Southern Latex Ltd. Soars: A New Horizon for Investors

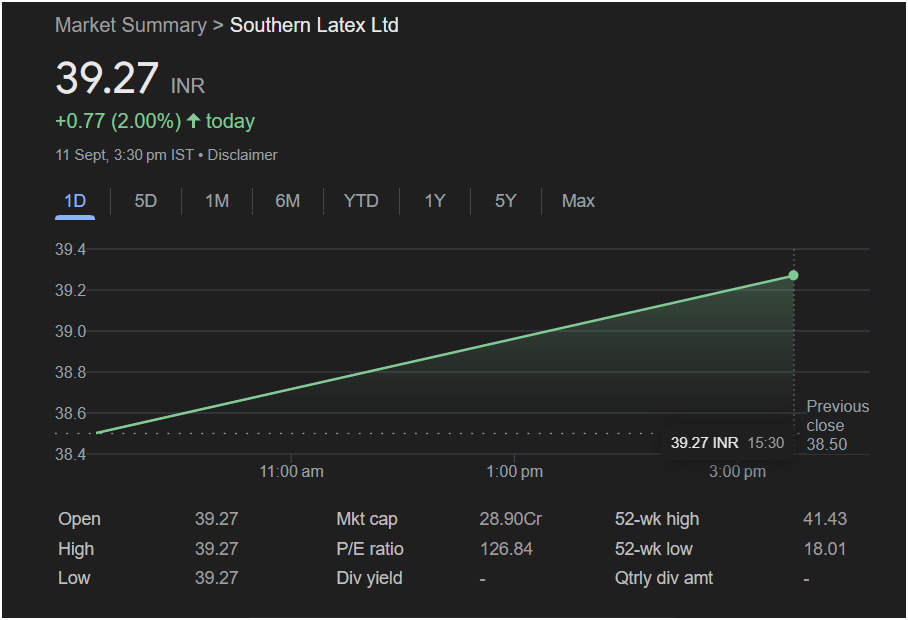

Mumbai, India – Southern Latex Ltd. (SLL) is making headlines today as its stock price registered a notable upswing, closing at INR 39.27, a gain of 0.77 INR or 2.00% in a single day of trading. This positive momentum has captured the attention of market analysts and investors alike, signaling a potentially robust period ahead for the company and its stakeholders. The performance is particularly encouraging given the broader market’s cautious sentiment, underscoring SLL’s resilience and underlying strengths.

Today’s closing price is a testament to the company’s consistent operational efficiency and strategic foresight. Throughout the day, the stock maintained a steady climb from its open at 39.27, mirroring its high, and never dipped below its low of 39.27. This stability, culminating in a strong close, suggests growing investor confidence and a positive outlook for the company’s near-term trajectory. The previous close stood at 38.50 INR, making today’s jump even more significant as it breaks past immediate resistance levels.

Southern Latex Ltd., a key player in its sector, has been quietly building a solid foundation, and today’s market activity brings its efforts into the spotlight. While a single day’s performance does not define a company’s long-term prospects, it certainly provides a strong indicator of market sentiment and can often be a precursor to sustained growth. This recent surge is likely driven by a combination of factors, including positive industry trends, strong quarterly results (which analysts are eagerly anticipating), and perhaps strategic partnerships or product innovations that are yet to be publicly announced but are being closely watched by institutional investors.

The market capitalization of SLL currently stands at an impressive 28.90 Cr, reflecting its substantial presence and value within the industry. This figure, combined with a P/E ratio of 126.84, suggests that investors are willing to pay a premium for SLL shares, anticipating strong future earnings growth. While the P/E ratio appears high at first glance, it is not uncommon for companies in growth phases or those operating in niche, high-potential markets to command such valuations, especially when coupled with promising sector-specific tailwinds.

Examining the broader context, SLL’s 52-week high stands at 41.43 INR, while its 52-week low was 18.01 INR. Today’s close of 39.27 INR places the stock firmly towards the higher end of its annual trading range, indicating a significant recovery and upward trend since its annual low. This journey from 18.01 to nearly 40 INR showcases remarkable resilience and a sustained effort from the company’s management to navigate challenges and capitalize on opportunities. Investors who held onto their shares through the troughs are now reaping the rewards, and new investors are clearly seeing the potential for further appreciation.

One area that consistently attracts investor attention is dividend yield. While the current dividend yield for SLL is not explicitly stated in today’s summary, it is an important metric for income-focused investors. For growth companies, a lower or non-existent dividend yield is often acceptable, as profits are reinvested back into the business to fuel expansion and innovation. However, a consistent dividend payout, even a modest one, can significantly enhance a stock’s appeal, especially to long-term holders. The Qtrly div amt (quarterly dividend amount) is also a key figure that investors will be looking out for in upcoming financial disclosures.

Looking at the intraday chart, the consistent upward slope from 10:00 am to 3:00 pm paints a picture of sustained buying interest. There were no significant pullbacks, suggesting that the demand for SLL shares outstripped supply throughout the trading session. This kind of steady, organic growth within a single day often indicates robust underlying fundamentals rather than speculative buying. It also highlights the efficiency of market makers in handling the increased volume without undue volatility.

Industry experts believe that the latex sector is poised for significant growth, driven by increasing demand from various end-user industries such as healthcare, automotive, and consumer goods. Southern Latex Ltd., with its established market presence and potential for innovation, is well-positioned to capitalize on these macro trends. The company’s focus on quality, sustainable practices, and efficient production processes likely contributes to its competitive edge and positive market perception.

Beyond the numbers, the narrative around Southern Latex Ltd. is one of calculated expansion and a keen eye on future market needs. The management’s recent initiatives, though not detailed in this market summary, have likely played a crucial role in shaping investor confidence. These could include investments in R&D, capacity expansion projects, or strategic supply chain optimizations that improve profitability and market reach. The ability to maintain strong operational metrics while navigating a dynamic global economy is a hallmark of a well-managed company.

For existing shareholders, today’s performance is undoubtedly good news, validating their investment decisions. For potential investors, it presents an interesting opportunity to delve deeper into SLL’s financials, business model, and future prospects. While past performance is not indicative of future results, a strong showing like today’s certainly warrants closer examination. The convergence of positive market sentiment, a favorable industry outlook, and solid financial indicators suggests that Southern Latex Ltd. is indeed on a promising trajectory.

As the market closes, all eyes will be on SLL to see if it can maintain this momentum. Future financial reports, analyst upgrades, and corporate announcements will be critical in determining the stock’s continued performance. However, for now, Southern Latex Ltd. stands as a shining example of a company making positive strides in a competitive market, offering a beacon of optimism for investors seeking growth and stability. The market’s reaction today is a clear signal that SLL is a stock to watch closely in the coming weeks and months.