American Express Co Stock Analysis – Comprehensive Exploration of Market Performance and Strategic Positioning

American Express as a Global Financial Powerhouse

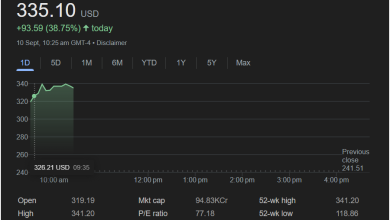

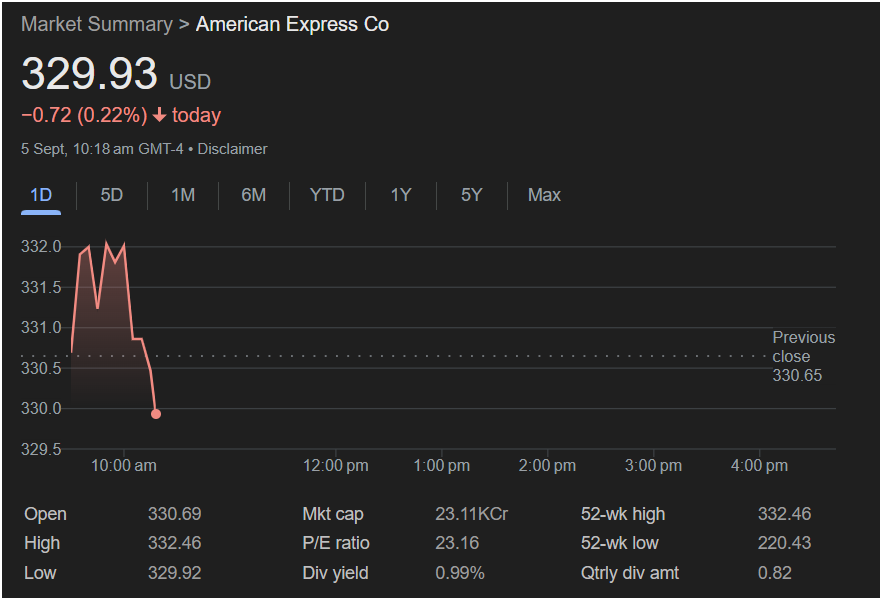

American Express Co (Amex) is one of the world’s leading payment networks, known for its premium card offerings, strong customer base, and integrated business model that combines card issuance, merchant network, and customer rewards programs. As of this trading session, the stock is priced at $329.93 USD, reflecting a 0.22% decline from the previous close. This movement provides an excellent opportunity to examine its short-term price action, long-term fundamentals, and position in the competitive financial services landscape.

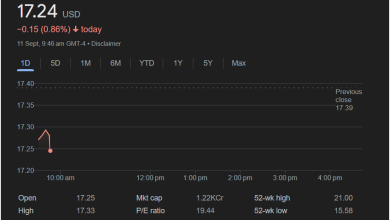

Section 1: Daily Trading Overview

- Opening Price: $330.69

- Day’s High: $332.46

- Day’s Low: $329.92

- Previous Close: $330.65

- Market Cap: $23.11T (thousand crore equivalent)

- P/E Ratio: 23.16

- Dividend Yield: 0.99%

- Quarterly Dividend Amount: $0.82

Today’s narrow range shows that traders are carefully watching interest rate expectations, credit growth, and consumer spending trends before taking strong directional positions.

Section 2: Business Model and Revenue Streams

American Express operates as a closed-loop payments network, which means it acts as both the issuer and the network operator. This allows Amex to capture:

- Discount Revenue from merchants

- Net Card Fees from premium cardholders

- Net Interest Income from lending activities

- Other Fees (foreign transaction, service fees)

Its affluent customer base tends to be less sensitive to economic slowdowns, providing relative stability compared to peers.

Section 3: Macroeconomic Drivers

Key external factors influencing Amex’s stock performance include:

- Interest Rate Environment: Higher rates can expand net interest margin on its lending portfolio.

- Consumer Spending Trends: Particularly in travel, dining, and luxury categories, where Amex dominates.

- Credit Quality: Delinquency rates and charge-offs directly affect earnings.

- Global Economic Growth: International expansion and FX fluctuations contribute to revenue diversification.

Section 4: Competitive Landscape

Competitors include Visa, Mastercard, Discover, and large banks with their own card portfolios. Amex differentiates itself through:

- A premium rewards ecosystem

- Exclusive partnerships with airlines and hotels

- Superior customer service rankings

Its unique closed-loop system provides valuable data insights, which enhance marketing and risk management strategies.

Section 5: Technical Price Analysis

Current support and resistance levels based on the chart:

- Immediate Support: Around $330

- Near-Term Resistance: $332.50

- Momentum: Slightly bearish intraday, but holding key support levels.

The stock may consolidate before making a move based on upcoming economic data releases.

Section 6: Earnings and Valuation

With a P/E ratio of 23.16, American Express trades at a moderate premium relative to the broader financial sector. Investors may be pricing in strong growth expectations, particularly in travel-related spending and lending revenue as global economies stabilize.

Section 7: Growth Drivers

- Expansion of Membership Rewards Programs to boost card spending.

- Digital Transformation and Fintech Integration through partnerships and in-house innovation.

- Global Travel Recovery – A core driver of transaction volume growth.

- Millennial and Gen Z Adoption – Targeting younger affluent consumers with tailored products.

Section 8: Risks and Challenges

- Economic Downturns: Could impact discretionary spending and loan repayment rates.

- Competition from Fintechs: Digital-first challengers could erode market share.

- Regulatory Risks: Payment network regulations, interchange fee caps, and lending oversight may affect profitability.

- Currency Volatility: Impacts international revenue streams.

Section 9: Investor Sentiment

Analyst consensus tends to favor Amex as a “buy” or “strong hold,” citing its premium customer base and resilience to economic cycles. However, some caution is expressed about rising credit risk in a high-rate environment.

Section 10: Open-Ended Outlook

The future trajectory of American Express will depend on its ability to sustain cardmember growth, expand merchant acceptance globally, and manage credit risk efficiently. Investors will closely watch quarterly earnings for signals about consumer spending strength, delinquency trends, and rewards program engagement.