The Auto Parts Retail Landscape: A Deep Dive into Advance Auto Parts Inc

Understanding a Key Player in the Automotive Aftermarket

The automotive aftermarket industry is a robust and essential sector, serving millions of vehicle owners globally. It encompasses everything from replacement parts and accessories to service and maintenance. Within this intricate ecosystem, retailers play a pivotal role, connecting manufacturers with end-users and professional installers. Advance Auto Parts Inc. stands as one of the significant contenders in this space, operating a vast network of stores and a growing online presence. Examining a company like Advance Auto Parts involves looking beyond just its daily stock fluctuations and delving into the fundamental drivers of its business, the competitive pressures it faces, and its strategic responses to an evolving market.

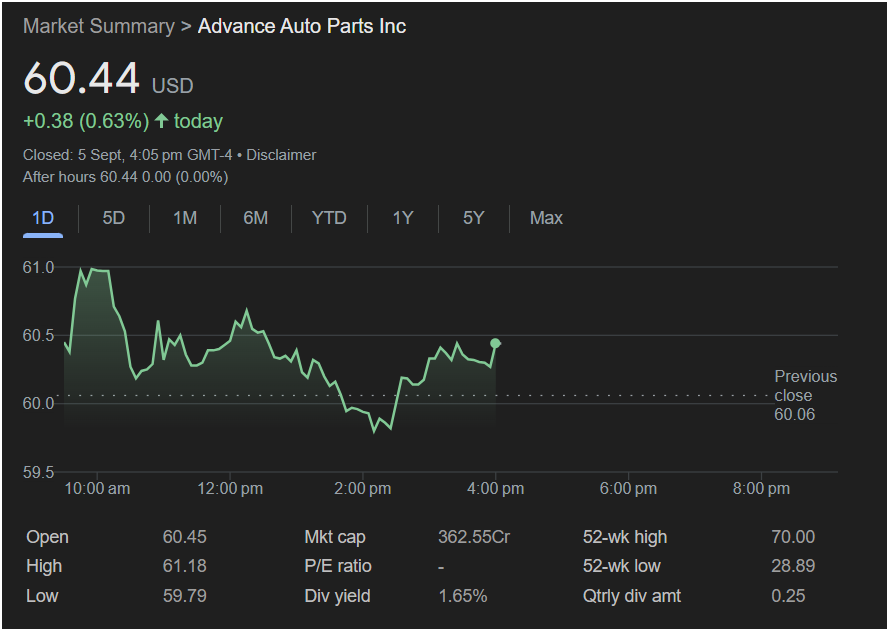

The information you’ve shared—a daily stock summary—offers a singular data point in a much larger narrative. While the immediate gain of 0.63% might appear modest, it is the culmination of countless internal and external factors influencing investor sentiment and market valuation. To truly understand Advance Auto Parts, one must consider its historical performance, its operational strategies, and the broader economic and technological trends shaping the automotive industry.

The Macroeconomic Environment and Automotive Trends

The performance of auto parts retailers is inextricably linked to broader macroeconomic conditions. Factors such as consumer spending, interest rates, fuel prices, and overall economic stability directly impact vehicle ownership, maintenance cycles, and the propensity of consumers to undertake DIY (Do-It-Yourself) repairs versus DIFM (Do-It-For-Me) professional services. During economic downturns, consumers might defer new vehicle purchases, leading to an aging car parc (the total number of vehicles on the road), which often translates to increased demand for replacement parts. Conversely, a booming economy could see more new car sales, potentially reducing immediate aftermarket demand for older vehicles, though new vehicles still require maintenance and eventually parts.

Beyond economic cycles, specific automotive trends are critical. The shift towards electric vehicles (EVs), while still a smaller segment of the overall vehicle fleet, presents both challenges and opportunities. EVs have fewer moving parts, particularly in their powertrains, which could reduce demand for traditional internal combustion engine (ICE) components. However, they still require tires, brakes, suspension components, and various other parts, as well as specialized tools and training for service. Advance Auto Parts, like its competitors, must strategically adapt to this evolving landscape, investing in inventory, training, and technology to cater to both the existing ICE fleet and the burgeoning EV market.

Furthermore, advancements in vehicle technology, such as sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and complex sensor networks, require new types of diagnostic tools and replacement parts. The increasing complexity of modern vehicles also drives a greater reliance on professional mechanics, potentially bolstering the DIFM segment of the market where Advance Auto Parts has a significant presence through its commercial sales.

Advance Auto Parts’ Business Model and Market Positioning

Advance Auto Parts operates a dual business model, serving both DIY customers and professional installers (DIFM). This dual approach allows the company to capture different segments of the aftermarket.

DIY Segment: For the DIY customer, convenience, price, and accessible product information are paramount. Advance Auto Parts aims to provide a broad assortment of parts, tools, and accessories, often leveraging its store footprint for quick pick-up and its knowledgeable staff for guidance. The rise of e-commerce has significantly impacted this segment, with online retailers offering vast selections and competitive pricing. Advance Auto Parts has responded by enhancing its online platform, offering in-store pickup, and integrating its digital and physical channels to create a seamless customer experience.

DIFM Segment (Commercial Sales): The commercial segment is characterized by relationships with independent repair shops, car dealerships, and national service chains. For these professional customers, speed of delivery, availability of specialized parts, competitive pricing, and robust customer service are critical. Advance Auto Parts invests in dedicated commercial sales teams, robust distribution networks, and sophisticated inventory management systems to meet the demanding needs of this segment. This often involves daily deliveries to garages and the ability to source less common or specialized parts quickly. The competition in the commercial segment is fierce, with other large retailers and specialized distributors vying for market share.

