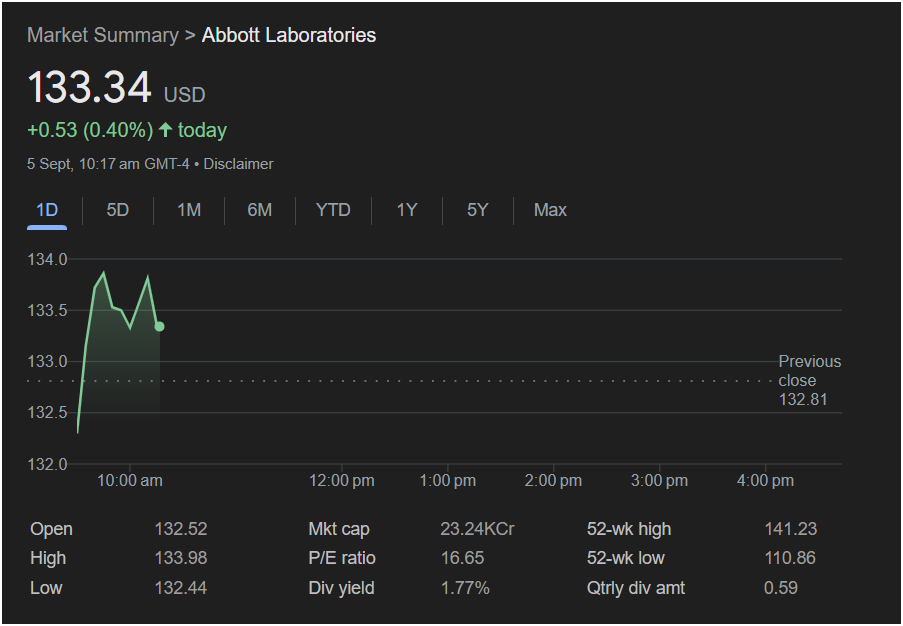

The provided image offers a concise, yet informative, snapshot of Abbott Laboratories’ stock performance as of September 5th, at 10:17 AM GMT-4. Currently trading at 133.34 USD, the stock has seen a modest increase of 0.53 (0.40%) today. This immediate upward movement, while seemingly small, can be indicative of various short-term market reactions, ranging from positive news within the company or the broader healthcare sector, to general market sentiment.

Delving deeper into the presented data, we can observe the stock’s performance over different timeframes. The ‘1D’ (1-day) graph clearly illustrates the intraday fluctuations, showing a peak around the initial trading hours before settling into a slightly fluctuating pattern. This kind of volatility within a single trading day is common and can be influenced by early morning trading, investor reactions to overnight news, or simply the natural ebb and flow of market activity.

Beyond the immediate daily performance, the presence of tabs for ‘5D’, ‘1M’, ‘6M’, ‘YTD’, ‘1Y’, and ‘5Y’ suggests that a comprehensive analysis would require examining its historical trends over these periods. For instance, a strong positive performance over ‘1Y’ or ‘5Y’ would point to sustained growth and investor confidence, while a more volatile or negative trend might warrant a closer look at underlying business challenges or market shifts.

The ‘Previous close’ price of 132.81 USD provides a benchmark against which today’s opening and current prices can be compared. The ‘Open’ price of 132.52 USD indicates a slight gap up from the previous close, further reinforcing the day’s positive momentum. The ‘High’ of 133.98 USD and ‘Low’ of 132.44 USD for the day demonstrate the range within which the stock has traded, offering insights into its intraday volatility.

Further enriching this market summary are key financial metrics. The ‘Mkt cap’ (Market capitalization) stands at 23.24KCr, a substantial figure that underscores Abbott Laboratories’ position as a major player in the healthcare industry. Market capitalization is calculated by multiplying the current stock price by the number of outstanding shares, and it serves as a common indicator of a company’s size and value. A large market cap often suggests a well-established company with a significant presence in its sector.

The ‘P/E ratio’ (Price-to-Earnings ratio) is 16.65. This metric is a widely used valuation tool that compares a company’s current share price to its per-share earnings. A P/E ratio of 16.65 suggests that investors are willing to pay 16.65 times the company’s annual earnings per share. While the interpretation of a P/E ratio can vary significantly across industries and market conditions, it generally provides an indication of how the market values the company’s earnings. A higher P/E might suggest that investors expect higher future growth, while a lower P/E could indicate a company that is undervalued or has lower growth expectations.

The ‘Div yield’ (Dividend yield) is 1.77%. This represents the annual dividend payment per share as a percentage of the stock’s current share price. A dividend yield is particularly attractive to income-focused investors who seek regular payouts from their investments. Abbott Laboratories’ dividend yield suggests that the company is returning a portion of its profits to shareholders, which can be a sign of financial health and stability.

Finally, the ‘Qtrly div amt’ (Quarterly dividend amount) is 0.59. This indicates the specific amount of dividend paid out per share on a quarterly basis. This concrete figure, combined with the dividend yield, offers a clear picture of the income potential for investors holding Abbott Laboratories stock.

The ’52-wk high’ of 141.23 and ’52-wk low’ of 110.86 are crucial indicators of the stock’s performance over a full year. These figures represent the highest and lowest prices at which the stock has traded in the past 52 weeks. Comparing the current price to these extremes can give investors a sense of where the stock stands within its annual trading range. For instance, being closer to the 52-wk high might suggest strong recent performance or positive momentum, while being closer to the 52-wk low could indicate a recent downturn or a potential buying opportunity.

This market summary, while presented in a concise format, is a gateway to a much deeper financial analysis. Each data point, from the daily price movements to the long-term highs and lows, contributes to a comprehensive understanding of Abbott Laboratories’ market position and its appeal to various types of investors. The interplay between these metrics – for example, how a strong P/E ratio aligns with a consistent dividend yield, or how daily fluctuations fit into the broader 52-week trend – paints a dynamic picture of the company’s financial health and market perception. Without further historical context or detailed financial reports, it remains a valuable but open-ended snapshot, inviting further exploration into the factors driving these numbers and their implications for the future.