Shopify Inc. Market Analysis: A Deep Dive into Performance and Potential

Exploring the Dynamics of a Leading E-commerce Platform

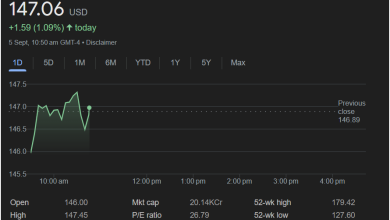

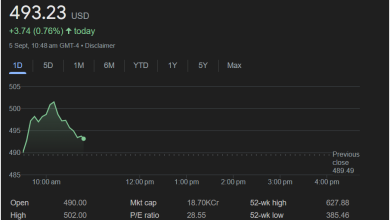

Shopify Inc. stands as a prominent figure in the e-commerce landscape, providing a robust platform that empowers businesses of all sizes to establish and manage their online stores. The provided market summary screenshot, dated September 5th at 10:47 am GMT-4, offers a snapshot of its intraday performance, showing the stock trading at $145.41 USD, up $0.26 (0.18%) for the day. This seemingly small movement, however, is part of a much larger narrative that involves intricate market forces, investor sentiment, and the fundamental strength of the company’s business model. To truly understand Shopify’s position and potential, we must dissect the various components presented and delve into broader market contexts, examining historical trends, competitive pressures, and future growth drivers.

The intraday chart, covering a single day, illustrates a fluctuating trajectory. Starting around $146.50, the stock initially experienced a peak near $147.97 before dipping and then stabilizing around the $145 mark towards the end of the depicted period. Such daily fluctuations are common in the stock market, often driven by a multitude of factors including news, analyst reports, broader market trends, and even algorithmic trading. A slight upward movement, as seen here, could indicate a positive sentiment for the day, or simply a recovery from an earlier dip. However, it’s crucial not to draw definitive conclusions from such a short timeframe. The “1D” view is merely a glimpse; a more comprehensive understanding requires examining the “5D,” “1M,” “6M,” “YTD,” “1Y,” “5Y,” and “Max” charts, each revealing different phases of Shopify’s journey and offering insights into its long-term volatility and growth.

Looking at the summary data provided, several key metrics emerge. The “Open” price of $146.59 and “Previous close” of $145.15 suggest a slightly positive opening compared to the prior day’s closing. The “High” of $147.97 and “Low” of $145.28 define the trading range for the day, highlighting the stock’s intra-day volatility. These numbers, when viewed in isolation, are data points. Their significance comes from their comparison to historical data, industry benchmarks, and analyst expectations. For instance, a high trading volume alongside a narrow range might indicate consolidation, while a wide range with high volume could signal strong conviction in a particular direction.

Beyond the immediate price action, the “Mkt cap” (Market capitalization) of 19.00KCr (likely referring to 19.00 Billion Canadian Dollars, given Shopify’s Canadian origins, or an abbreviation for a different currency unit if the platform is not specifically showing CAD) is a critical indicator of the company’s overall value as perceived by the market. A high market cap like Shopify’s signifies its status as a large-cap company, often implying stability and a significant influence within its sector. However, market cap alone does not guarantee future success; it merely reflects current valuation based on outstanding shares and stock price. A detailed analysis would involve comparing this market cap to its peers in the e-commerce enablement space, such as Adobe (with its Magento platform) or even broader tech giants with e-commerce offerings.

The “P/E ratio” (Price-to-Earnings ratio) of 81.11 is particularly striking. A high P/E ratio, especially one exceeding traditional market averages, often suggests that investors have high growth expectations for the company. It implies that shareholders are willing to pay a premium for each dollar of earnings, anticipating substantial future earnings growth. For a technology company like Shopify, which operates in a rapidly expanding sector and has historically demonstrated strong revenue growth, a high P/E ratio is not uncommon. However, it also signifies that the stock can be sensitive to any signs of slowing growth or missed earnings targets. Investors often scrutinize companies with high P/E ratios more intensely, demanding continued innovation and market expansion to justify the elevated valuation. A deeper dive into this metric would necessitate comparing it to Shopify’s historical P/E ratios, industry averages, and the growth rate of its earnings per share (EPS).

Another important set of metrics relates to the stock’s 52-week performance: “52-wk high” of $156.85 and “52-wk low” of $69.84. This wide range indicates significant volatility over the past year. The current price of $145.41 is considerably closer to its 52-week high than its low, suggesting a strong recovery or sustained upward trend over the past year. This range often reflects the market’s response to various company-specific news (e.g., earnings reports, new product launches, strategic partnerships) and broader economic or industry-specific trends (e.g., e-commerce growth rates, interest rate changes, consumer spending habits). Analyzing the events that occurred around the 52-week low and high points can provide valuable context regarding investor sentiment shifts and market catalysts.

