JPMorgan Chase & Co. Edges Up, Closes Above $301 on August 29th

Financial Giant Shows Steady Performance with Minor Gains Ahead of Weekend

August 31, 2025 – JPMorgan Chase & Co. (JPM), one of the world’s leading financial services firms, concluded its trading day on Friday, August 29th, with a modest increase in its stock price. Shares closed at 301.42 USD, marking a gain of 0.35 USD, or 0.12%, from its previous close of 301.07 USD. This performance indicates a stable day for the banking titan as the markets headed into the weekend.

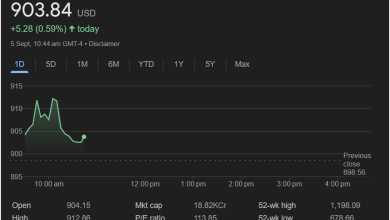

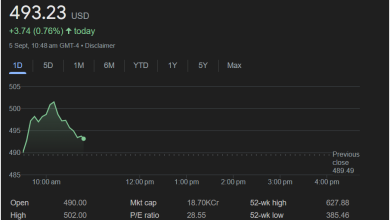

The trading session for JPMorgan Chase & Co. commenced at 302.04 USD. The stock experienced an early dip, reaching an intraday low of 299.73 USD, before recovering significantly to hit a high of 302.95 USD. This upward movement was particularly noticeable around midday, with the stock maintaining a generally positive trend through the afternoon. In after-hours trading, the positive momentum continued slightly, with shares gaining an additional 0.34 USD (0.11%) to reach 301.76 USD by 7:58 PM GMT-4.

JPMorgan Chase & Co.’s market capitalization stands robustly at 82.39 trillion (Kr, indicating a very large numerical value), underscoring its immense scale and influence in the global financial sector. The company’s P/E ratio is currently at 15.47, a key metric for investors assessing a company’s valuation relative to its earnings. For income-seeking investors, the firm offers an attractive dividend yield of 1.86%, with a quarterly dividend amount of 1.40 USD.

From a broader perspective, JPMorgan Chase & Co.’s 52-week high is 302.95 USD, remarkably hitting this peak on August 29th, while its 52-week low is 200.61 USD. The day’s closing price of 301.42 USD positions the stock very close to its annual high, reflecting strong investor confidence and a healthy trajectory over the past year.

As the financial markets gear up for a new week, JPMorgan Chase & Co.’s steady performance on August 29th highlights its enduring stability and leadership in the banking industry, continuing to be a cornerstone for many investment portfolios.