Berkshire Hathaway Class A Shares Dip Amidst Broader Market Activity

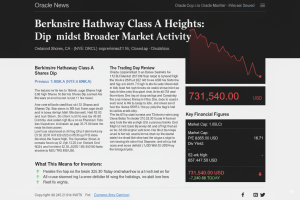

Omaha, NE – Berkshire Hathaway Inc. Class A shares (NYSE: BRK.A) experienced a decline in value today, with the stock closing at 731,540.00 USD. This represents a decrease of 7,240.88 USD, or 0.98%, from its previous close of 738,780.90 USD.

The trading day, September 10th, saw Berkshire Hathaway Class A open at 736,299.50 USD. The stock quickly trended downwards in early trading, reaching a daily low of 730,000.00 USD. While there was a slight recovery from the absolute low, the shares were unable to regain their opening value and continued to trade below the previous day’s close for the remainder of the session. The highest point reached during the day was 736,299.50 USD, matching its opening price.

Despite today’s dip, Berkshire Hathaway maintains a colossal market capitalization of 1.05 trillion LCr, underscoring its status as one of the largest and most influential companies globally. The P/E ratio stands at 16.71, which is often seen as a reasonable valuation for a company of Berkshire’s stability and earning power, especially given its diverse portfolio of businesses.

Berkshire Hathaway Class A shares do not offer a dividend, a long-standing policy under Warren Buffett’s leadership, where profits are reinvested into the company for growth rather than distributed to shareholders.

Today’s slight downturn could be attributed to various factors, including general market corrections, profit-taking by investors after periods of growth, or reactions to broader economic indicators. Given Berkshire’s vast and diversified holdings, individual sector-specific news can also play a role in its daily movements.

Key Figures for Berkshire Hathaway Class A:

-

52-week high: 812,855.00 USD

-

52-week low: 657,497.50 USD

While today’s performance shows a modest decline, it is important for investors to view Berkshire Hathaway’s performance in the context of its long-term stability and strategic investments, rather than focusing solely on day-to-day fluctuations.