AbbVie Holds Steady Amidst Market Fluctuations: A Look at Yesterday’s Performance

Pharmaceutical Giant Shows Resilience with After-Hours Gain as Investors Eye Long-Term Stability

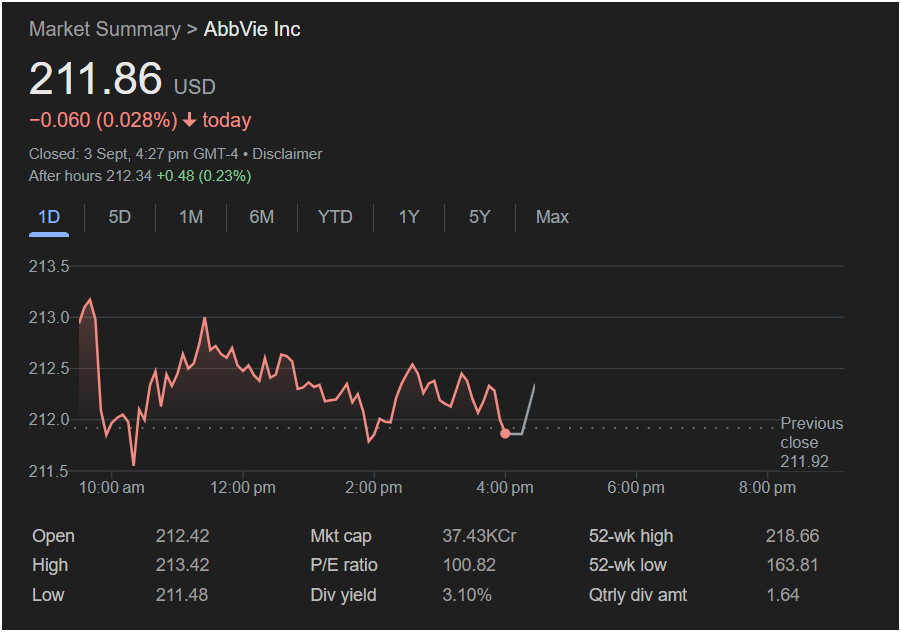

[City, State] – September 4, 2025 – Pharmaceutical powerhouse AbbVie Inc. (ABBV) demonstrated a characteristically resilient performance on Wednesday, September 3, 2025, closing the day at $211.86 USD. While the stock saw a marginal dip of 0.060 USD, or 0.028%, by the market’s close at 4:27 PM GMT-4, it quickly regained some ground in after-hours trading, climbing to $212.34, a positive shift of $0.48 or 0.23%. This modest recovery after regular trading hours signals continued investor confidence in the biopharmaceutical leader.

AbbVie, a company with a robust market capitalization exceeding $374 billion (37.43K Cr), has long been a staple in investor portfolios, known for its strong pipeline of innovative medicines and consistent dividend payouts. The slight intraday fluctuation seen yesterday is often par for the course in dynamic market environments, especially for a stock trading at a high valuation.

Throughout the trading day, AbbVie’s stock experienced a range of movements. It opened at $212.42 and reached an intraday high of $213.42 before finding its low for the day at $211.48. These movements illustrate the active trading and price discovery characteristic of a widely held equity. The previous closing price was $211.92, setting the stage for yesterday’s relatively flat performance.

Key Financial Indicators Highlight Stability

Despite the day’s marginal decline, AbbVie’s fundamental metrics continue to paint a picture of a well-established and financially sound company. Its 52-week high stands at an impressive $218.66, with a 52-week low of $163.81, indicating significant growth and value appreciation over the past year.

The company’s Price-to-Earnings (P/E) ratio, currently at 100.82, reflects the market’s high expectations for future earnings growth and its premium valuation within the pharmaceutical sector. Investors are often willing to pay a higher multiple for companies with strong intellectual property, consistent revenue streams from blockbuster drugs, and promising research and development initiatives.

Furthermore, AbbVie remains an attractive option for income-focused investors, boasting a dividend yield of 3.10%. The quarterly dividend amount is a substantial $1.64 per share, underscoring the company’s commitment to returning value to its shareholders. This consistent dividend, coupled with a history of increases, makes AbbVie a compelling choice for those seeking both growth and regular income.

Looking Ahead: Innovation and Market Position

As AbbVie navigates the evolving landscape of healthcare, its strategic focus on immunology, oncology, neuroscience, and aesthetics continues to solidify its market position. The company’s ongoing efforts in developing next-generation therapies and expanding the reach of its existing portfolio are critical drivers for sustained long-term growth.

The after-hours uptick following a relatively flat trading day can be interpreted as a positive signal, suggesting that investors are looking beyond minor daily movements and focusing on the underlying strength and future potential of the company. With a strong market presence, a healthy dividend, and a commitment to innovation, AbbVie appears well-positioned to continue delivering value to its shareholders in the years to come.