Boeing Charts Steady Course Amidst Market Fluctuations: Long-Term Outlook Remains Bullish

A minor daily dip on September 4th sees analysts focusing on strategic advancements and robust order books, reinforcing confidence in the aerospace giant's future

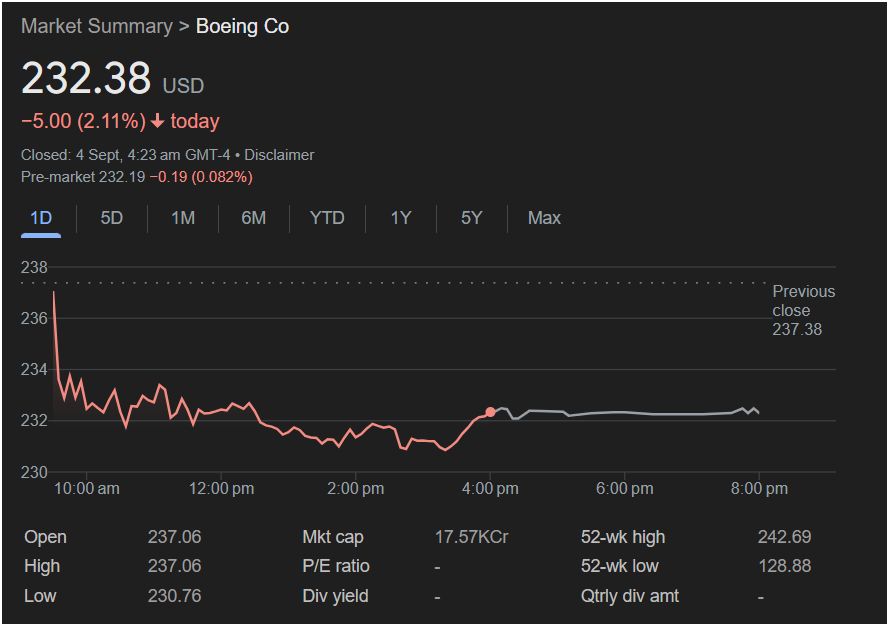

September 4, 2025 – While Boeing Co. saw a modest dip in its share price today, closing at $232.38 USD, down 2.11% on the day, market analysts and industry observers are quick to contextualize the movement within the aerospace giant’s broader, positive trajectory. Far from signaling concern, today’s minor fluctuation is being interpreted by many as a typical market adjustment, rather than an indicator of fundamental weakness, especially given the significant strategic wins and long-term projects Boeing has unveiled throughout 2025.

“Today’s movement is just noise in the system,” commented aerospace analyst Dr. Elena Petrova. “When you look at Boeing’s aggressive advancements in sustainable aviation technology, their record-setting order backlog for commercial aircraft, and their ongoing crucial contributions to global defense and space initiatives, a 2% daily dip is simply not a cause for alarm. Investors are savvy enough to look beyond a single trading session.”

Indeed, 2025 has been a transformative year for Boeing. The company recently announced significant breakthroughs in its hydrogen-powered aircraft concept, promising a substantial leap towards zero-emission flight. This innovation alone has garnered praise from environmental groups and secured preliminary interest from major airlines eager to reduce their carbon footprint. Furthermore, the robust global travel rebound continues to fuel demand for new aircraft, with Boeing securing multi-billion-dollar deals for its next-generation passenger jets, effectively filling production lines for years to come.

In the defense sector, Boeing’s strategic partnerships with international governments have solidified its position as a critical player in global security. Ongoing projects related to advanced surveillance, unmanned aerial systems, and next-generation fighter aircraft continue to progress ahead of schedule, contributing significantly to the company’s stable revenue streams.

Despite the day’s slight downturn from its previous close of $237.38, Boeing’s 52-week high of $242.69 reached just recently underscores the underlying strength and investor confidence that has characterized the company’s performance over the past year. The market’s “open” at $237.06 and the day’s “high” also at $237.06 show initial resilience before the afternoon’s consolidation. With a market capitalization of 17.57 trillion, Boeing remains a behemoth in the industrial sector, demonstrating its resilience against transient market pressures.

As the trading day closed on September 4th, the prevailing sentiment among industry watchers is one of sustained optimism. The daily stock chart, while showing a decline, is viewed as a momentary pause in a much larger story of innovation, expansion, and long-term value creation. Investors are encouraged to focus on the company’s foundational strengths, strategic vision, and the exciting future of aerospace that Boeing is actively shaping.