The company’s market positioning also involves its brand portfolio, which includes owned brands and national brands. Offering a mix of private label and well-known manufacturer brands allows Advance Auto Parts to cater to various price points and quality expectations, while also providing opportunities for higher margin sales through its proprietary offerings.

Financial Health and Performance Indicators

To gain a deeper understanding of Advance Auto Parts, one would analyze its financial statements, including its income statement, balance sheet, and cash flow statement. Key metrics for evaluation would include:

-

Revenue Growth: Is the company expanding its top line? What are the drivers of this growth (e.g., new store openings, comparable store sales, e-commerce growth, commercial vs. DIY)?

-

Gross Margin: This indicates the profitability of its sales after accounting for the cost of goods sold. Fluctuations here can reflect changes in pricing strategies, product mix, or supplier costs.

-

Operating Expenses: How efficiently is the company managing its overhead, including store operations, marketing, and administrative costs?

-

Net Income and Earnings Per Share (EPS): These are crucial indicators of overall profitability for shareholders.

-

Balance Sheet Health: Examining assets (inventory, property, plant, and equipment) and liabilities (debt) provides insights into the company’s financial stability and capital structure. High inventory levels can be a double-edged sword: good for availability but costly to carry.

-

Cash Flow: Analyzing cash flow from operations, investing, and financing activities reveals how the company generates and uses cash, which is vital for long-term sustainability and growth.

-

Comparable Store Sales (Comps): This metric measures the sales performance of stores that have been open for at least a year, providing an indication of organic growth.

-

Inventory Turnover: How quickly is the company selling its inventory? A higher turnover generally indicates efficient inventory management.

-

Return on Equity (ROE) and Return on Invested Capital (ROIC): These profitability ratios show how effectively the company is generating profits from shareholder equity and total invested capital.

The stock price movement you provided (60.44 USD, +0.63%) is a reflection of how investors are valuing the company based on these underlying financial realities, as well as future expectations. It’s important to note that a single day’s movement is just a blip; long-term trends and the overall trajectory of these financial indicators provide a more meaningful picture.

Competitive Landscape and Strategic Challenges

The automotive aftermarket is highly competitive, featuring other major national chains like AutoZone and O’Reilly Auto Parts, as well as smaller regional players, independent shops, and a growing number of online retailers, including Amazon. Each competitor has its strengths and weaknesses, and their strategic moves directly impact Advance Auto Parts.

Key competitive factors include:

-

Store Density and Location: Proximity to customers and repair shops is crucial for quick access to parts.

-

Inventory Assortment and Availability: Having the right part at the right time is paramount, especially for commercial customers.

-

Pricing Strategies: Balancing competitive pricing with maintaining healthy margins.

-

Customer Service and Expertise: Knowledgeable staff can be a differentiator, particularly for DIY customers seeking advice.

-

E-commerce Capabilities: A strong online presence, efficient delivery, and convenient in-store pickup options are increasingly vital.

-

Supply Chain Efficiency: A robust and resilient supply chain is essential to ensure product availability and manage costs.

Advance Auto Parts faces ongoing challenges related to supply chain disruptions, inflationary pressures affecting raw material and transportation costs, and labor shortages in both its own operations and the broader automotive service industry. Adapting to these challenges requires continuous investment in technology, logistics, and human capital.

One significant strategic challenge for traditional auto parts retailers is the evolving vehicle repair ecosystem. As vehicles become more complex and software-driven, the lines between automotive and technology industries blur. This necessitates new diagnostic tools, highly specialized training for technicians, and potentially new types of partnerships with technology providers.

Strategic Initiatives and Future Outlook

Companies like Advance Auto Parts are constantly undertaking strategic initiatives to maintain and grow their market share. These might include:

-

Store Optimization: Opening new stores in underserved markets, closing underperforming ones, and modernizing existing locations to enhance the customer experience.

-

Supply Chain Enhancements: Investing in distribution centers, improving last-mile delivery, and leveraging data analytics to optimize inventory placement.

-

Digital Transformation: Further developing e-commerce platforms, mobile apps, and in-store digital tools to streamline shopping and order fulfillment.

-

Commercial Business Growth: Strengthening relationships with professional customers, offering enhanced services, and expanding specialized product lines.

-

Talent Development: Investing in training for both store associates and commercial sales teams to ensure they have the expertise to serve a diverse customer base and handle increasingly complex automotive parts and systems.

-

Sustainability Efforts: Implementing environmentally friendly practices in operations, from energy efficiency in stores to responsible waste management.

The future outlook for Advance Auto Parts, and the aftermarket industry as a whole, will largely depend on its ability to navigate these trends and challenges. The aging car parc in many developed markets provides a consistent demand base, but the transition to EVs, the increasing complexity of vehicles, and the ongoing digital disruption will require agile and forward-thinking strategies. The company’s capacity to innovate, adapt its product offerings, and enhance its customer experience—both in-store and online—will be critical determinants of its long-term success.

The provided image offers a fleeting glimpse into the daily performance of Advance Auto Parts Inc. While it highlights a positive daily gain, a comprehensive understanding of the company requires a much broader analysis. This involves dissecting its business model, evaluating its financial health, understanding the macroeconomic and industry-specific forces at play, and scrutinizing its strategic responses to a highly competitive and rapidly evolving market. The automotive aftermarket is a dynamic sector, and the journey of companies like Advance Auto Parts is a continuous adaptation to technological shifts, consumer preferences, and economic realities, ensuring their ongoing relevance in an industry that remains fundamental to modern transportation.