RTX Corp Shows Resilience Amidst Market Fluctuations

Stock Closes Strong, Signaling Investor Confidence Despite Minor After-Hours Dip

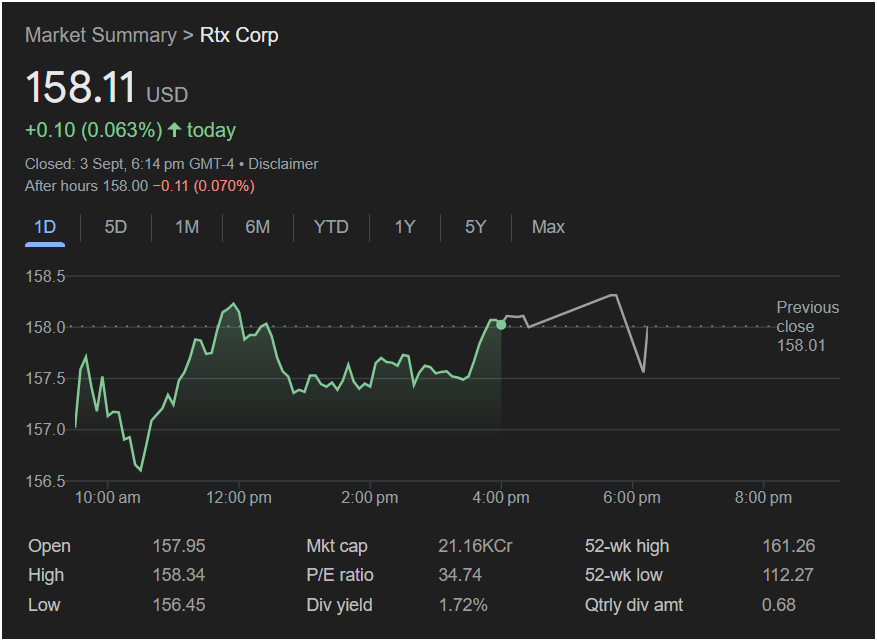

September 4, 2025 – RTX Corporation (NYSE: RTX) demonstrated a day of steady performance and modest gains on September 3rd, closing at

0.10 (0.063%) from its previous close. This positive movement underscores the company’s robust market position and ongoing investor interest.

Throughout the trading day, RTX Corp experienced minor fluctuations but managed to maintain an upward trajectory for most of the afternoon. The stock opened at $157.95, reached an intraday high of $158.34, and saw its low at $156.45. Despite a slight dip of $0.11 (0.070%) in after-hours trading, settling at $158.00, the overall sentiment remains positive, reflecting a resilient market presence.

The company’s market capitalization stands strong at $21.16 trillion, indicating a significant valuation in the current economic landscape. With a P/E ratio of 34.74, RTX Corp suggests strong earnings potential relative to its share price, often attractive to growth-oriented investors.

Shareholders can also appreciate the company’s commitment to returning value, highlighted by a dividend yield of 1.72% and a quarterly dividend amount of $0.68. These figures reinforce RTX Corp’s stability and appeal as a long-term investment.

Looking at the broader context, RTX Corp’s 52-week high stands at $161.26, while its 52-week low was $112.27. The current trading price of $158.11 positions the stock comfortably near its annual high, showcasing consistent performance over the past year and indicating sustained growth momentum.

As the market looks ahead, RTX Corp’s consistent performance, healthy financials, and shareholder returns position it as a noteworthy entity in its sector, suggesting continued stability and potential for future growth.