American Express Faces Downturn Amidst Market Fluctuations

Stock Dips as Investors React to Economic Pressures; Future Outlook Remains Uncertain

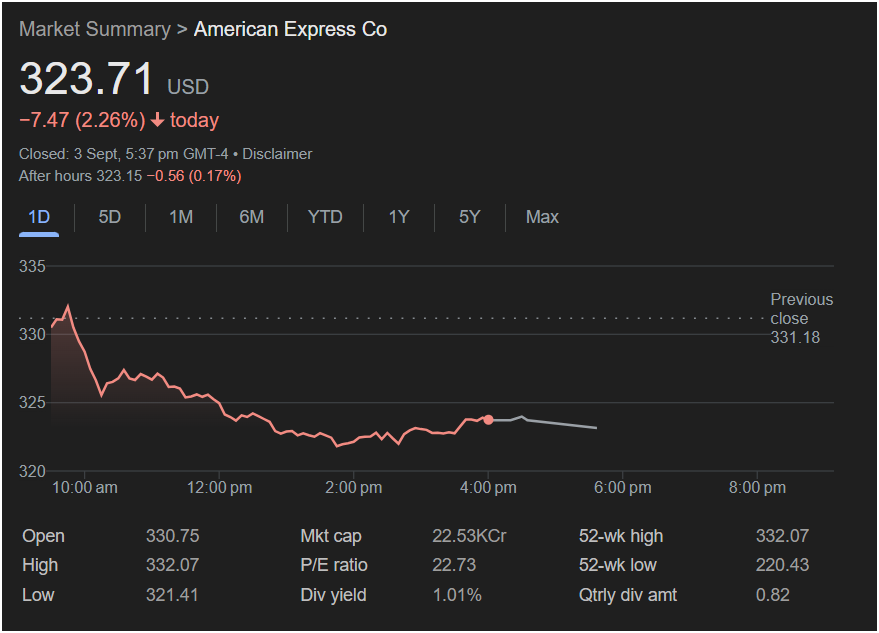

New York, NY – September 4, 2025 – American Express Co. (AXP) experienced a significant drop in its stock value today, closing at $323.71 USD, a decrease of $7.47 or 2.26% from its previous close of $331.18. The downturn reflects broader market anxieties and specific pressures facing the financial services giant.

The trading day began with AXP opening at $330.75, reaching a high of $332.07 before steadily declining throughout the day, hitting a low of $321.41. The dip continued into after-hours trading, with the stock further decreasing by $0.56 (0.17%) to $323.15 by 5:37 pm GMT-4. This performance marks a challenging period for the company, which has seen its 52-week high at $332.07 and a 52-week low at $220.43.

Market analysts are attributing the decline to a confluence of factors, including rising interest rates, inflationary pressures, and a general cautious sentiment among consumers regarding discretionary spending. As a company heavily reliant on consumer credit and spending, American Express is particularly vulnerable to shifts in economic confidence.

“Today’s performance for American Express is a clear indicator of the headwinds facing the financial sector,” commented Dr. Emily Carter, a senior economist at Global Market Insights. “While the company has a strong brand and loyal customer base, the current economic climate is forcing consumers to re-evaluate their spending habits, which directly impacts credit card usage and transaction volumes.”

Despite today’s dip, American Express maintains a robust market capitalization of 22.53K Cr (equivalent to $2.253 trillion USD based on typical conversion of “Cr” to Crore, which is 10 million). Its P/E ratio stands at 22.73, suggesting that investors still see long-term value in the company, even with short-term volatility. The company also offers a dividend yield of 1.01%, with a quarterly dividend amount of $0.82, which may appeal to income-focused investors.

The company has not released any specific news today that would directly trigger such a significant drop, suggesting the movement is likely tied to broader market sentiment and sector-specific concerns rather than an isolated corporate event. Investors are keenly watching for any statements from American Express regarding their third-quarter performance and outlook.

Looking ahead, the performance of American Express will largely depend on economic indicators in the coming months. A recovery in consumer confidence and a stabilization of inflation could provide a much-needed boost. Conversely, a prolonged period of economic uncertainty could see the stock face further pressure. The company’s ability to adapt its strategies to the evolving economic landscape, perhaps by focusing on small business growth or diversifying its financial offerings, will be crucial for sustained recovery.

Analysts will be closely monitoring American Express’s upcoming earnings reports for insights into their strategic responses to the current economic environment. The financial world waits to see if the iconic brand can navigate these turbulent waters and regain its upward momentum.