Analyzing Bank of America Corp. (BAC): A Deep Dive into its Market Performance and Financial Metrics

Exploring Daily Fluctuations, Key Ratios, and Strategic Positioning in the Financial Landscape

Bank of America Corporation (BAC) stands as one of the prominent financial institutions globally, playing a pivotal role in the U.S. and international banking sectors. Its extensive range of financial services, including consumer banking, global wealth and investment management, and global banking and markets, caters to a diverse client base. Understanding BAC’s market performance involves a multi-faceted approach, scrutinizing its daily stock movements, long-term trends, and the underlying financial metrics that influence its valuation and investor sentiment. This analysis delves into the provided market summary for Bank of America Corp., aiming to dissect the nuances of its performance on a specific trading day while also touching upon broader implications for its financial health and market standing.

Daily Market Summary: A Snapshot of September 5th Performance

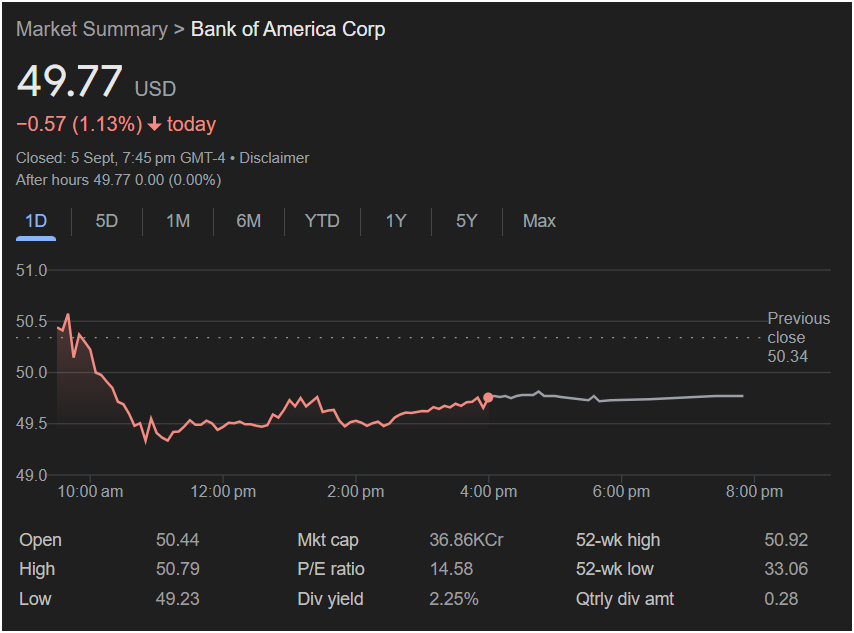

On September 5th, Bank of America Corp. (BAC) closed at 49.77 USD, marking a decrease of 0.57 USD (1.13%) from its previous close. This daily movement, while seemingly minor, reflects the dynamic interplay of market forces, investor reactions to news, and general economic sentiment within a single trading session. The stock’s performance on this particular day illustrates the constant ebb and flow inherent in equity markets, where prices adjust in real-time based on a myriad of factors.

Intraday Trading Analysis

The provided graph offers a visual representation of BAC’s intraday trading activity, spanning from approximately 9:30 AM to 8:00 PM GMT-4. The “Previous close” at 50.34 sets the starting point for the day’s comparison.

-

Opening and Initial Movement: The stock opened at 50.44, slightly above its previous close, indicating a positive initial sentiment or pre-market trading activity. It quickly reached an intraday high of 50.79 shortly after market opening, suggesting an initial surge of buying interest. This early peak could be attributed to various factors, such as positive analyst reports, general market optimism at the open, or the release of favorable economic data.

-

Mid-Morning Decline: Following its early peak, BAC experienced a noticeable decline, dropping below its opening price and continuing to fall through the mid-morning. This downward trend is a critical point of interest. What might have caused this reversal? Potential drivers include profit-taking by early buyers, broader market sell-offs affecting the financial sector, negative news specific to Bank of America, or even just a natural correction after an initial overbought condition. The lowest point reached during this period was the intraday low of 49.23, observed around 11:30 AM – 12:00 PM.

-

Afternoon Stabilization and Recovery: After hitting its low, the stock showed signs of stabilization and a gradual, albeit modest, recovery through the afternoon. It traded mostly in a narrower range between 49.50 and 49.80, attempting to regain some lost ground. This pattern suggests that selling pressure subsided, and some buying interest re-emerged, preventing further significant drops. The closing price of 49.77 indicates that while it recovered from its absolute low, it was unable to return to its opening levels, ending the day in negative territory.