The “Div yield” (Dividend yield) and “Qtrly div amt” (Quarterly dividend amount) both show a dash, indicating that Shopify does not currently pay a dividend. This is a common characteristic of growth-oriented technology companies. Instead of distributing profits to shareholders as dividends, these companies typically reinvest their earnings back into the business to fund research and development, expand operations, acquire new technologies, or enter new markets. This strategy aims to accelerate growth and ultimately increase the stock’s capital appreciation, which is often more appealing to growth investors than regular dividend payments. For income-focused investors, the absence of a dividend might be a deterrent, but for those seeking capital gains, it aligns with a high-growth investment thesis.

The success of Shopify is intrinsically linked to the broader trends within the e-commerce sector. The COVID-19 pandemic, for instance, dramatically accelerated the shift to online shopping, providing a significant tailwind for platforms like Shopify. While some of these pandemic-driven surges have normalized, the fundamental shift in consumer behavior towards online purchasing is expected to continue. Shopify benefits from this by providing the essential tools for businesses—from small artisanal shops to large enterprises—to establish an online presence. Its ecosystem includes not just the core e-commerce platform, but also payment processing (Shopify Payments), shipping solutions, point-of-sale systems, app integrations, and marketing tools, creating a comprehensive suite that reduces the barrier to entry for online commerce.

Competition in the e-commerce platform space is fierce. While Shopify is a leader, it faces challenges from established players like Adobe (Magento), BigCommerce, and Wix, as well as emerging platforms and even direct-to-consumer strategies enabled by social media giants. Each competitor offers different strengths, pricing models, and target demographics. Shopify’s continued success depends on its ability to innovate, expand its service offerings, attract and retain merchants, and adapt to evolving technological and consumer demands. For example, the increasing importance of social commerce, headless commerce, and international expansion presents both opportunities and threats that Shopify must navigate effectively.

Looking ahead, several factors could influence Shopify’s future performance. The global economic outlook, including inflation rates, consumer spending power, and interest rate policies, will undoubtedly play a role. A robust economy generally supports consumer spending, which in turn benefits e-commerce platforms. Conversely, economic downturns could lead to reduced consumer spending and business activity, potentially impacting Shopify’s merchant base and transaction volumes. Technological advancements, such as artificial intelligence (AI) in personalization and automation, blockchain for supply chain transparency, and augmented reality (AR) for enhanced shopping experiences, offer new avenues for Shopify to innovate and add value for its merchants. The company’s investments in these areas will be crucial for maintaining its competitive edge.

Furthermore, Shopify’s strategic acquisitions and partnerships are vital for its long-term growth. Acquisitions can expand its technology stack, market reach, or customer base, while partnerships can open up new distribution channels or integrate complementary services. The company’s ability to seamlessly integrate these new components into its existing ecosystem, without disrupting the user experience, is critical for realizing their full potential. The expansion into new geographic markets, particularly developing economies with burgeoning internet penetration and a growing middle class, also represents a significant growth opportunity for Shopify. Tailoring its platform and services to meet the specific needs and regulatory environments of these diverse markets will be a key challenge and opportunity.

Another important aspect to consider is the regulatory environment. As e-commerce continues to grow, governments worldwide are increasingly focusing on issues such as data privacy, consumer protection, anti-trust concerns, and taxation of digital services. Changes in these regulations could impact Shopify’s operational costs, business practices, and even its ability to operate in certain jurisdictions. The company’s proactive engagement with policymakers and its ability to adapt to evolving regulatory landscapes will be crucial for mitigating potential risks and ensuring continued growth.

Ultimately, the market’s perception of Shopify, as reflected in its stock price and valuation metrics, is a dynamic interplay of its financial performance, strategic decisions, competitive positioning, and the broader economic and technological environment. While the snapshot provided offers a singular moment in time, it serves as a starting point for a much broader and more complex analysis. Understanding Shopify’s journey requires an ongoing examination of its financial reports, investor calls, news releases, and industry trends, synthesizing these various data points into a coherent picture of its past achievements, current challenges, and future potential. The high P/E ratio, in particular, places a significant burden of expectation on the company to continue delivering robust growth and innovation, making its trajectory a compelling case study in the ever-evolving world of technology and e-commerce.