PepsiCo Navigates Volatility: A Look at September 4th’s Market Movements

Despite a Daily Dip, Long-Term Indicators and Pre-Market Gains Suggest Resilience

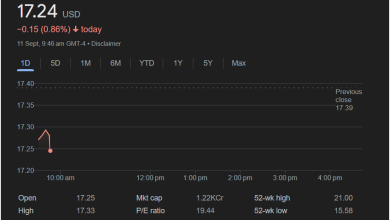

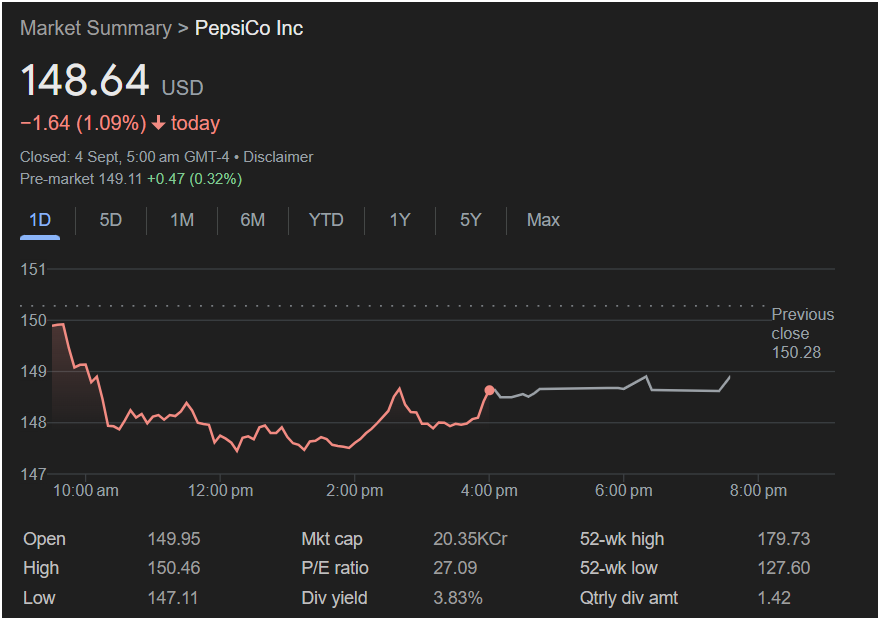

New York, NY – September 4, 2025 – PepsiCo Inc. (PEP) experienced a slight downturn in its stock performance on September 4th, closing the trading day at $148.64, a decrease of $1.64 or 1.09% from its previous close of $150.28. This daily fluctuation saw the consumer giant’s shares open at $149.95, reach a high of $150.46, and touch a low of $147.11 during the session.

While the daily dip might catch some attention, a closer look at the broader market context and immediate future hints at the company’s underlying strength. Following the close, pre-market trading activity indicated a positive rebound, with shares up $0.47 (0.32%) to $149.11. This suggests investor confidence in PepsiCo’s fundamentals remains robust, and the daily dip might be viewed as a temporary adjustment rather than a significant shift in sentiment.

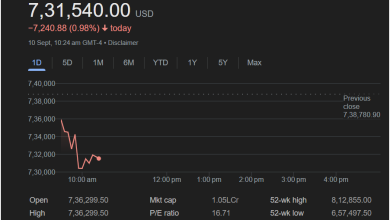

PepsiCo’s market capitalization stands impressively at 20.35 trillion, underscoring its massive scale and influence in the global beverage and snack industry. The company’s P/E ratio is noted at 27.09, reflecting investor expectations for future earnings growth.

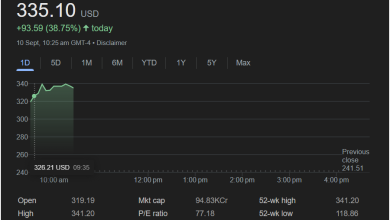

Investors continue to be attracted to PepsiCo’s consistent dividend policy, with a reported dividend yield of 3.83% and a quarterly dividend amount of $1.42. This steady return on investment is a hallmark of mature, stable companies like PepsiCo, often making it a favorite among income-focused investors.

Looking at its 52-week performance, PepsiCo has traded within a significant range, hitting a high of $179.73 and a low of $127.60. The current price of $148.64 sits comfortably within this range, indicating it’s well off its annual lows, though there’s still room for growth to re-approach its 52-week peak.

Industry analysts often point to PepsiCo’s diversified portfolio, encompassing iconic brands in both beverages (like Pepsi, Gatorade) and convenient foods (such as Lay’s, Doritos, Quaker Oats), as a key driver of its stability and long-term growth prospects. Despite the minor daily movement, the pre-market uptick suggests that the market is already looking past today’s session, focusing instead on the company’s enduring market position and strategic initiatives.

As the market continues to evolve, PepsiCo’s performance on September 4th serves as a reminder of the dynamic nature of stock trading, where daily fluctuations are a common occurrence, often overshadowed by broader trends and strong corporate fundamentals.