-

After-Hours Trading: The market summary also notes “After hours 49.77 (0.00%).” This indicates that after the official market close at 7:45 PM GMT-4, the stock’s price remained unchanged at its closing value during the initial after-hours trading period. After-hours trading can be influenced by earnings announcements, significant news releases, or large institutional trades, and its stability here suggests no major immediate catalysts post-close.

Key Financial Metrics and Their Significance

Beyond the daily price movements, the market summary provides crucial financial metrics that offer deeper insights into Bank of America’s valuation and underlying financial health.

-

Market Cap (36.86KCr): This figure represents the total market value of Bank of America’s outstanding shares. A market capitalization of 36.86 “KCr” (likely interpreted as ‘crore’ in some regional contexts, implying a very large number, or more commonly as “Trillion” if “KCr” is a typo for “Tr”) underscores BAC’s status as a mega-cap company. The market cap is a primary indicator of a company’s size and can influence its liquidity, investor base, and inclusion in various market indices. A large market cap often suggests stability and broad institutional ownership.

-

P/E Ratio (14.58): The Price-to-Earnings (P/E) ratio is a widely used valuation metric that compares a company’s current share price to its earnings per share. A P/E ratio of 14.58 suggests that investors are willing to pay 14.58 times the company’s annual earnings for each share. This ratio can be compared against the P/E ratios of competitors within the banking sector, the broader market, and BAC’s historical P/E to assess whether the stock is undervalued, overvalued, or fairly priced. A moderate P/E in the financial sector can indicate a stable, mature company with consistent earnings, though context is crucial for a complete assessment.

-

Div Yield (2.25%): The Dividend Yield represents the annual dividend payment per share as a percentage of the current share price. A 2.25% dividend yield indicates that investors receive a return of 2.25% on their investment through dividends alone, separate from any capital appreciation. For income-focused investors, a consistent and healthy dividend yield is an attractive feature. Banks, in particular, are often known for their dividend payouts, reflecting their stable revenue streams and capital adequacy.

-

Qtrly div amt (0.28): This refers to the quarterly dividend amount per share, which is 0.28 USD. This figure, when multiplied by four, gives the annual dividend per share, which then contributes to the dividend yield calculation. A stable or growing quarterly dividend signals management’s confidence in future earnings and commitment to returning value to shareholders.

52-Week High and Low: Contextualizing Performance

The 52-week high and low figures provide a broader perspective on BAC’s stock performance over the past year.

-

52-wk high (50.92): This indicates the highest price Bank of America’s stock reached in the last 52 weeks. The closing price of 49.77 on September 5th is relatively close to its 52-week high, suggesting that the stock has performed well over the past year and is trading near its peak valuation within that period.

-

52-wk low (33.06): This represents the lowest price the stock traded at in the last 52 weeks. The significant difference between the 52-week high and low (a range of nearly 18 USD) highlights the volatility and potential for both gains and losses over a yearly cycle. Comparing the current price to these extremes helps investors gauge the stock’s current position within its annual trading range. Trading near the 52-week high can be interpreted as a sign of strong momentum but also potentially limited immediate upside, depending on future catalysts.

Factors Influencing Bank Stock Performance

The performance of a financial institution like Bank of America is intricately linked to a complex web of economic and industry-specific factors. Understanding these influences is crucial for a comprehensive analysis.

-

Interest Rates: As a bank, BAC’s profitability is highly sensitive to interest rate changes. Rising interest rates generally benefit banks by increasing their net interest margin (NIM), the difference between the interest earned on loans and the interest paid on deposits. Conversely, falling rates can compress NIMs. Central bank policies, such as those by the Federal Reserve, play a direct role in shaping the interest rate environment.

-

Economic Growth: A robust economy typically leads to increased loan demand, lower loan defaults, and higher consumer spending, all of which positively impact bank earnings. Conversely, economic slowdowns or recessions can lead to reduced lending activity, higher credit losses, and decreased financial transactions.

-

Regulatory Environment: The banking sector is heavily regulated. Changes in regulations, capital requirements, or compliance costs can significantly impact a bank’s operations and profitability. For example, stricter capital rules might limit a bank’s ability to return capital to shareholders through buybacks or dividends.

-

Credit Quality: The quality of a bank’s loan portfolio is paramount. High levels of non-performing loans or increased provisions for credit losses can severely impact earnings. Economic conditions, industry-specific risks, and individual borrower health all contribute to credit quality.

-

Competition: The financial services industry is intensely competitive, with traditional banks vying with online lenders, fintech companies, and other financial institutions. Competition can put pressure on fees, interest rates, and customer acquisition costs.

-

Technological Advancement: The rapid pace of technological change necessitates significant investment in digital platforms, cybersecurity, and data analytics. Banks that effectively leverage technology can enhance customer experience, improve operational efficiency, and develop new revenue streams. Those that lag behind may face challenges.

-

Geopolitical Events: Global political stability, trade relations, and international conflicts can have far-reaching effects on financial markets and banking operations, particularly for institutions with a significant international presence like Bank of America.

-

Company-Specific News: Earnings reports, management changes, mergers and acquisitions, litigation outcomes, and strategic initiatives can all directly influence BAC’s stock price. Positive news can drive appreciation, while negative news can lead to declines.

Interpreting the Day’s Decline

The 1.13% decline on September 5th, while not catastrophic, warrants consideration. Without additional context, it’s challenging to pinpoint the exact cause. However, potential explanations could include:

-

Broader Market Weakness: If the overall stock market or the financial sector experienced a down day, BAC’s decline might simply reflect a broader trend.

-

Profit-Taking: After possibly strong performance leading up to this day, some investors might have decided to sell shares to lock in profits, leading to downward pressure.

-

Anticipation of Negative News: Investors might have been reacting to rumors or anticipation of upcoming negative economic data, a less favorable analyst rating, or potential policy shifts that could impact banks.

-

Specific Bank of America News: Although not immediately apparent from the summary, there could have been news released during or before the trading day that specifically impacted BAC, such as a downgrade by an analyst, a report on increased loan loss provisions, or a less optimistic outlook from management.

It is crucial to emphasize that a single day’s performance should not be the sole basis for long-term investment decisions. Market volatility is a natural phenomenon, and short-term fluctuations often do not reflect the fundamental health or long-term prospects of a company.

Strategic Positioning and Future Outlook (Open-Ended Discussion)

Bank of America’s long-term trajectory will depend on its ability to navigate the evolving financial landscape. Several areas are critical for its continued success:

-

Digital Transformation: Investing in and enhancing its digital banking capabilities is paramount to retaining and attracting customers, particularly younger demographics. This includes intuitive mobile apps, online self-service options, and personalized digital financial advice. The bank’s ability to leverage AI and machine learning for efficiency and customer insights will also be a differentiator.

-

Responsible Growth: Balancing growth initiatives with prudent risk management is a perpetual challenge for banks. This includes maintaining strong capital ratios, managing credit risk effectively, and adhering to regulatory requirements while still pursuing opportunities for expansion and market share gains.

-

Diversification of Revenue Streams: While traditional lending remains a core business, diversifying revenue through wealth management, investment banking, and other fee-based services can provide greater stability and reduce reliance on interest rate sensitive activities. BAC’s strong presence in wealth management, for instance, offers a significant advantage.

-

Sustainability and ESG Initiatives: Environmental, Social, and Governance (ESG) considerations are increasingly influencing investor decisions. Banks that demonstrate a commitment to sustainability, ethical practices, and social responsibility may attract a broader investor base and enhance their brand reputation. BAC’s efforts in green financing and community development will be watched closely.

-

Talent Acquisition and Retention: In a competitive industry, attracting and retaining top talent in areas like technology, risk management, and client relationship management is vital for innovation and service delivery.

-

Navigating Economic Cycles: The ability to effectively manage through different economic cycles – from periods of robust growth to downturns – is a hallmark of a resilient financial institution. This involves robust stress testing, dynamic capital planning, and agile business strategies.

-

Global Presence and Geopolitical Risks: For a global entity like Bank of America, monitoring and adapting to international economic shifts, trade policies, and geopolitical tensions is essential. International operations can offer diversification but also expose the bank to additional risks.

The market summary for Bank of America Corp. on September 5th provides a concise yet informative snapshot of its daily performance and key financial indicators. The slight decline on this particular day highlights the inherent volatility of stock markets, where prices constantly adjust to new information and investor sentiment. However, a broader view reveals a company with a substantial market capitalization, a respectable P/E ratio, and an attractive dividend yield, suggesting a fundamentally strong institution. The fact that its current price is close to its 52-week high indicates a generally positive sentiment over the past year.

Moving forward, Bank of America’s journey will undoubtedly involve navigating the complexities of interest rate environments, regulatory changes, technological disruption, and evolving customer expectations. Its continued success hinges on its strategic foresight, operational efficiency, and ability to adapt to both micro and macroeconomic shifts. Investors and analysts will continue to scrutinize its earnings reports, management commentary, and strategic initiatives to assess its long-term growth prospects and ability to generate sustainable shareholder value. The ongoing narrative of Bank of America’s market performance is thus a continuous story, with each trading day adding another chapter to its extensive financial history.